That’s so millennial — high rent drives young buyers

It's no secret that millennials are a different generation, and don't follow societal norms. They're getting married later and staying single longer; taking multiple jobs and quitting desk jobs to travel the world; challenging gender norms and taking a stand on issues that matter to them. Basically, they're eschewing conformity for personal satisfaction.

With this personal freedom, millennials are buying homes less frequently than other generations, and at a later age. They're renting longer because it suits their nomadic lifestyle. And when they settle down, they're skipping over the starter home in favor of larger houses. Because millennials don't want to do this the conventional way. And they'll thank you to take your preconceived notions and stuff them.

To rent or not to rent?

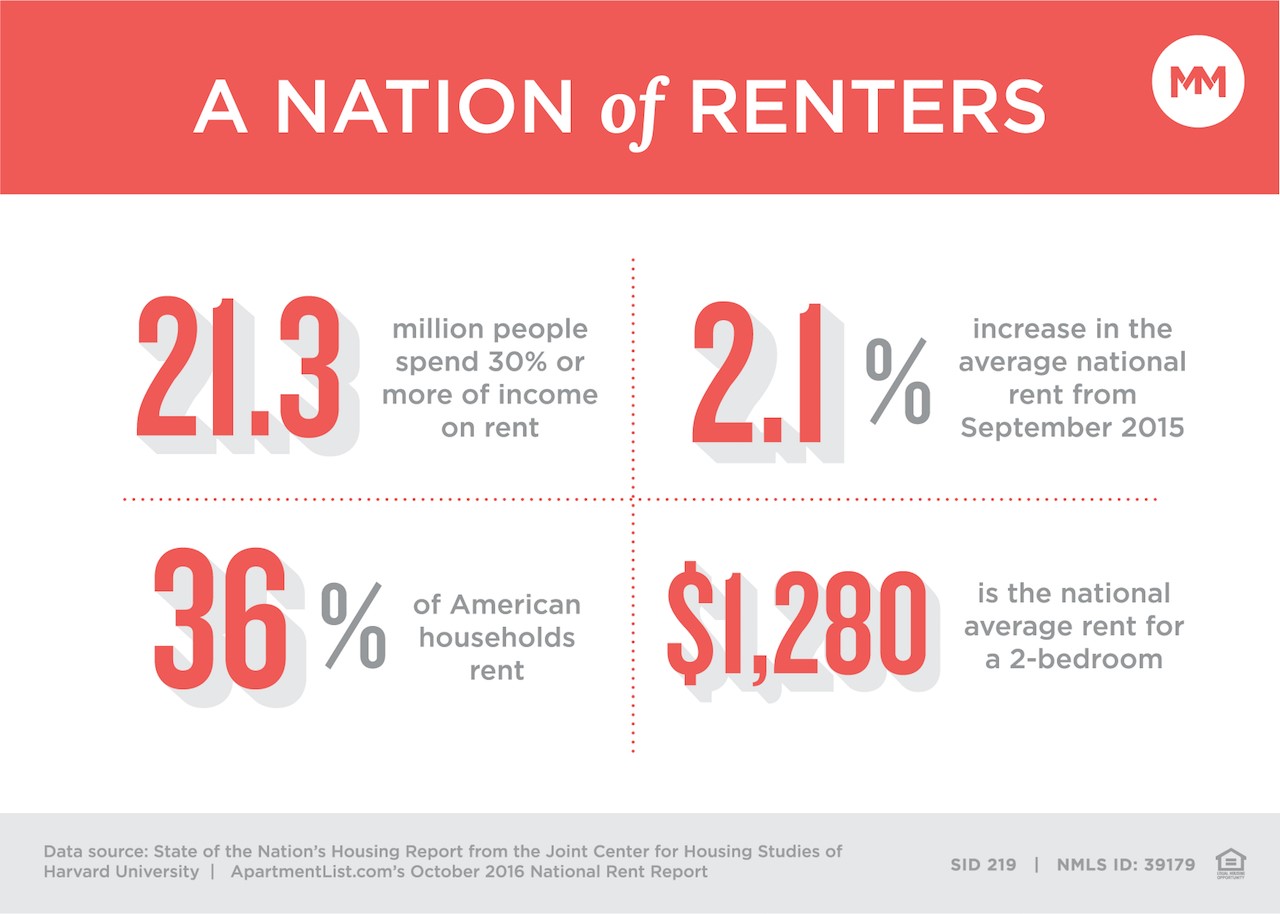

Currently, 36 percent of households in the U.S. rent. A staggering 21.3 million people spend 30 percent or more of their income on rent, and 11 million spend at least 50 percent of their income on rent. Add to that the fact that the national average rent payment is rising — while the national income isn't growing quite as quickly — and it becomes clear that renting isn't sustainable.

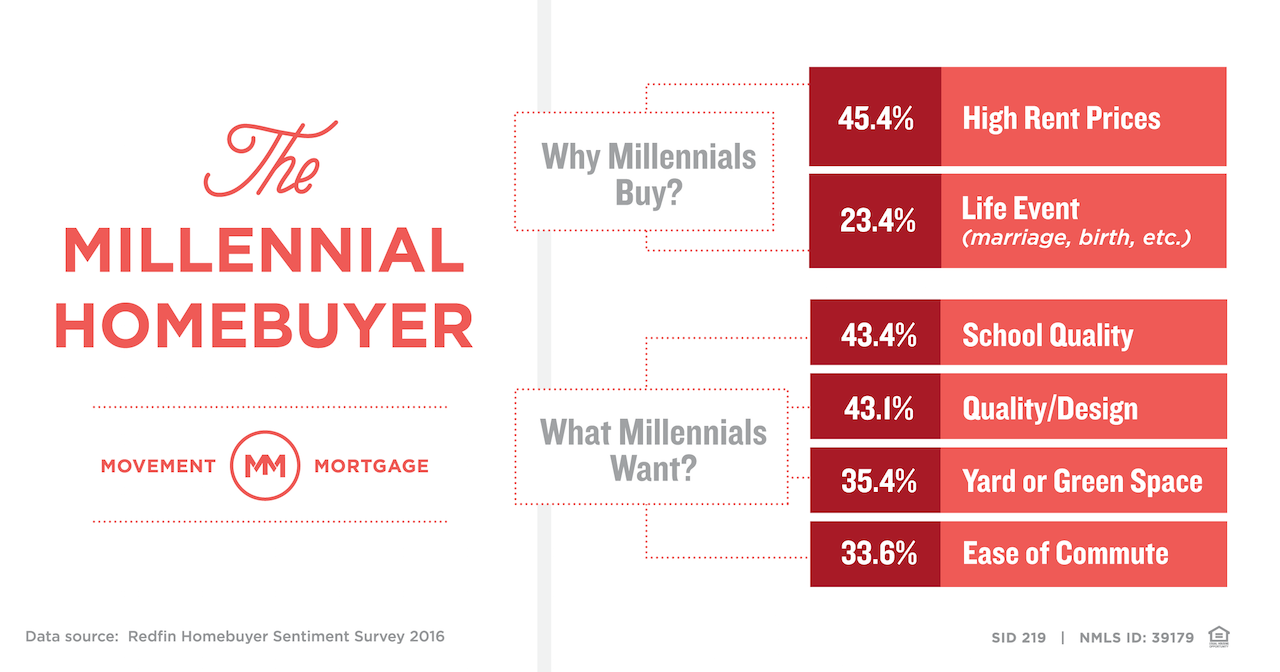

So it's not surprising to hear that millennials are starting to buy, and are projected to become the largest sector of the housing market. Even though 32.5 percent of millennials cite affordability as their biggest concern when buying a house, and 10.3 percent are worried they won't be able to make a down payment, the high cost of rent is still the top reason first-time homebuyers decided to pull the trigger on a house.

Buying isn't just for newlyweds

In fact, just 23.4 percent of millennials decided to buy because of a major life event, like getting married or getting pregnant. Meanwhile, 45.4 percent – almost half of all first-time homebuyers – say the high cost of rent drove them to purchase. Plus, the number of single homebuyers is on the rise: 15 percent of homebuyers in 2015 were single women, and 9 percent were single men. Because millennials don't need no life partner. Hashtag so millennial.

What do they want?

The good news is that they're not asking for a lot in a house. They only want good neighborhoods, quality houses, ideal floor plans, easy commutes, large yards and green spaces and, of course, the best schools. In fact, school quality comes in ahead of all other qualifications; so rest assured, they'll be starting a family in their non-starter home.

Does it matter?

The answer is yes.

A report from the U.S. Department of Housing and Urban Development shows that more new houses were purchased in July 2016 than in almost a decade. And housing prices continue to trend upward at a sustainable rate — roughly 5 percent year over year, according to the Case-Shiller Home Price Index.

So while millennials continue to shun tradition, they're still poised to become a formidable force in the housing industry, making decisions that shape the market. Because there's nothing more millennial than starting trends.