The era of the single female homebuyer

What's behind the rising trend

Add buying a house to the list of things women may do better than men (right between multitasking and living longer).

For yet another year — the 35th to be exact — single females outpaced bachelors in purchasing homes, according to data from the National Association of Realtors.

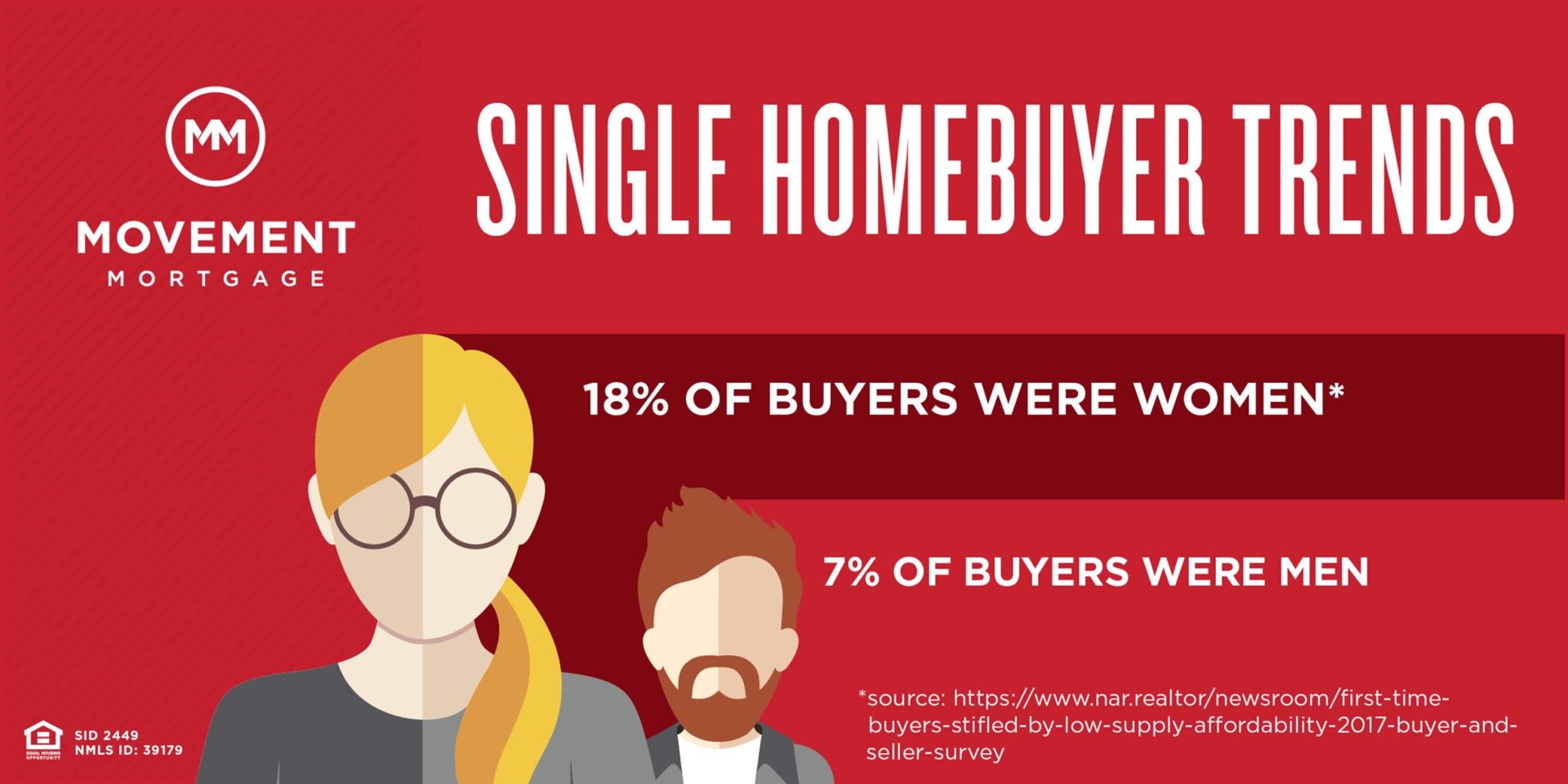

In fact, researchers say 18 percent of homebuyers last year were unmarried women while just 7 percent were single men. And single women were the second most common household buyer demographic behind married couples.

So dudes, what's the deal? Biology? Laziness? Short attention spans? It's probably none of the above.

Historically, women have placed a higher priority on homeownership. This has been especially true since federal regulation, such as the 1968 Fair Housing Act, gave women equitable access to credit and mortgages.

Plus, women seem willing to go to greater lengths to finance their abode.

"They have lower incomes than males (on average) but they're making more financial sacrifices," says Jessica Lautz, director of survey research and communication for the National Association of Realtors. "Earning income through a second job is more common for women than single males."

There are other reasons:

Single women want to be homeowners

The reason most homebuyers purchased a house last year is simple enough: They wanted to own their own home. Single women are no exception.

A study from the NAR in 2016 showed that 37 percent of single women said owning their own house motivated their decision to buy.

They like space

Single men and women both like single-family detached homes, still the most popular choice for most homebuyers.

But when it comes to how much they're willing to pay for space, women emerge the victors. On average, single women spent more on their homes than single men despite earning less income.

They seek community

Here's where biology could come into play. Women are natural nesters and want to build a community around them, Lautz says.

So, it's no surprise that 43 percent of single women in 2016 cited convenience to family and friends as a factor that influenced where they would live. Women were more likely to buy homes in suburbs, subdivisions and small towns while men were most likely to live alone in urban and rural areas.

Single women have the cash

While the income disparity between men and women is still problematic, some experts suggest the tide could be turning.

In cities like Boston, San Francisco, Seattle and Charlotte, more women than men are earning over $100,000 a year, according to Redfin data cited by Bloomberg.

A 2015 report from the New York Federal Reserve shows that women who are recent college graduates out-earn men in fields like social services and engineering.

And, adds Lautz, women apparently are quicker to eliminate luxury spending to afford their homes. Just ask the 27 percent who cut back on buying clothes last year.

What about single men?

It's a tough call — men are pretty complicated (or so many women would say).

An NAR spokesperson told Dame Magazine men may be more interested in consumption until they're ready to settle down.

But a 2010 New York Times story suggests societal pressures — such as the expectation to provide rather than consume — keeps bachelors away from such a large financial commitment.

Others say men are more willing to live with roommates or family longer.

Whatever the reason, here's there's a big force that trumps single buyers of both sexes: Married couples were 66 percent of homebuyers last year.