This year tested our industry, but in moments of challenge, true purpose is revealed. 2024 was a year of building—investing in tools, teams, and opportunities to serve.

It was a year of preparation, setting up loan officers, agents and clients for success in a competitive market with lower rates. As an Impact Lender, the more successful our loan officers and homebuyers are, the greater the impact we can create together.

Profit doesn’t carry out change—people do: teammates delivering supplies after Hurricane Helene; educators who show up to nurture and inspire kids every single day; individuals doing hands-on work in their local communities or internationally.

Impact Lending doesn’t belong to Movement. It belongs to all of us.

Impact Lending is your story, too.

Click Here to read the full Impact Report letter from Movement Mortgage CEO Casey Crawford.

Throughout 2024, Movement remained dedicated to making a real difference in the communities we serve. Thanks to careful planning and prior investments, we were able to expand homeownership opportunities, open a new Movement School in South Carolina, and support those in need during crisis. Our commitment to creating lasting impact remains as strong as ever, reinforcing our purpose as a true Impact Lender.

In a shifting market, homebuyers require a lender that delivers innovative solutions and personalized guidance. Movement does just that by meeting the needs of one homebuyer—one family, one veteran, one senior citizen—at a time.

Serving communities means serving those who served us. VA loans offer unique benefits and complexities. That’s why we hosted our first VA summit, equipping loan officers with education and strategies to better support our veterans.

#7 VA LENDER IN THE COUNTRY*

$2.83 BILLION IN VA VOLUME

6,987 MILITARY FAMILIES HELPED

Builders nationwide are tackling the housing shortage, with lenders playing a key role. Movement’s vertical financing program offers phase-by-phase funding to keep projects on track, driving a 76% increase in Movement's builder loan volume.

5,631 BUILDER UNITS

$2.1 BILLION IN BUILDER VOLUME

Home equity is a powerful retirement tool. For seniors facing rising living costs, reverse mortgages can offer qualified borrowers cash flow, flexibility, and a way to improve retirement quality in their golden years.

#12 REVERSE LENDER IN THE COUNTRY**

415 SENIOR FAMILIES SERVED

$58.4 MILLION IN REVERSE MORTGAGES

High-cost markets*** call for financing solutions with competitive rates and flexible options. Our jumbo loan options allow qualified homebuyers to dream bigger.

2,048 JUMBO LOANS

$1.6 BILLION IN JUMBO VOLUME

Homebuyers need options that meet their unique goals and serve them in today’s market challenges. Here are just a few of the products we rolled out in 2024 to help borrowers invest, build, and save while adding to our suite of over 3,200 loan programs.

Fixed-Rate Second Lien

Single Close Construction loans

Fix & Flip for investors

Movement helps close the homeownership gap by providing the right resources and support. In 2024, 40 Black and Hispanic loan officers joined the team, driving representation and empowering their communities.

$880,000 GIVEN IN MMCA GRANTS BY MOVEMENT

NEWSWEEK: TOP WORKPLACE FOR DIVERSITY 2025

19 LOAN OFFICERS NAMED TO NAHREP’S TOP 250

With $75 million in financing under his belt, Chad is using Movement’s vertical financing program to simplify construction, eliminate red tape, and help builders meet tight deadlines. His work contributed to a 76% growth in Movement's new construction loans, creating jobs and strengthening local economies. Chad’s impact goes beyond funding—he was on the front lines during Hurricane Helene, delivering essential supplies to communities in need. For Chad, vertical financing isn’t just a tool. It’s a way to address the housing crisis and make a real, lasting difference.

Chad Fleener | Sales Manager – Fort Mill, SC | NMLS: 133146

A home is one of the most significant purchases someone can make—one that can create stability, build wealth and foster a brighter future. But the impact doesn’t have to stop there. And for us, it doesn’t. As an Impact Lender, we reinvest nearly 50% of our profits back into the communities we serve. The closing table has never been our finish line.

In communities with limited access to quality education, Movement Schools is breaking cycles of poverty and opening doors to opportunity. We create spaces where scholars thrive academically, build character, and develop a love of learning. With over 1,700 scholars served, more than 150 jobs created, and a $27 million impact on local economies, we’re shaping the next generation of leaders. CEO Kerri-Ann T. Thomas shares, “We’re cutting down barriers, opening doors for future leaders.”

Bridge View in North Charleston, SC, opened as the first Movement School outside North Carolina. In its first year, it led the network in test scores for K-1. Principal Bobby Miles believes in teaching beyond academics, focusing on character. “Kids need tools to thrive in life,” he says. His leadership is helping scholars thrive and building a foundation for future grades to come. As Bobby notes, "Investing in education can truly change lives."

Principal Bobby Miles | Movement School Bridge View

Love Works, an employee-funded program, provides financial assistance to teammates in need, fostering a culture of care. The Movement Foundation channels nearly 50% of profits into projects supporting underserved communities, from schools to housing. Through GraceWorks grants (made possible by Karis Management Group), employees nominate nonprofits for $10,000 grants, totaling $1.5M given in 2024. Match Giving amplifies employee donations, and Vision Trips give teammates the chance to work hands-on with marginalized communities, creating lasting change.

BUILDING A TECHNOLOGY ENGINE THAT DRIVES RESULTS

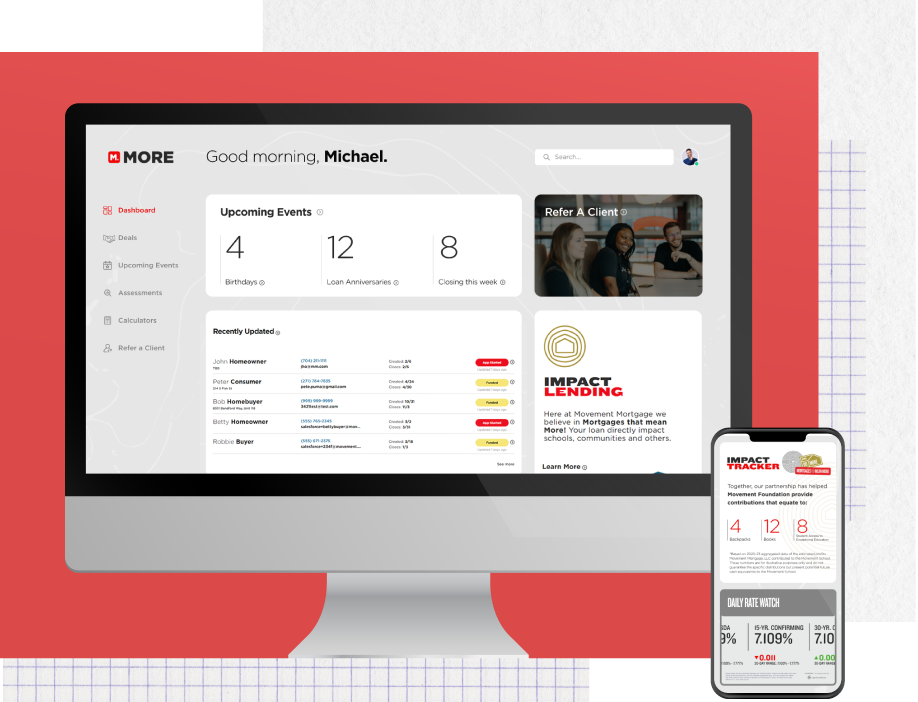

We built upon MORE–our comprehensive operations, sales, and marketing platform–to address the real-world challenges of loan officers and their agents. MORE is designed to simplify daily tasks and help loan officers focus on what matters most: supporting their clients and growing their business.

Movement loan officers are now more connected than ever to their customers for life. MORE’s Proactive Opportunity Dashboard analyzes loan and rate data to pinpoint optimal refinancing moments, empowering loan officers to act at the right time. We also introduced integrated dialer and SMS capabilities to unify communication across loan officer teams. Marketing tools like Automated Annual Mortgage Reviews help loan officers stay connected with clients, uncovering refinancing opportunities. Rate Watch emails keep agents ahead of market shifts, while 1:1 Marketing allows for personalized client outreach. The MORE Marketplace offers access to tools like Mortgage Coach and MBS Highway at preferred pricing.

Delivering an exceptional experience for agents is non-negotiable, and the enhanced Partner Portal is designed to do just that. This platform streamlines collaboration with agents by providing real-time loan updates, integrated marketing tools and client data all in one place. It simplifies pre-approvals, tracks loan progress and improves communication between all parties.

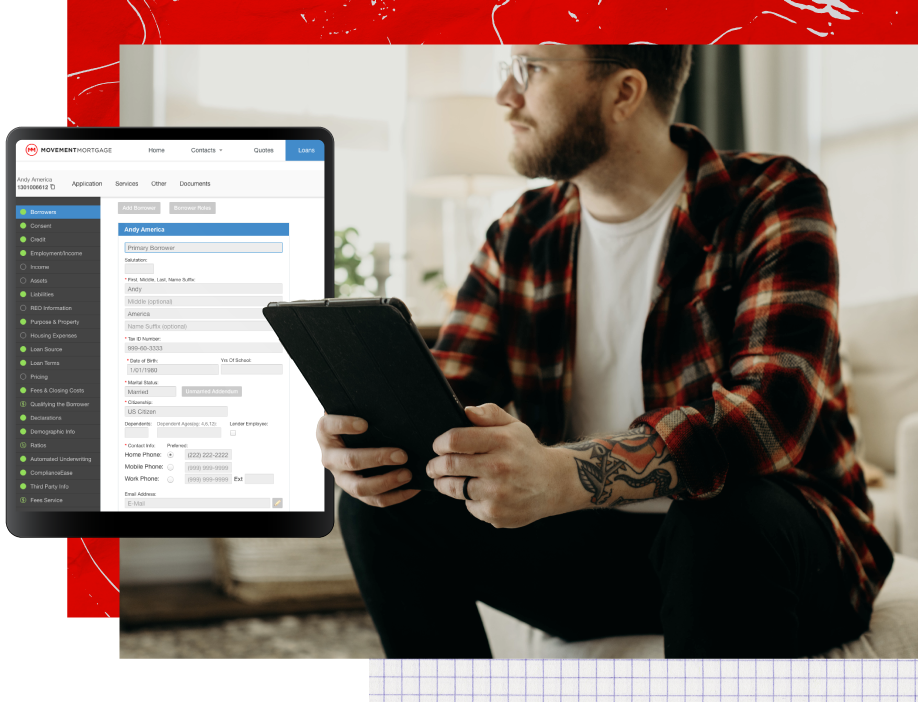

The new MORE LOS, powered by Blue Sage Solutions, will transform the mortgage process at Movement. By automating key tasks, increasing collaboration between stakeholders and simplifying documentation and submissions, the MORE LOS will provide intelligent automation for every process, helping accelerate loan approvals and closings.

Jeremy Berrios knows the value of efficiency: “In this industry, time is everything.” That’s why Jeremy has embraced MORE – to optimize his workflow and refocus his energy on the work that generates revenue and strengthens relationships. “We’ve streamlined applications, document requests, and follow-ups. It takes the stress out,” he explains. “We’ve replaced spreadsheets and endless emails with a system that works.” MORE also helps improve agent collaboration. “Agents love our portal. It cuts down on back-and-forth and strengthens relationships.” In a tough market, MORE helped Jeremy’s team grow 5x, focusing on great service over sales.

Jeremy Berrios | Branch Leader – Virginia Beach, VA | NMLS: 1108217

NOTE: Movement Mortgage is not affiliated, endorsed, or sponsored by the Department of Veterans Affairs or Federal Housing Administration, U.S. Department of Agriculture, U.S. Department of Housing and Urban Development or any other government agency.

*2024 Scotsman Guide, Top Mortgage Lenders Rankings

**HECMWORLD.com, "Top 100 Lender Report", HECM Endorsements 2024 year in review

***Loan limits vary. Reach out to a loan officer for more details.

****Including volunteer hours