Market reacts to Trump’s Fed Chair pick

The major stock market indexes once again recorded new all-time highs during the week while bond prices also recorded modest gains to send yields slightly lower.

Political events during the week seemed to create crosscurrents within investor sentiment.

An announcement of a couple of indictments and a conviction last Monday by Special Prosecutor Robert Mueller in his investigation into Russian interference in the 2016 presidential election seemed to dampen investor sentiment, but this was offset by the release of the “Tax Cuts and Jobs Act” by Republican House leaders. This bill calls for an immediate cut in the top corporate tax rate to 20% which should stimulate the economy and create more jobs. Additionally, President Trump announced last Thursday he was nominating Federal Reserve Governor Jerome Powell to succeed Janet Yellen as the next chairman of the Federal Reserve. Powell is viewed more as a monetary policy "dove" than a "hawk" will likely have a carefully measured approach to rate increases and this news was well received by the bond market.

The week's economic news was mixed. Personal Spending increased by a more than expected +1.0% in September while the Conference Board reported Consumer Confidence in October reached its highest level in nearly 17 years with a reading of 125.9. The ISM Manufacturing Index, while strong at 58.7, slightly missed expectations of 59.0. Employment costs crept higher with the 3rd Quarter Employment Cost Index increasing by a greater than forecast 0.7% while Unit Labor Costs gained a higher than expected 0.5%. The closely watched Employment Situation Summary for October (Jobs Report) showed fewer jobs (261,000) were created than forecast (300,000), but this was thought to be due to negative effects of the recent hurricanes causing volatility in jobs data. The unemployment rate fell to 4.1% from 4.2% while October average hourly earnings were flat at 0.0% after increasing 0.5% in September. Over the last 12 months, average hourly earnings have increased 2.4%, versus 2.9% for the 12 months ending in September.

As for mortgages, mortgage application volume decreased during the week ending October 27. The Mortgage Bankers Association (MBA) reported their overall seasonally adjusted Market Composite Index (application volume) fell by 2.6%. The seasonally adjusted Purchase Index decreased 1.0% from the prior week while the Refinance Index decreased 5.0%.

Overall, the refinance portion of mortgage activity decreased to 48.7% of total applications from 45.5% in the prior week. The adjustable-rate mortgage share of activity increased to 6.8% of total applications from 6.4%. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.22% from 4.18% with points increasing to 0.43 from 0.42.

For the week, the FNMA 3.5% coupon bond gained 43.7 basis points to close at $103.00. The 10-year Treasury yield decreased 8.30 basis points to end at 2.3325%. The major stock indexes ended the week higher.

The Dow Jones Industrial Average gained 105.00 points to close at 23,539.19. The NASDAQ Composite Index increased 63.18 points to close at 6,764.44 and the S&P 500 Index advanced 6.77 points to close at 2,587.84. Year to date on a total return basis, the Dow Jones Industrial Average has gained 19.11%, the NASDAQ Composite Index has advanced 25.66%, and the S&P 500 Index has added 15.59%.

This past week, the national average 30-year mortgage rate fell to 3.96% from 4.06%; the 15-year mortgage rate decreased to 3.27% from 3.34%; the 5/1 ARM mortgage rate dropped to 3.18% from 3.22% and the FHA 30-year rate decreased to 3.60% from 3.75%. Jumbo 30-year rates decreased to 4.15% from 4.24%.

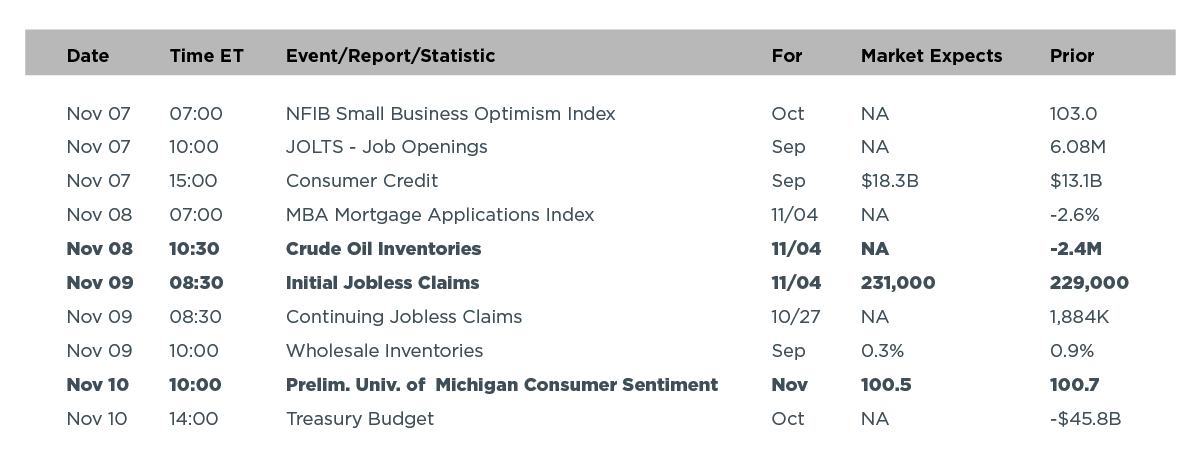

Economic Calendar – for the Week of November 6, 2017

Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

Mortgage Rate Forecast with Chart – FNMA 30-Year 3.5% Coupon Bond

The FNMA 30-year 3.5% coupon bond ($103.00, +43.7 bp) traded within a 39.1 basis point range between a weekly intraday high of $103.00 on Friday and a weekly intraday low of $102.609 on Wednesday before closing the week at $103.00 on Friday.

Mortgage bond prices continued to move higher last week following the new buy signal from October 27. The bond moved above a couple of resistance levels at $102.73 and $102.806 and these levels now revert to support levels. There isn't much in the way of economic news this coming week to influence the bond market, so there is greater likelihood for the market to be influenced by technical signals. Technically, the slow stochastic oscillator indicates the bond is not yet "overbought" so the bond has more time to move higher before reaching an overbought level where it would be more susceptible to a downturn.

Therefore, we should see the bond continue to move higher to challenge a dual layer of resistance at $103.06 and $103.13. A break above these levels will lead to an improvement in bond prices and mortgage rates. However, a failure to break above resistance should result in rates remaining close to where they currently are.