Tax bill anticipation sends stocks soaring

The stock market advanced to new highs in anticipation both houses of Congress would reach an agreement on a tax cut bill. It appeared on Friday the reconciliation process had run its course as House Ways and Means Chairman Kevin Brady stated the conference committee had completed its negotiations. It now appears the Republican controlled congress has enough support to pass their tax reform bill with a final vote taking place sometime this coming week.

Bond yields were largely unchanged for the week although 10-year Treasury yields slipped a little lower on softer than expected inflation numbers from the release of November's Consumer Price Index (CPI). The November CPI came in at 0.4% as forecast but the Core CPI, which excludes volatile food and energy prices, was reported to have increased just 0.1% versus a consensus forecast of a 0.2% increase. Elsewhere, the Federal Reserve voted to raise the fed funds target range by 25 basis points to 1.25%-1.50% on Wednesday, as widely expected. While the Fed admitted overall inflation and core inflation have declined this year and are running below 2.0%, Fed members still anticipate three additional rate hikes in 2018 and two in 2019.

In housing, mortgage application volume decreased during the week ending December 8. The Mortgage Bankers Association (MBA) reported their overall seasonally adjusted Market Composite Index (application volume) decreased 2.3%. The seasonally adjusted Purchase Index decreased 1.0% from the prior week while the Refinance Index fell by 3.0%.

Overall, the refinance portion of mortgage activity increased to 52.4% of total applications from 51.6% in the prior week. The adjustable-rate mortgage share of activity decreased to 5.6% of total applications from 5.7%. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.20% from 4.19% with points decreasing to 0.39 from 0.40.

For the week, the FNMA 3.5% coupon bond lost 1.6 basis points to close at $102.797. The 10-year Treasury yield decreased 2.66 basis points to end at 2.3512%. The major stock indexes ended the week higher.

The Dow Jones Industrial Average gained 322.58 points to close at 24,651.74. The NASDAQ Composite Index advanced 96.50 points to close at 6,936.58 and the S&P 500 Index added 24.31 points to close at 2,675.81. Year to date on a total return basis, the Dow Jones Industrial Average has gained 23.11%, the NASDAQ Composite Index has advanced 27.07%, and the S&P 500 Index has added 18.43%.

This past week, the national average 30-year mortgage rate fell to 3.96% from 3.97%; the 15-year mortgage rate decreased to 3.30% from 3.31%; the 5/1 ARM mortgage rate dropped to 3.20% from 3.21% and the FHA 30-year rate fell to 3.55% from 3.60%. Jumbo 30-year rates decreased to 4.12% from 4.14%.

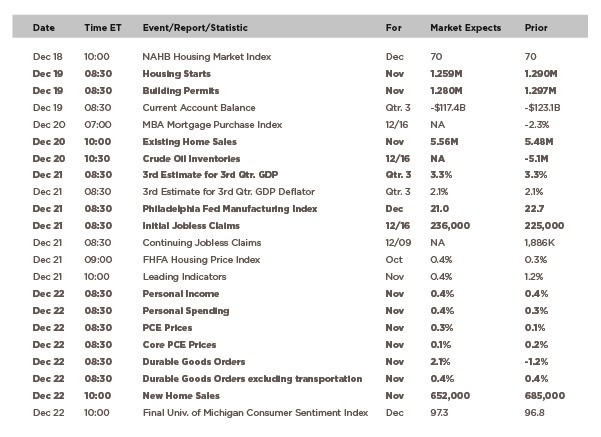

Economic Calendar – for the Week of December 18, 2017

Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

Mortgage Rate Forecast with Chart – FNMA 30-Year 3.5% Coupon Bond

The FNMA 30-year 3.5% coupon bond ($102.80, -1.60 bp) traded within a 59.4 basis point range between a weekly intraday high of $102.875 on Monday and a weekly intraday low of $102.281 on Wednesday before closing the week at $102.797 on Friday.

There was an increase in volatility early in the week centered on tax reform news and the Federal Reserve's Federal Open Market Committee meeting on Tuesday and Wednesday. However, when it was all said and done, mortgage bonds ended the week very close to where they began. Stubborn resistance continues to be found at the 38.2% Fibonacci retracement level at $102.806 while a band of support is found just below at converging 25-day and 50-day moving averages highlighted in the chart below.

There was a new buy signal on Thursday from a positive stochastic crossover and the bond is not yet "overbought" so we should see the bond challenge resistance at 102.806 once more early this week. A successful break above this level could propel the bond toward the next level of resistance at the 100-day moving average at $103.02 resulting in a slight improvement in mortgage rates. However, if the bond fails and is turned away from resistance it would likely result in sideways to lower movement with rates remaining largely unchanged to slightly worse than they are currently.