Putting the “Pro” back in mortgage PROcess

Moving is frustrating. Before you can pack all of your stuff, load it into the UHaul – No, Tommy, the box labeled 'breakable' should NOT be thrown in lightly – and start the arduous process of packing, you've got to find a new house, navigate the process of getting a loan, make an offer, have it accepted, and close. Not to mention selling your current place of residence (unless you're moving out of an apartment, in which case, count your blessings, but not your deposit).

Any one of these things would be stressful on its own, but to have to do all of them is enough to make you want to pull your hair out, strand by strand, until you look like that guy on the subway who licks the ground.

Luckily for you, we're here to help. We took the old mortgage process, thought long and hard, and threw it out the window. Instead, we've developed a new process that's designed with you in mind. Because we like you with your hair.

File that under 'no thank you'

If you think the mortgage industry is still stuck in 1980, we'd like, totally like you to rethink that. To avoid mountains of paperwork and deadly papercuts (a hazard of the industry), we created the Easy App, a mortgage application that lets you plug in all your information, sync your bank accounts and tax returns, and track the progress of your loan all from your phone, tablet or computer. So starting the process is as simple as pressing a button. (But you know, if you happen to have fond memories of the '80s, we're flexible. Feel free to compile your documents in a file folder. Or a PDF. Or on a thumb drive – but please no floppy discs.)

It's always better to be upfront

Once you've got all your ducks in a row, it's off to the races. With most companies, you'd get a pre-approval based on a credit score and the loan officer's best guess. Your file wouldn't see an underwriter's desk – that's the person who actually makes a decision on your loan based on their analysis of your financial documents, history, and more – until after you'd found a house and put in an offer. That means that after weeks and weeks of searching, you're still not guaranteed a loan amount when you put in your offer. And that is NOT good for you, or your hair.

Once you've got all your ducks in a row, it's off to the races. With most companies, you'd get a pre-approval based on a credit score and the loan officer's best guess. Your file wouldn't see an underwriter's desk – that's the person who actually makes a decision on your loan based on their analysis of your financial documents, history, and more – until after you'd found a house and put in an offer. That means that after weeks and weeks of searching, you're still not guaranteed a loan amount when you put in your offer. And that is NOT good for you, or your hair.

Instead, we send your file directly to an underwriter once you've collected and provided all your information. Our team has a goal to underwrite each file in six hours, meaning that you'll know exactly wat you can afford, before you even start looking for a house.

Instead, we send your file directly to an underwriter once you've collected and provided all your information. Our team has a goal to underwrite each file in six hours, meaning that you'll know exactly wat you can afford, before you even start looking for a house.

Process makes perfect

Once your file has seen an underwriter, it goes directly to a processor, who fulfills the conditions the underwriter has laid out. In most situations, this wouldn't happen until weeks or months into the process, and only after it had gone back and forth between a bunch of people. Instead, we've simplified the process: underwriter reviews the file, identifies the conditions, then sends it to a processor, who fulfills the conditions. Nice and easy.

Our processing team has a goal to process files in just seven days, which means a little over a week from submitting your file, you can be headed to closing. Now, you've got a processed and underwritten loan in your back pocket, so when you find your dream house, you're ready to move. Hashtag winning.

Real talk

We can't take the stress out of the mortgage process completely. It's a big financial decision and commitment, and should be treated with respect. What we can do is make the process as effective and efficient as possible, so that you don't waste time or energy spinning your wheels on options that aren't viable. Because we respect you, and your time.

And then maybe once we're done with our end, you can find a dream home with a masseuse. Hey, you can dream, right?

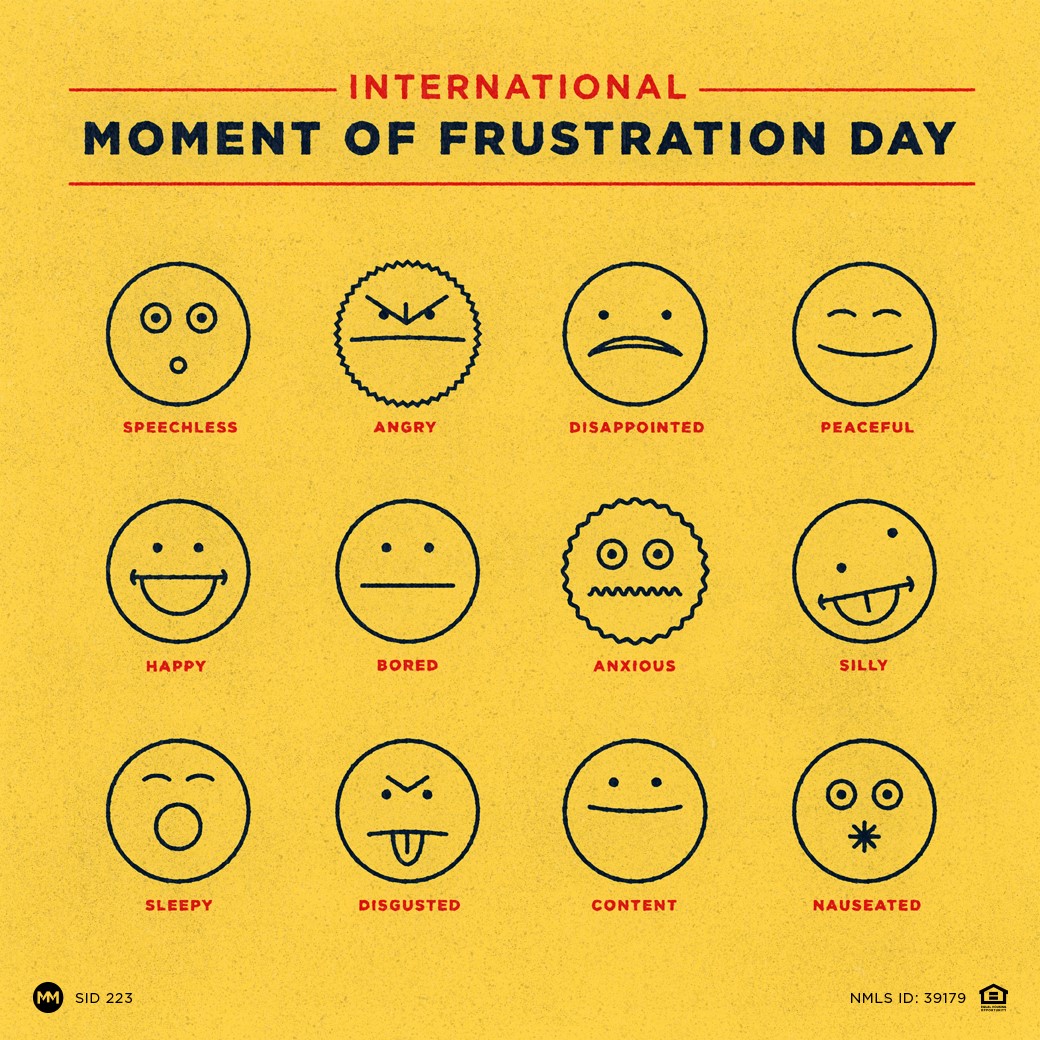

Need something to help you beat your frustrations?

Download this graphic here.