8 reasons to ditch the rental and buy a condo

Renting, which involves relatively low stress and commitment, is often seen as an affordable alternative to buying a home. However, rent prices in major cities and metro areas around the US are becoming increasingly expensive.

Since Covid began to change all of our lives, there has been a lot of talk about whether young singles and couples should ditch being a renter and buy their own place, something a little bigger to handle a home office space or two, and maybe a little outdoor area to break away from lockdown claustrophobia.

Start adulting and switch to owning

Many renters today find themselves flush with a little extra cash. They weren't commuting for over a year. They started preparing meals at home rather than eating out at restaurants. Netflix binging replaced going to concerts and movies. And it turns out, being your own mixologist was way less expensive than shelling out uber loads of cash at the bar.

That extra cash helped many renters decide they had enough of a down payment saved up to investigate becoming real homeowners! Talk about adulting!

Besides, for all the talk about rents dropping because of Covid-induced city evacuations, rents haven't really fluctuated all that much. It's still expensive to be a renter, and buying is still a better financial option. Ask yourself why you continue to pay so much rent every month and have nothing to show for it at the end of the lease.

Average rents fluctuate in the USA, with the highest average rent being in Hawaii ($1,617) and the lowest average being in West Virginia ($725). According to World Population Review, the average rent in the country is $1,098 — and that's just the average, probably not anywhere near a luxury rental. Even so, if your rent alone is $1,098 a month, that's $13,176 a year that you're shelling out.

That's a lot of cash to give to someone else every year. So let's dig into the reasons why you might be better off purchasing a home, and since you're obviously used to the apartment lifestyle (it does have its benefits), let's focus on buying a condo, rather than a single-family detached home.

Reason # 1. The rent is too high

As we stated above, the average rent in the country is $1,098. But that certainly fluctuates depending on region, property condition, and many other factors. So let's narrow things down a little bit so we can look at a real example. Let's use Charlotte, NC, as an example.

According to World Population Review, Charlotte is the 3rd fastest growing city in the US. Today, the average rent in Charlotte is, according to Zillow, just under $1,420 a month. Better neighborhoods will clearly demand higher rents.

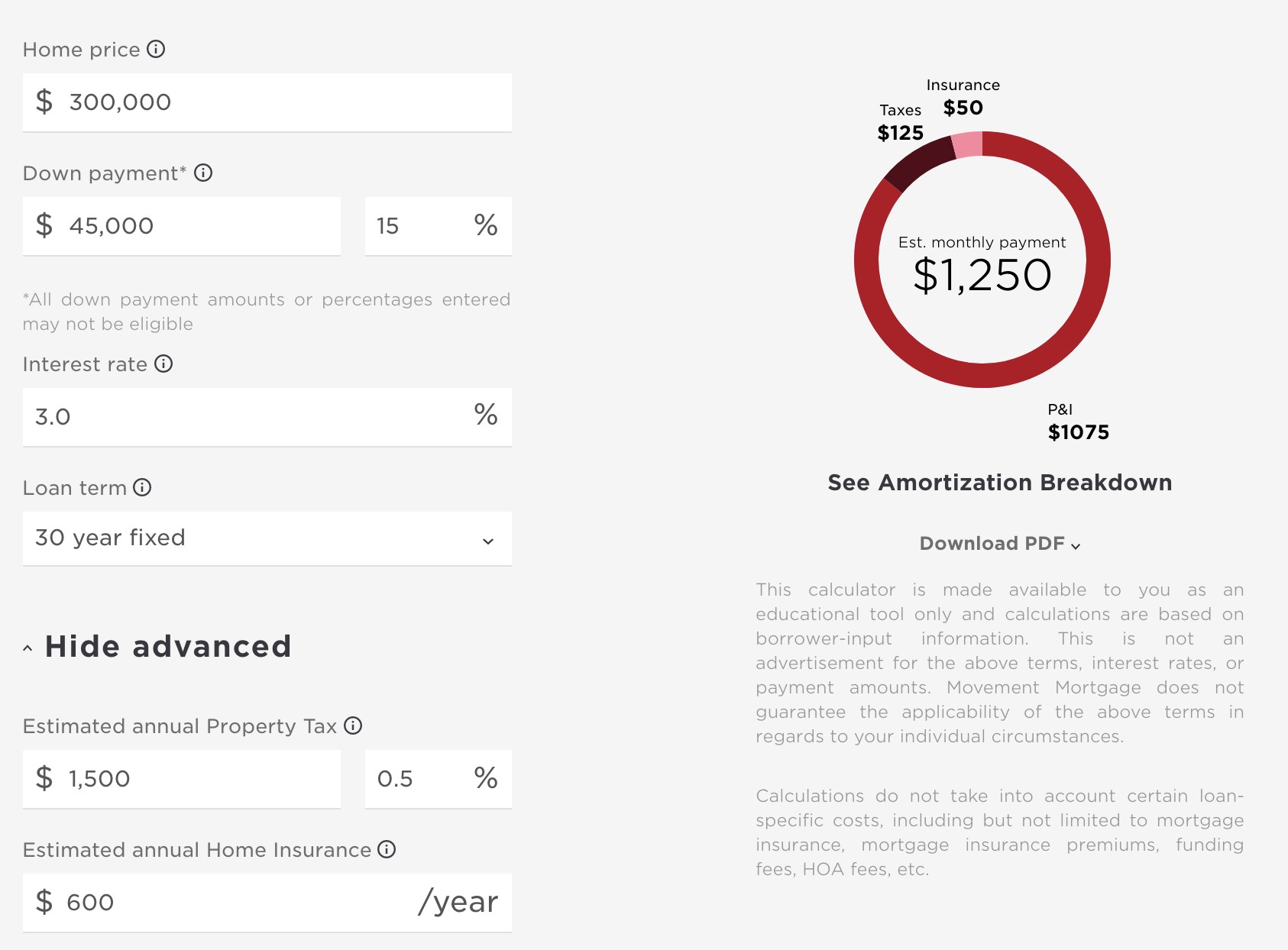

According to the Charlotte Weekly, Charlotte's average home price is around $295K, but let's round it up to $300K to make the math easier. Based on Charlotte's inner-city tax rate, property taxes on a home at that price would be just under $1,500 a year. Let's guess that monthly homeowner insurance is $600. Now let's say you were able to put down 15%, or $45K. To find out what your monthly mortgage payment would be, we used Movement's handy-dandy mortgage calculator and plugged in a 3% interest rate.

Would you look at that! Your monthly mortgage ends up being less than your rent!

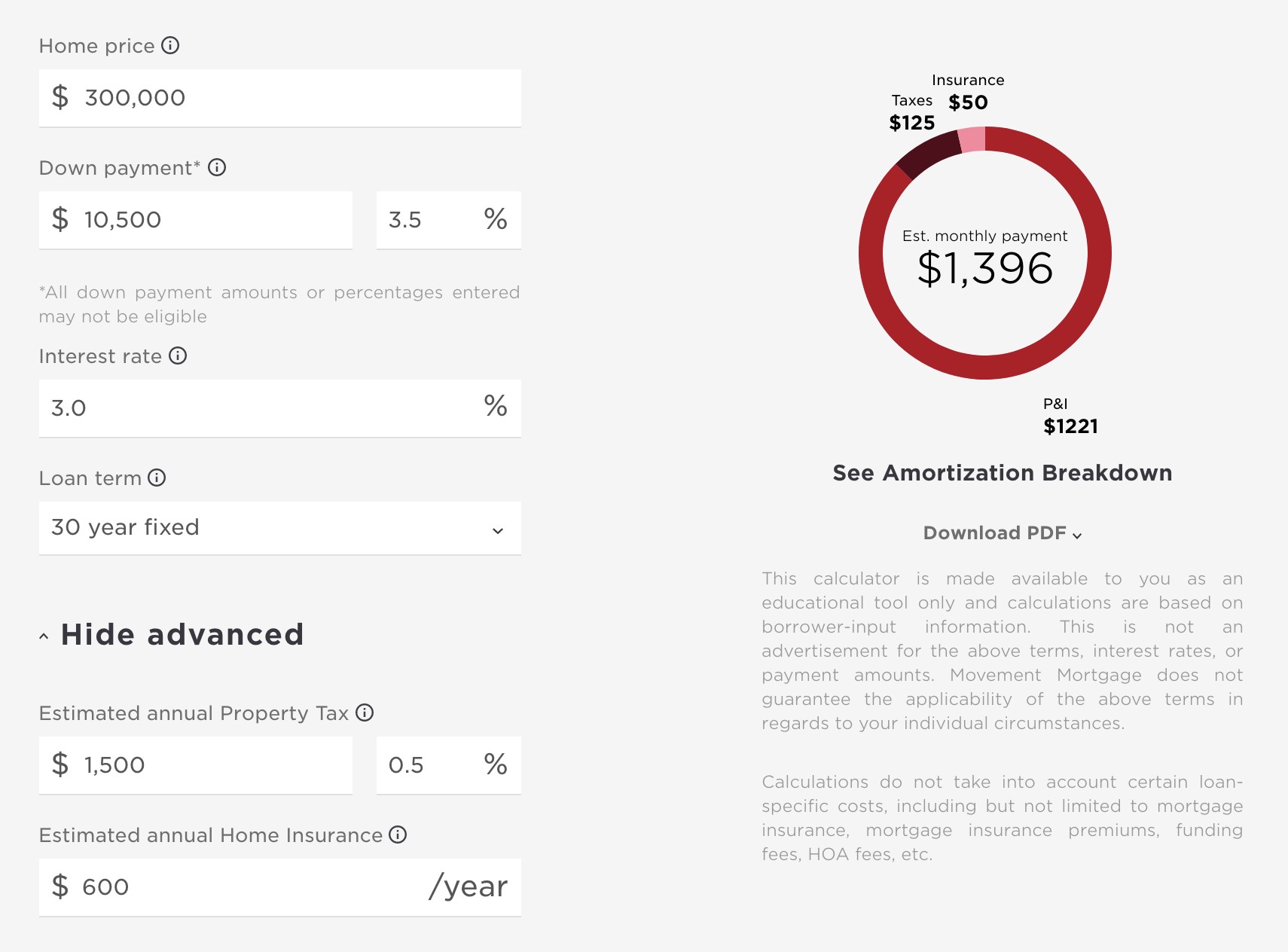

Now, let's say you didn't have all that money to put down. After all, forty-five grand is a big chunk of change. You could look at an FHA loan (3.5% down payment), which would equate to having to put just $10,500 down.

It's still less than the average rent! What you enter for your city, down payment, and other parameters will affect the outcome, but chances are you can save money and stop getting a landlord wealthy by buying rather than renting!

Reason # 2. At the end of the term, the property is yours!

Let's say you did go with the 30-year loan and did nothing more than stay there or even rent it later on. You still end up owning the property outright at the end of the term. After that, you don't worry, and principle and interest payments– and you're only on the hook for property taxes and homeowners insurance.

So let's do that basic math using the figure above (for ease) using today's dollars: Monthly taxes are $125, and insurance payments are $50 a month, bringing your total monthly out-of-pocket responsibilities to just $175 a month. That's way less than paying $1,420 a month in rent. (And remember, rents are bound to keep going up, not down.)

Reason # 3. Built-in retirement asset

Let's say you keep the condo full-term (30 years) and then decide to sell it. Anything over your original $300K purchase price is profit you can put directly into your bank or retirement account!

Reason # 4. Rental income

We don't know how the US dollar will fluctuate, so let's still use today's dollar value and again assume you keep the condo full-term (30 years). Now you own it outright, but instead of selling it, you decide to become a landlord yourself. Let's also assume that the average rent remains the same at $1,420.

If, as a landlord, you list your condo for rent at $1,420 a month, and you're paying $175 a month out-of-pocket for taxes and insurance, as we calculated above, your monthly rental income will be $1,245. Not too shabby. And again, market-rate rent is bound to be higher even.

Reason # 5. Kids & college

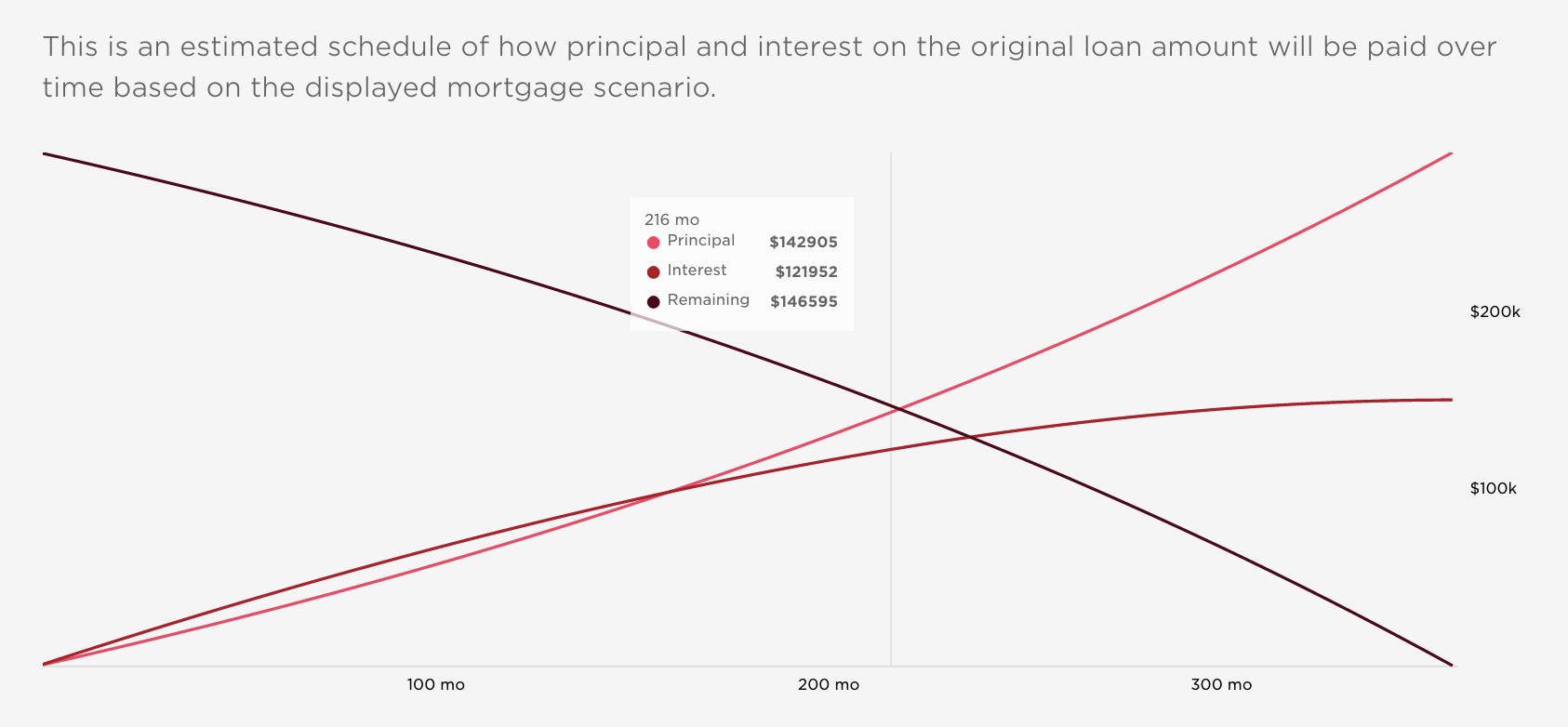

As you start paying down the principle, you earn equity in your house. Let's imagine you want to leverage this equity to help fund your future child's future college education. Just for argument's sake, let's also pretend you have a baby during the first month you own your condo. In 18 years — or 216 monthly mortgage payments — your kid will be ready for college. Luckily, you'll already have paid off nearly half the mortgage by then. That means you can tap into that equity for things like home improvements, vacations, and — being you're a thoughtful parent — paying down the college tuition. The mortgage loan amortization chart below shows how much you would have paid off based on the outlined loan scenario.

Reason # 6. A smaller nest when the nest is empty

Once the kids are out of college, they inevitably move on. Suddenly, you have a bit of grey hair, and the single-family home you bought to raise kids in is just too much work. You've become an empty nester, and cleaning the gutters, painting the trim, and seasonal lawn upkeep is no longer fun or easy (i.e., the kids aren't there to help anymore). Also, by this time, climbing stairs are a pain in the neck (or, more literally, the knees). Why not sell or rent out your home and move back into that easier-to-manage condominium?

Reason # 7. Don't forget the IRS!

We didn't even address the tax benefits of owning a home! Factor in the mortgage interest deduction, and your monthly payment adds up to be even less. Thanks, Uncle Sam.

Reason # 8. You can't take it with you

Certainly, you don't think about the grim reaper when you're buying a home, but life happens! Keep that condo for 30 years, even if you have since purchased a second home but kept the condo as an investment, and you'll have a paid-off asset that you can pass on to your children or grandchildren. This is legacy wealth we're talking about.

Summing up

All of the points raised above could also be used if weighing a house instead of a condo. If you're not prepared for that step yet, consider having a condo be your starter home and then either keep it or sell to transition into a larger home down the line — maybe when the market isn't so crazy or the inventory isnt so tight!

Want to discuss options in your neck of the woods? Reach out to one of our local loan officers. We're here to help! Or, if you're ready to get started now, you can always apply online!