Spring homebuying going strong, U.S. economy building confidence

Markets were all about earnings this week as major corporations reported their outlooks for the year. The earnings outlooks are paramount for analysts looking for signs of an actual recession instead of just a short slowdown. If major companies don't believe they will have enough profit, they will typically scale down their number of employees and that can cause recession.

The week on Wall Street has been volatile ahead of the longer Easter weekend, as positives with tech and industrials are undermined by very weak healthcare stocks. However, the market has rallied and the S&P 500 is within 1% of its record high from September. Generally, economic sentiment is strong, and has been boosted this week by better-than-expected consumer data.

Another very strong unemployment number has built confidence this week. Once again, weekly jobless claims have gone down to 49-and-a-half year lows, according to the Labor Department. Claims for unemployment benefits have now declined for five straight weeks. The unemployment rate is at 3.8% currently, which is just above the 3.7% year-end prediction from the Federal Reserve.

Also supporting a sentiment of growth is the Federal Reserve's Beige Book, a compilation of anecdotal economic accounts from the regional reserve banks. The recent release shows growth at a slight-to-moderate pace across all 12 districts with tourism and housing showing more upbeat reports.

U.S. retail sales also had a big boom in March, increasing by the largest amount in one-and-a-half years. Car purchases led the way in retail sales, going up by 1.6%. Many analysts, including those with Bloomberg, predicted just 1% growth for the March report from the Commerce Department. That's another indication that the slow start to the year economically may have been a false start.

Chief economist at Amherst Pierpont Securities, LLC, Stephen Stanley, is confident that this shows stability and growth. "The labor market is alive and well," said Stanley, "as long as the labor market is doing well there is good reason to expect consumer spending should do fine."

The Fannie Mae Economic and Strategic Research Group's April Outlook predicts growth to slow to about 2.2%, well under the 3% growth we saw in 2018. The group's study also points out, however, that wage growth, slowing home price appreciation and lower mortgage rates should all contribute to a housing sales pace on part with 2018. The lower rates right now have the ESR group predicting refinances to come in higher than previously forecast, but overall the levels will still be down slightly year-over-year.

First-quarter Gross Domestic Product numbers are due on April 26. If those are stronger than expected, it may spur analysts to revise up their 2019 growth predictions.

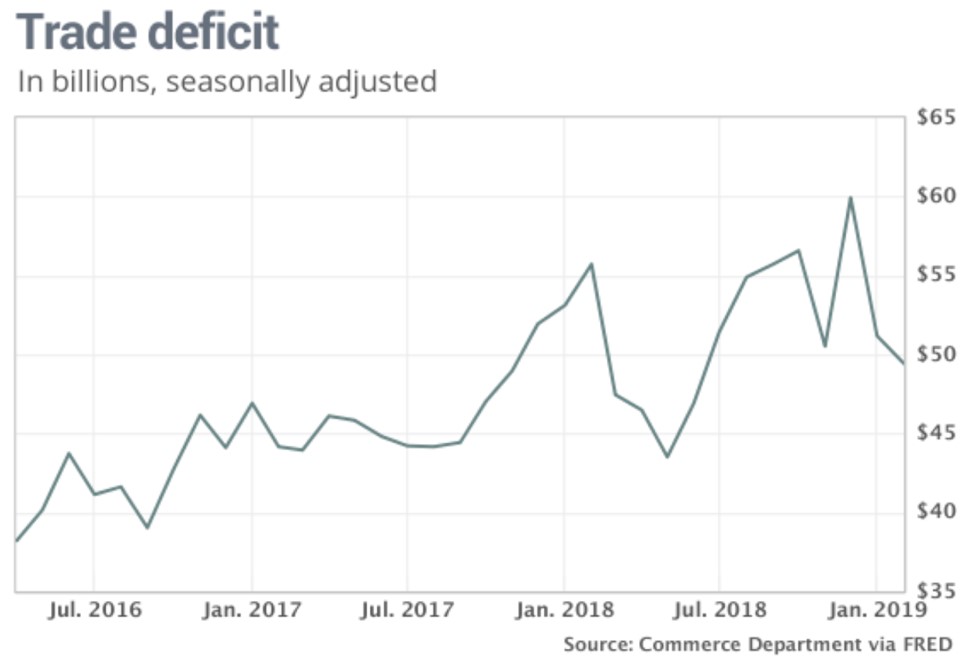

Trade deficit decreases

Against expectations of an increase, the United States trade deficit fell again in February and now sits at $49.4 billion. That is the lowest level in eight months. Exports are once again outpacing imports, increasing by 1.1% to a four-month high of $209.7 billion. However, this is not necessarily a sign of consistent decline. February's data was supported by a surge in commercial aircraft shipments. That will likely change with March's trade deficit report considering the Boeing 737 Max aircrafts were grounded in March.

The chart below shows the trade deficit over the last three years and, while it has decreased for two months in a row, it is still considerably higher than it has been in previous years.

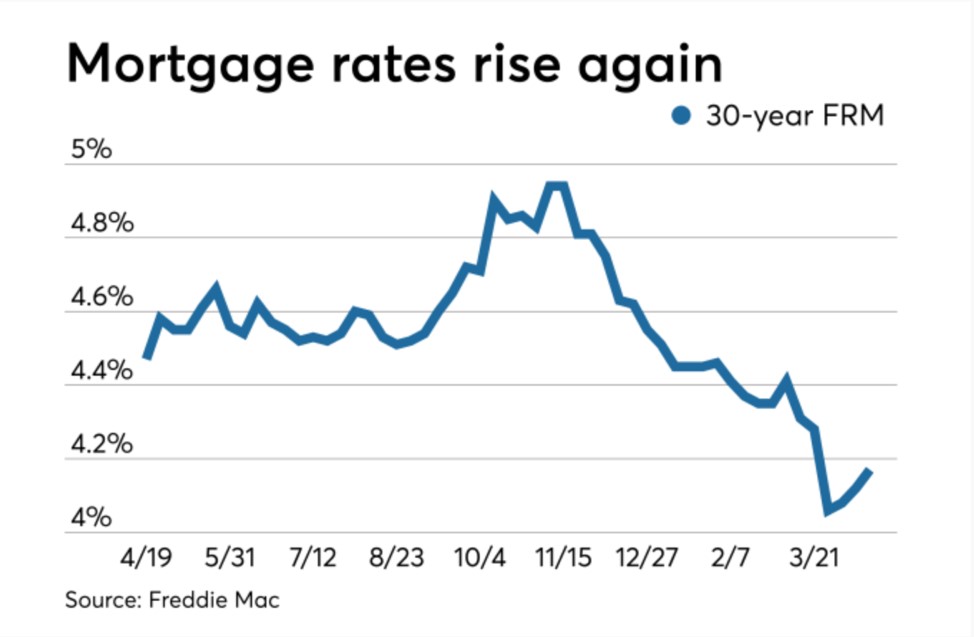

Rates inch up as economy shows strength

After a big dropoff at the end of March, mortgage rates have slowly increased for three straight weeks. The current Freddie Mac average on a 30-year fixed-rate mortgage is 4.17%. However, that hasn't yet seemed to deter people from getting in on what's turning into a hot homebuying season.

The chart below shows the last year of average mortgage rates on a 30-year fixed-rate according to Freddie Mac. You can see that yes, rates are on an upward trend, but they are still far below what we saw a year ago and especially lower than what we saw just a few months ago.

The Mortgage Bankers Association showed that mortgage applications as a whole were down for the week ending April 12. However, that was due mainly to drops in refinance applications. Home purchase activity has actually gone up to its highest level since April of 2010.

"The spring buying season continues to be robust with activity more than 7% higher than a year ago and up year-over-year for the ninth straight week," said Joel Kan, the MBA Vice President of Economic and Industry Forecasting.

Kan also noted that the MBA data shows refinancings slid by 8% and "average loan sizes dropped back to normal levels."