China’s latest move could put pressure on interest rates

The tension between the United States and China has escalated greatly this week, causing volatility in the stock market and pressure on the U.S. economy and interest rates.

The United States outlined its plan to implement the 25% tariffs on another $300 billion worth of Chinese imports. That would not start until July at the earliest, leaving room for a trade talk resolution potentially at the end of June.

In retaliation, China released its list of U.S. goods on which the country will place tariffs up to 25%. That caused the Dow to drop sharply, trading down more than 700 points on Monday.

The list consists of consumer goods like watches and things like alcohol and honey, but the most pertinent to our interests would be building supplies. Items like pipes, tubes, wood flooring, carpets and small tools are all on the list of goods to be taxed.

In the latest move this week, China has started to cut its holdings of U.S. debt, made up of Treasury notes, bonds and bills. Right now China holds about $1.12 trillion in U.S. debt, which is a two-year low. If China started a massive selloff of any of that debt, that could cause a disruption in the bond market, which could in turn put pressure on interest rates causing them to rise.

However, many analysts believe any fire sale of US Treasury notes and bonds would hurt China more than help them. Robert Tipp, Chief Investment Strategist and head of global bonds for PGIM Fixed Income, says "It's a self-destructive nuclear option. Maybe it helps them as a bargaining chip, but it's endangering the value of something they're deeply involved in."

In short, China selling off its ownership of US debt would cause their own portfolio to go down in value. However, it is an option that some call the "biggest weapon they have."

Consumer spending down, manufacturing gets a boost

While there is strong sentiment that the U.S. economy is still chugging along at a good pace, consumer spending seems to be heading the opposite direction. April's retail sales numbers were lower than expected, with core retail sales stagnant, suggesting a slowdown in momentum. The Commerce Department data shows April's retail sales slipping by 0.2% in sharp contrast to a 1.7% increase in March.

However, the National Retail Federation cited slower tax refunds and also the severe flooding in the Midwest as two main reasons why there would be a slip in April after such a strong surge in March.

The Philly Fed Manufacturing index saw an increase in May putting it at a four-month high. That's a good sign for the industrial sector amid the trade war with China, but not everyone is sold on this better-than-expected month. Many analysts believe the industrial economy is still weak, but may have hit its bottom. That means it's not getting weaker, but also not necessarily getting stronger.

The economy as a whole is still expected to be strong in 2019 with the Fannie Mae Economic and Strategic Research group projecting real GDP at 2.3% for the full-year. That's one-tenth higher than previous forecasts. The report shows that for the first time, net exports were the largest contributor to quarterly growth. As expected, the risks to growth are trade tensions with China and elevated corporate debt while the potential positive growth factors include global demand growth and productivity growth.

The biggest takeaway from the ESR report is that the group does not expect the Federal Reserve to raise interest rates within its two-year forecast horizon.

Mortgage interest rates hold steady, housing starts rise

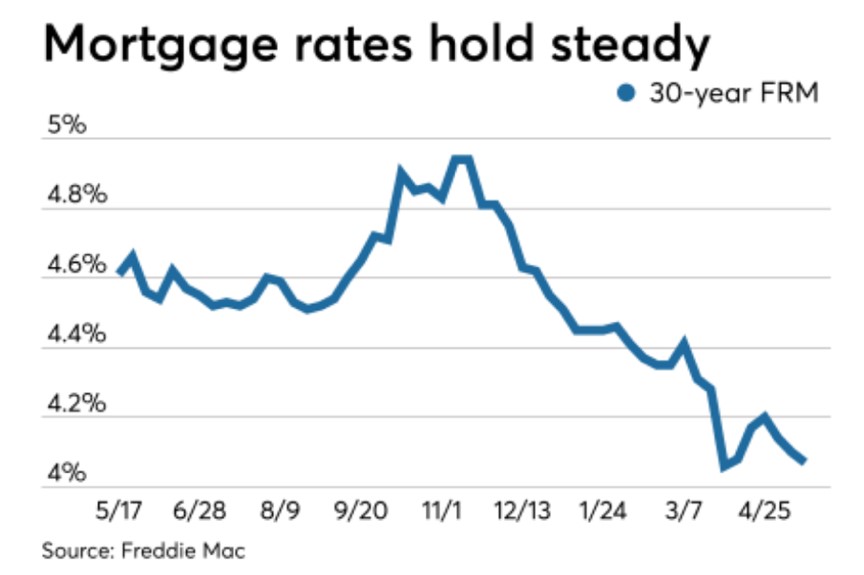

Despite the trade issues with China causing disruption in the market, mortgage rates are holding steady. Right now the average rate for a 30-year fixed rate mortgage is sitting at 4.07%, according to the Freddie Mac average. That's far below the 4.94% we saw in November of 2018 and the lowest level in 18 months.

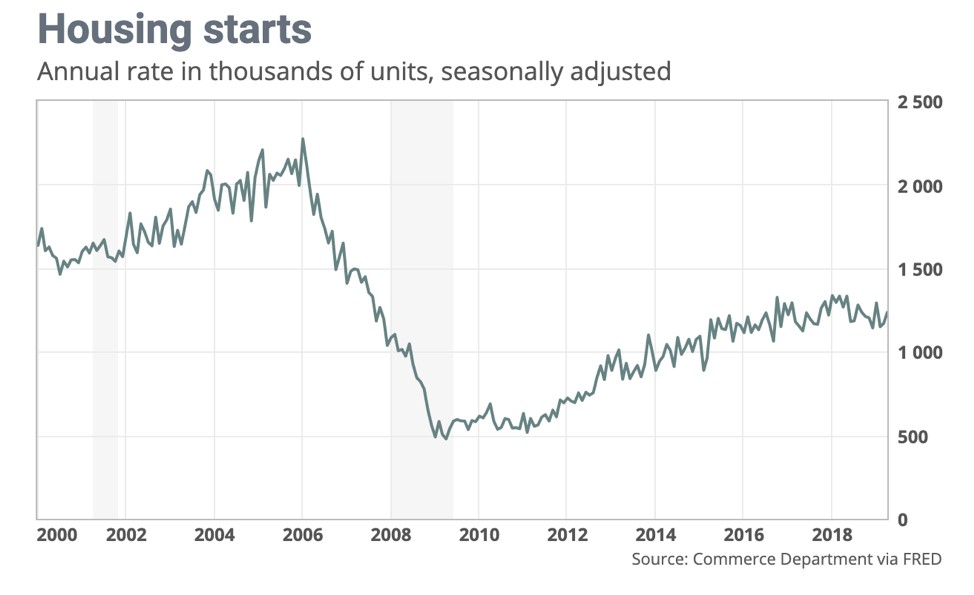

Declining mortgage rates may be the reason that housing starts increased by more than expected in April with March numbers also being revised higher than previously reported. Housing starts rose by 5.7% in April, according to a report from the Commerce Department.

This increase was driven by an increase in both single-family and multi-family housing, with single-family starts going up by 6.2% month-over-month. The strongest activity was seen in the Midwest and Northeast regions.

Data for March showed the homebuilding pace rising as well. The National Association of Home Builders' confidence index increased by three points in April, suggesting optimism. That's supported by the number of completed new homes waiting to hit the market, which is up year-over-year by 5.5%. However, year-over-year April housing starts were down by 2.5% which might point to a less optimistic future.

The chart to the left from Market Watch shows housing starts from 2000 to present. You can see the slow rebound from the nadir of 2009.

The chart to the left from Market Watch shows housing starts from 2000 to present. You can see the slow rebound from the nadir of 2009.

After declining for three straight months, building permits also rose in April by 0.6%. However, we did not see that same strengthening in single-family building permits. Those fell for a fifth-straight month. Permits are used to estimate future homebuilding activity.