Rates continue to rise but MBA is still bullish on the Purchase Market

Housing data released this week confirmed the predictions of many analysts that we would see a decrease in starts and a continued stagnation in new housing.

However, while housing starts were down overall it was multi-family units taking the brunt of the hit with a 15.2 percent decline. Single-family housing in comparison declined just 0.9 percent with the majority of the decline in the South region hit by Hurricane Florence. A similar decline is expected to be seen in October for Florida and the surrounding areas hit by Hurricane Michael.

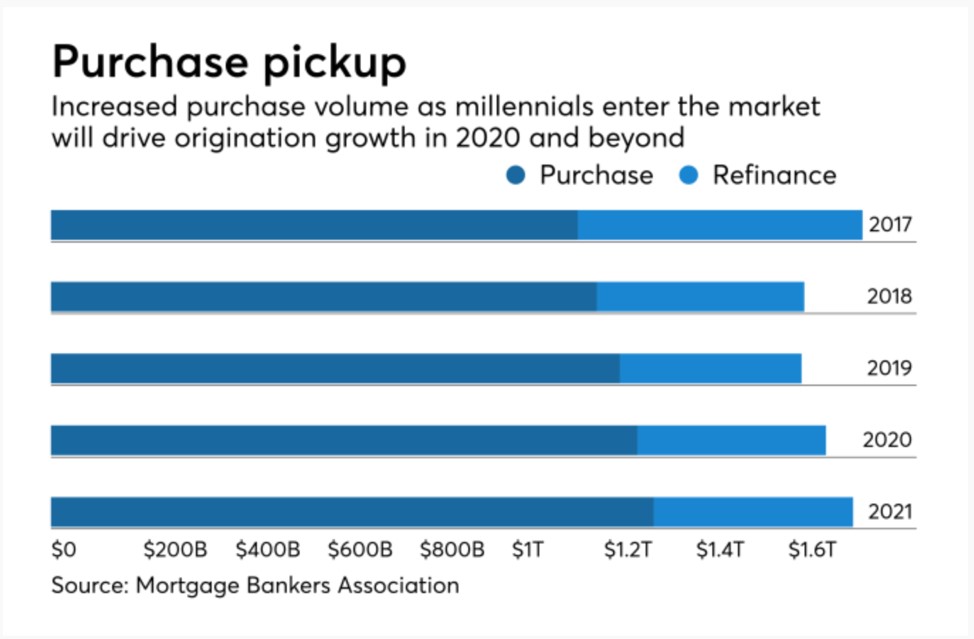

While a small bump in residential housing construction may still happen before the end of 2018, new forecasts from the Mortgage Bankers Association predict a rise in purchase mortgage volume through 2020 and beyond as millennials start buying homes. Chief Economist Mike Fratantoni expects 30-year mortgage rates to rise only modestly even with the expected short-term increase by the Fed.

As home prices start to show signs of decline, the unemployment rate continues to dwindle. It's expected the high number of job openings paired with the low unemployment rate will cause wage growth prompting more purchasing confidence.

Housing market index goes up

Although predicted to take a slight step down from September, October's Housing Market Index inched upward by one point to 68. One reason for the bullish response is the drop in soft lumber prices which hit an all-time high earlier this year.

Buyer traffic also went into positive territory at 53 points, up from 49 in August and September, although purchases aren't expected to speed up because prices and rates are still high.

Fed minutes

Future interest rate hikes seem not only inevitable for 2018 but for 2019 as well according to the recently released September meeting minutes from the Federal Open Market Committee. Much to the chagrin of an openly critical President Trump, the minutes show Fed members believe that "further gradual increases in the target range for the federal funds rate would most likely be consistent with a sustained economic expansion, strong labor market conditions, and inflation near 2 percent over the medium term."

But they didn't stop there. Right now, another rate hike is expected for 2018 with three or four hikes penciled in for 2019. A number of members feel the need for more restriction past simply normalizing rates in order to reign in a burgeoning economy and stave off inflation.

While there is confidence in the growth of the economy, there is also concern that the President's tariffs will hinder production, specifically in the energy sector, and that could cause further declines. The uncertainty was met with more questions this week as the US opened trade talks with Japan, the UK and the EU. Futures were lower this week and the major markets, like the S&P 500 and NASDAQ, haven't been able to post back-to-back gains yet this month. Expect to see more and more volatility in the markets with a continued trend to higher mortgage rates.

The Fed did cause a stir by removing one word from its description on future policy—accommodative. Fed Chair Jerome Powell urged people not to read too much into it and the change was more a way to remove any false sense of precision.

Weak retail rise

Economists projected a 0.6 percent rise in retail sales for September after a revised down report for August showing it at unchanged instead of 0.1 percent growth. September's actual numbers fell far short of projections, instead hitting a paltry 0.1 percent increase. September's numbers also saw the steepest decline in spending in restaurants and bars in two years.

However, when you take out spending on automobiles, gasoline, building materials and food services, the core retail sales jumped 0.5 percent this past month. Those core retail numbers are expected to hold off any economic drag brought on by a stale housing market.

Odds and ends

- Equities followed last week's decline and continued on a roller coaster ride with large daily swings. The Dow jumped more than 500 points on Tuesday after better-than-expected earnings reports from Goldman-Sachs, Johnson & Johnson and UnitedHealth.

- According to Goldman Sachs, September's existing home sales numbers decreased 3.4% month-over-month to a seasonally annualized rate of 5.15 million units, which is the lowest level since 2015.

- Despite retail numbers lagging, the economy grew at a 4.2 percent pace in the second quarter with growth estimates for the third quarter sitting above 3.0 percent.

- The monthly JOLTS (Job Openings and Labor Turnover Survey) was released by the Labor Department on Tuesday, showing 7.14 million job openings in August. That's the highest level since 2000, the year the series started. That was up from 7.08 million in July.

- The hiring rate was also higher in August compared to July, sitting at 3.9 percent up from 3.8 percent with hiring reaching a record high of 5.78 million in August.