Fed pushes rates up, housing sinks lower

Headwinds in the housing market were on display this week as the Federal Reserve continued forward on its path to increase interest rates, while home sales and price data softened.

The week's top financial headline was the Fed's expected decision to increase interest rates for a third time this year. The federal funds target rate is now between 2 and 2.25 percent. From 2008 to 2016, the rate had been zero. The gradual increases this year have cemented the rising rate policies of the Fed under Chairman Jerome Powell.

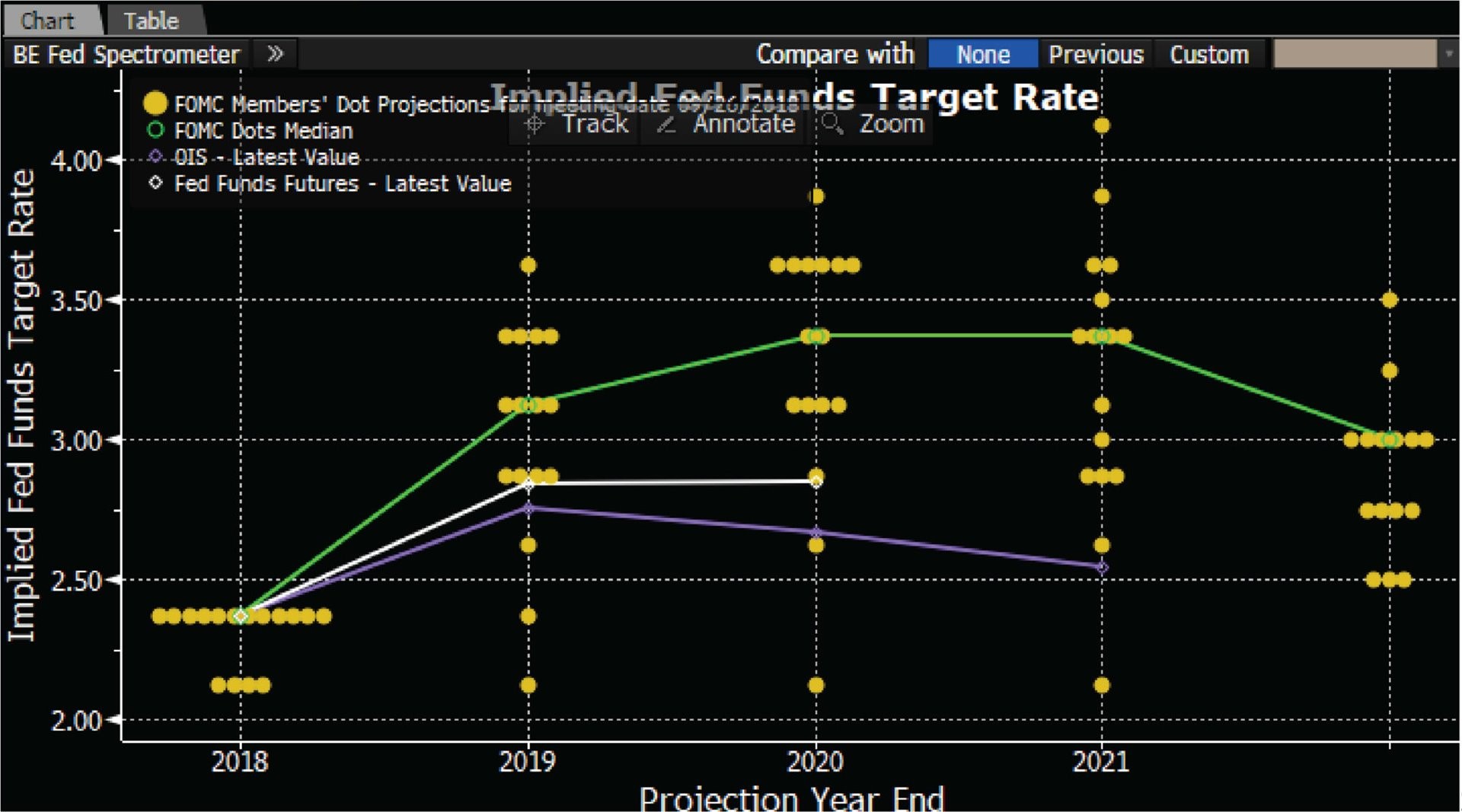

The Fed's released statement following its decision also removed the word "accommodative" from the line describing its policy. Plus, the long run projection of future rate increases set the target slightly higher at 3 percent, with three additional rate hikes likely in 2019 and a fourth hike in 2020, according to the Fed's Summary of Economic Projections, also known as the long-term dot-plot.

Investors reacted without much surprise, as they had expected this hike for months. The Fed is trying to strike a balance between normalizing interest rate policy without crimping the economy. Economic growth has increased in 2018 and rising rates may also help keep a lid overcharged growth.

However, President Trump publicly criticized the Fed's decision, an unorthodox move for a sitting president. Most elected officials refrain from critiquing the central bank because it is designed to run free from political interference.

Trump acknowledged the increases are due to strong economic growth and a forecast of more growth in the foreseeable future. Still, he advocated for a prolonged low-rate environment to stoke expansion.

"We're doing great as a country. Unfortunately, they just raised interest rates because we are doing so well. I'm not happy about that," Trump said at a Wednesday press conference. "I'd rather pay down debt or do other things, create more jobs. So I'm worried about the fact that they seem to like raising interest rates."

The yield on a 10 Year Treasury moved higher after the Fed announcement Wednesday, but then dipped slightly later in the week when data on inflation remained flat. The 10Y yield is still above 3 percent. Mortgage rates tend to follow the yield on the 10Y Treasury note.

Housing results slow

In other economic news this week, housing data painted a picture of a softer market for homebuyers.

- On Monday, economists at Bank of America claimed sales of existing homes have peaked and will now begin decreasing. The report suggested home prices may begin to decline as affordability and demand become issues for sellers. Read the report here.

- The S&P Case-Shiller home price index rose met expectations in July, but year-over-year growth slowed to 5.9 percent from 6.4 percent a month prior.

- Sales of new single-family homes increased 3.5 percent in August, but sales from the previous three months were revised downward by 40,000 units.

- Pending home sales, a leading indicator of actual sales over the next 60 days, decreased 1.8 percent in August, missing expectations. The decline was felt in all regions. In a research note, Goldman Sachs said it expects real estate investment to shrink for the third consecutive quarter.