Unpacking tariffs, the trade war and what it means for you

Trade war. It's been all over the headlines this week after President Trump threatened a new 10 percent tariff on $200 billion in Chinese goods.

The development spooked markets and investors traded out of equities, sending the Dow Jones Industrials down 300 points and into a six-day slide. The latest tariff announcement comes just weeks after several rounds of announced tariffs on other goods from China, Canada, Mexico and Europe.

To help you understand what this means for our economy, let's take a look at the basics of trade policy this week.

We'll start with the fundamental question: What is a tariff?

A tariff is a tax on imports or exports. Money collected from a tariff is called a duty. They are commonly used by governments to generate revenue or protect domestic industries from competition.

There are generally two types of tariffs. Tariffs are calculated either as a fixed percentage of the value of the imported goods or a fixed amount of money that does not vary with the price of the good.

What do higher tariffs on imported goods mean for the U.S. economy?

This is the question markets are trying to answer. The Trump administration is using the tariff to make it harder for other countries to import goods to the U.S. economy at prices that undercut our domestic businesses. This is known as protectionism, which is using trade policy to protect the interests of domestic businesses instead of allowing free trade in an open market.

In theory, this is designed to make the playing field more even for domestic companies, who will have an advantage over their foreign competition with better prices. The hope is these homegrown companies then produce more and create more jobs.

However, there's another side of the coin. Many economists argue that free trade, is better for overall economic health. Why? Because It allows for complete and open competition across the globe. Consumers have the opportunity to purchase items cheaper. This in turn frees up resources which can be used for other goods or services.

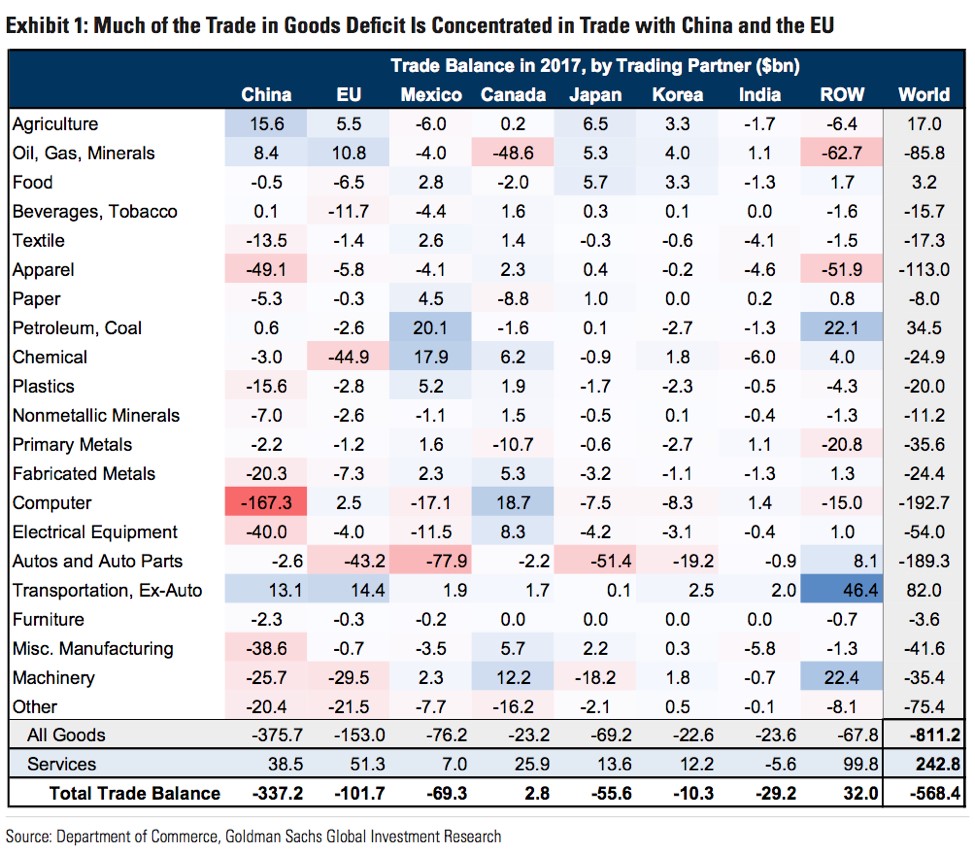

Of course, in the U.S. the policies of prior administrations that leaned toward free trade has created a large trade deficit. This means our economy imports more goods than it exports to other countries. Take a look at this graph from Goldman Sachs, showcasing the trade deficit.

The Trump administration is trying to reverse this trend by implementing tariffs that will tilt the scale back towards a balance or in favor of the U.S.

Some analysts expect this is all a political leveraging device designed to produce new trade agreements. But for Trump's gamble to pay off, he must be perceived as a serious threat by these foreign governments, which is one reason why he keeps escalating the trade war.

The reason markets are reacting negatively is the fear that a trade war with higher tariffs will result in higher consumer prices. That could harm consumer and business confidence and stall the economic growth we've seen recently.

If all of Trump's proposed tariffs are implemented (most are still not in effect), then the overall share of U.S. imports subject to substantial new tariffs would reach around $475 billion, or about 20 percent of all imports, according to Goldman Sachs. That's a material number that would have real economic consequences.

What does this mean for housing?

It's still early to make concrete forecasts, especially since many tariffs are not yet implemented. But in theory, higher prices on goods, even materials not used in homebuilding, will begin to chip away at consumer spending power. If that hurts consumer confidence and spending power, and isn't replaced by robust wage growth (which leads to inflation – another concern), then a decline in home purchasing is in play.

Of course, the threat of tariffs and an escalating trade war has caused the bond market to rally in recent days, pushing yields on the 10 Year US Treasury lower. Mortgage rates follow the 10 Year T-note, so we've seen borrowing costs go down. This helps consumers with home affordability, but it's not necessarily a sign of economic strength overall.

We did receive some housing data this week that once again disappointed. Existing home sales fell 0.4 percent month-over-month in May to a seasonally adjusted annualized rate of 5.43 million units. This disappointed the market, which had expected 1.1 percent rebound.

Sales decreased in single-family units (-0.6%) but rose among condos and co-ops (+1.6%). Sales were mostly weak by region, as sales fell in the Midwest (-2.3%), West (-0.8%), and South (-0.4%), but rose in the Northeast (+4.6%).

We will take a short mid-summer break from the Market Update blog beginning next week as we move into the July 4 holiday season. I'll be back with Market Update on Friday, July 13. Thank you for reading and sharing.