Markets rally amid strong housing numbers

The major stock market indexes traded to new all-time highs during a holiday shortened week characterized by light trading volumes. The week's economic data were mixed, but strong housing data reported on Tuesday from the latest Existing Home Sales report helped spark a market rally.

Existing Home Sales increased 2.0% month-over-month in October to a seasonally adjusted annual rate of 5.48 million compared to a consensus forecast of 5.42 million and a downwardly revised 5.37 million reading for September. The median existing home price for all housing types increased 5.5% to $247,000 while the median price for single-family homes climbed 5.4% from a year ago to $248,300. October was the 68th consecutive month of year-over-year gains.

The inventory of existing homes for sale at the end of October fell 3.8% to 1.80 million and is 10.4% lower than the year ago period. The inventory of existing homes for sale has now dropped year-over-year for 29 consecutive months. At the current sales pace, unsold inventory is at a 3.9 month supply compared to 4.4 months a year ago. This continues to be considerably lower than the 6.0-month supply typically seen in a more balanced market. First-time home buyers were responsible for 32% of the sales in October, up from 29% in September but down from 33% a year ago.

In other news, Weekly Initial Jobless Claims were reported near historic lows at 239,000 to match the consensus estimate, but October Durable Goods Orders weakened by 1.2% for the month, failing to reach the consensus forecast calling for a 0.4% gain. Wednesday afternoon, the minutes from the Federal Reserve's last monetary policy meeting were released in what was viewed by Fed watchers as a "dovish" report. The minutes indicated several Fed officials were concerned about the persistence of below-target inflation, and this triggered a sharp rally in bond prices as inflation erodes the value of fixed bond returns. The prospect of persistently low inflation preserves the value of bonds.

In the realm of mortgages, mortgage application volume increased very slightly during the week ending November 17. The Mortgage Bankers Association (MBA) reported their overall seasonally adjusted Market Composite Index (application volume) increased 0.1%. The seasonally adjusted Purchase Index increased 5.0% from the prior week while the Refinance Index decreased by 5.0%.

Overall, the refinance portion of mortgage activity decreased to 49.9% of total applications from 51.3% in the prior week. The adjustable-rate mortgage share of activity increased to 6.5% of total applications from 6.4%. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance increased to 4.20% from 4.18% with points increasing to 0.42 from 0.40.

For the week, the FNMA 3.5% coupon bond gained 7.8 basis points to close at $102.781. The 10-year Treasury yield decreased 0.51 basis points to end at 2.3401%. The major stock indexes ended the week higher.

The Dow Jones Industrial Average rose 199.75 points to close at 23,557.99. The NASDAQ Composite Index gained 106.37 points to close at 6,889.16 and the S&P 500 Index advanced 23.57 points to close at 2,602.42. Year to date on a total return basis, the Dow Jones Industrial Average has gained 19.20%, the NASDAQ Composite Index has advanced 27.98%, and the S&P 500 Index has added 16.24%.

This past week, the national average 30-year mortgage rate fell to 3.96% from 3.97%; the 15-year mortgage rate was unchanged at 3.30%; the 5/1 ARM mortgage rate decreased to 3.17% from 3.21% and the FHA 30-year rate remained unchanged at 3.60%. Jumbo 30-year rates decreased to 4.15% from 4.16%.

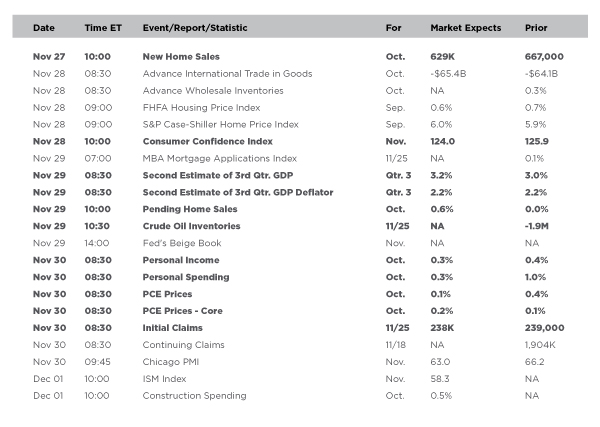

Economic Calendar – for the Week of November 27, 2017

Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

Mortgage Rate Forecast with Chart – FNMA 30-Year 3.5% Coupon Bond

The FNMA 30-year 3.5% coupon bond ($102.781, +7.8 bp) traded within a 36 basis point range between a weekly intraday high of $102.891 on Wednesday and a weekly intraday low of $102.531 on Monday before closing the week at $102.781 on Friday.

After pulling away lower from the 25-day moving average last Monday, mortgage bond prices rebounded on Tuesday and Wednesday to break above multiple resistance levels, only to pull back to these levels during an abbreviated trading session on Friday. The bond is now sitting at resistance, but is not oversold while remaining on a buy signal from last Wednesday. With a number of potential catalysts coming in the way of economic news, we could see the bond continue to advance to challenge further resistance at the 50 and 100-day moving averages resulting in stable to slightly improved mortgage rates this week.