Trump readies ban for specific Chinese goods as trade deadline looms

The stock market dropped more than 350 points on Thursday when CNBC reported that President Trump was unlikely to meet with Chinese President Xi Jinping before the March 1 trade deadline.

If no trade deal is agreed upon before the deadline, additional tariffs will be levied on goods coming from China. The Dow Jones, S&P 500 and Nasdaq Composite all recorded declines on the news.

President Trump is expected to sign an executive order next week that will ban Chinese telecom equipment from US wireless networks. In addition to that, the order will state that any Western nation allowing Chinese equipment in critical infrastructure will face risk of sanctions. It's being characterized by the White House as a push for future technology to prioritize cybersecurity. Chinese telecom company Huawei has been accused of using their technology to steal trade secrets.

It is interesting to note how sharply the US trade deficit declined in November, dropping by $6.4 billion. That kind of drop has not been seen in a while. Imports were down significantly, hitting a five-month low, while exports also declined albeit by a smaller margin.

Bank merger planned

With the Federal Reserve speaking positively about the economy and interest rates, and President Trump's State of the Union drawing little reaction from Wall Street, the other big news this week came from the banking world.

BB&T Corp. is set to buy SunTrust in a deal valued at $66 billion. That would create the sixth-largest bank in the United States (based on assets and deposits) and move the headquarters from Atlanta/Winston-Salem to Charlotte, North Carolina. The deal is expected to close in the fourth quarter of 2019.

Changes in tax laws helped facilitate this merger by freeing up capital thanks to a lower corporate tax rate.

Beyond the banks, the claims for state unemployment benefits fell by 19,000 for the week ending Feb. 2, according to the Labor Department. Many economists believe the drop was due in large part to a teacher strike in California ending along with the temporary end to the government shutdown.

Federal Reserve Chairman Jerome Powell spoke at a town hall in Washington D.C. this week and outlined his concerns about the future of the US economy. Although the Fed has hit pause on rate hikes, citing a strong labor market and low inflation, Powell has concerns about the widening wage gap and stressed the importance of increasing participation in the labor force.

With regard to the State of the Union address, there was very little reaction as President Trump did not go into detail about any economic plans.

Fannie and Freddie go to Congress

A proposal to housing finance reform legislation hit Capitol Hill last week, sponsored by Senate Banking Committee Chairman Mike Crapo (R-ID). It would end government control of Fannie Mae and Freddie Mac.

A proposal to housing finance reform legislation hit Capitol Hill last week, sponsored by Senate Banking Committee Chairman Mike Crapo (R-ID). It would end government control of Fannie Mae and Freddie Mac.

The plan would privatize the companies as well as put strict limits on capital and business lines. Fannie and Freddie have been under the conservatorship of the Federal Housing Finance Agency for 11 years.

Former head of the Mortgage Bankers Association and Federal Housing Administration David Stevens says this proposal "draws a bright line between guarantors and banks. It limits the role of the guarantor."

"We must expeditiously fix our flawed housing finance system," Crapo said. "My priorities are to establish stronger levels of taxpayer protection, preserve the 30-year fixed-rate mortgage, increase competition among mortgage guarantors and promote access to affordable housing."

Home prices falling, homebuyers on the rebound

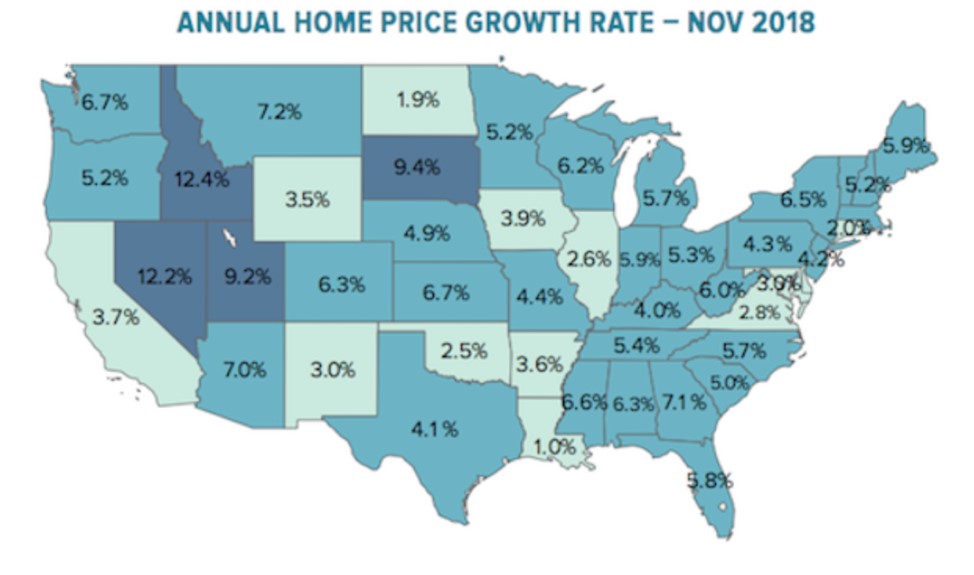

For the first time since early 2012, home values have declined for three consecutive months with the average home now down $1,361 in value since August of last year. Home prices are still in the positive and growing, but the growth has slowed significantly, especially in the western states.

Data from research company Black Knight shows home values saw the largest single-month decline in November (0.2 percent) since the housing market started to rebuild post-crash. The map below shows the latest home value growth rate for each state in the contiguous US.

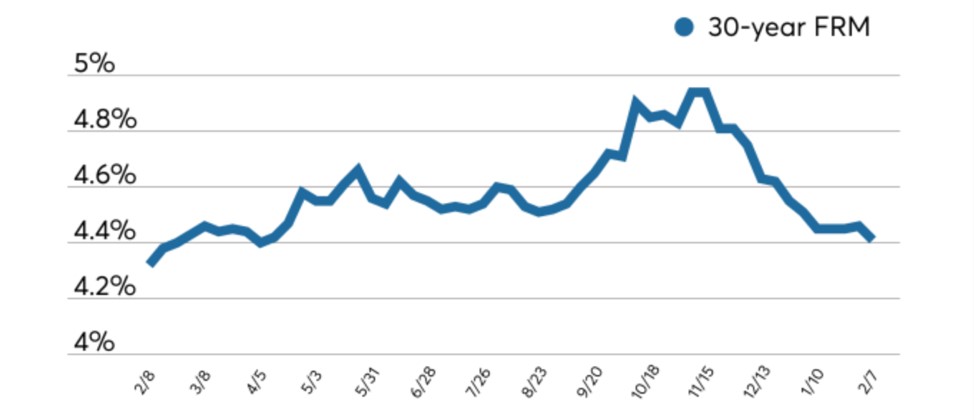

As we get closer to the popular spring homebuying season we have seen a shift in a positive direction for the housing market. With the Federal Reserve being conservative on rates and the stock market struggling to find stable footing, mortgage rates and housing prices cooled off, giving buyers a perfect window.

While still higher than a year ago, mortgage rates have hit a 10-month low with the 30-year fixed-rate mortgage averaging 4.41 percent for the week ending Feb. 7. The chart below from Freddie Mac shows what mortgage rates have done over the last year.

Lower mortgage rates did not seem to help much with buying at the end of 2018. However, what could boost sales are lower prices on current homes on the market. According to data from Realtor.com, home prices cuts were more common in January with price reductions increasing in 39 of the 50 largest markets.

While home prices are slowing down, they aren't necessarily affordable for the first-time homebuyer yet. Homes are staying on the market longer which is part of why inventory is increasing, but many are still not considered affordable. Experts in the field point to businesses buying up the less expensive homes in the post-crash years and turning them into rental properties.

Freddie Mac's chief economist Sam Khater is optimistic, believing homebuyers now have a little more wiggle room to make a deal. "Mortgage rates are essentially similar to a year ago," said Kahter, "but today's buyers have a larger selection of homes and more consumer bargaining power than they did the last few years."