Economy settles into mortgage market nirvana as Fed remains on pause

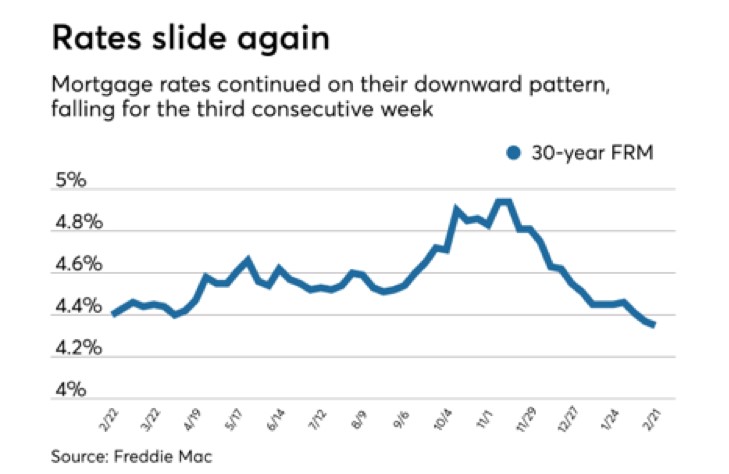

Right now we are in what I like to call nirvana for the mortgage market. We are seeing low mortgage rates, no volatility, moderate growth and no inflation. In addition, this week Freddie Mac reported that the 30-year fixed-rate mortgage fell again to a one-year low of 4.35 percent (see chart below). Equities continue the slow climb northward, the number of people filing for unemployment is fairly steady and inflation is still right around the sweet spot of 2 percent.

Because of all that, patience is still the strategy of choice for the Federal Reserve. The minutes from January's Federal Open Market Committee meeting were released this week and they confirm an emphasis on patience, citing slower growth domestically and internationally as well as softer inflation.

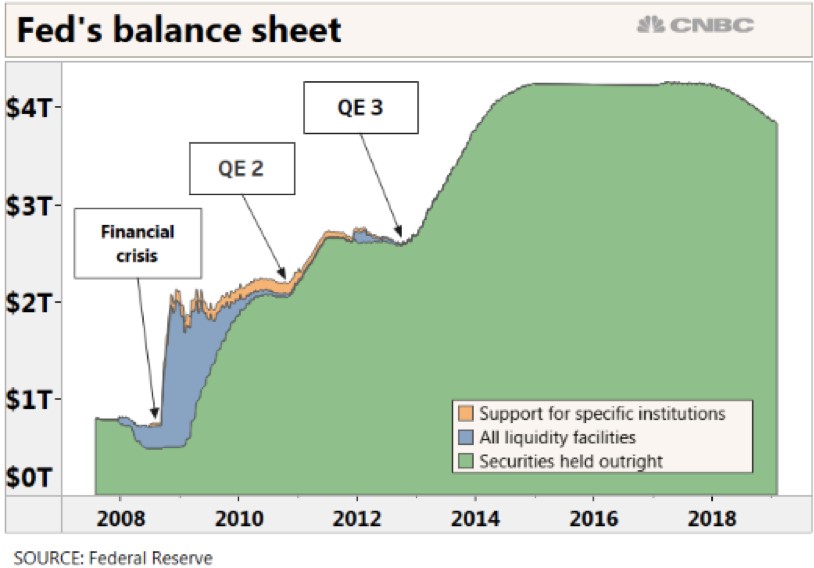

With rate hikes on hold for now (only one hike is expected in 2019), the next big issue for the Fed is its $4 trillion balance sheet. The Fed started growing its balance sheet after the financial crisis, and stocks and bonds responded. From 2009 to 2012, the Fed was slowly growing its balance sheet and stocks were moving higher as the interest rate moved lower. In late 2012, the balance sheet expansion grew dramatically. The balance sheet is mostly comprised of Treasuries and mortgage-backed bonds.

You can see in this chart below from CNBC how much the Fed's balance sheet has grown since 2008, and you can see how it has started to dip ever so slightly in the last few months.

At the January meeting, committee members discussed selling off the assets a little more aggressively. So far, the Fed has reduced its balance sheet by about $400 billion. After the release of the minutes, analysts believe there will be an announcement at the March meeting that the runoff will stop at the end of the third quarter. After that, it's expected the reserves will slowly be reduced.

This week's report on US jobless claims does hold a slight indication that the labor market is also cooling off. The number of Americans filing for unemployment benefits dropped, but the four-week average is up to a one-year high. That suggests a more moderate pace in job growth, mirroring what we are seeing in overall economic growth.

US and China pushing for March 1st deal

News is slowly trickling out about the potential for a trade deal between the United States and China on or before the March 1 deadline. CNBC reported that the two countries "have started to outline commitments in principle on the stickiest issues in their trade dispute, marking the most significant progress yet toward ending a seven-month trade war."

According to CNBC's article, there are reportedly six major issues being negotiated: Forced technology transfer and cyber theft, intellectual property rights, services, currency, agriculture and non-tariff barriers.

The deadline is exactly a week from today and President Trump has threatened to increase tariffs on Chinese goods should no agreement be reached.

Slow January enriches home inventory

The exciting news for potential homebuyers right now is that inventory is at a 10-year high over 54 metro areas, according to the latest national housing report from RE/MAX. The report also shows that January was the fourth-consecutive month for inventory growth. Obviously, the other side of the situation is rough for those selling homes.

Existing home sales data released on Thursday backs up the inventory data. The National Association of Realtors report shows US home sales fell to a 3-year low. Home prices are still going up, but definitely continuing to slow down their pace. At January's sales pace, the existing inventory would be exhausted in just under four months. That's better than where we were in December, but a six to seven month supply is viewed as a healthy balance.

As we inch closer to the spring buying season we are already seeing mortgage applications pick up. Data from the Mortgage Bankers Association shows that, after four straight weeks of decline, applications are up by 2 percent week-over-week and up 2.5 percent from a year ago.