Tax reform may not doom housing after all

Both House and Senate Republicans have now unveiled their versions of President Donald Trump's comprehensive tax reform plan. The Senate's plan keeps the popular mortgage interest deduction untouched; the House plan calls for a $500,000 cap on how much interest homeowners can deduct on their income taxes.

For weeks, pundits and reporters have blasted proposed changes to the mortgage interest deduction, suggesting it will make homeownership unaffordable for millions of Americans and sway renters to stay put in their apartments.

I'm skeptical that will happen.

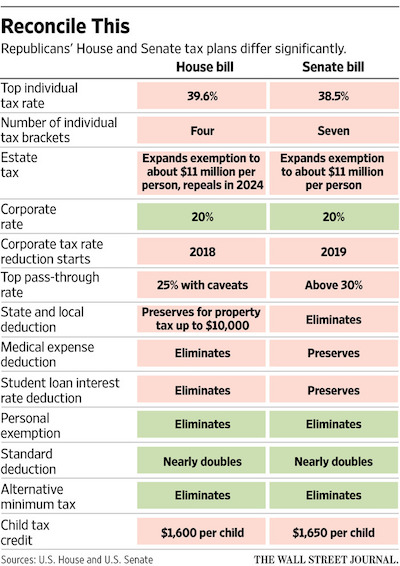

First, let's remember that the plan is still in the early stages. The GOP in both chambers will have to reconcile differences between their two versions of the plan. Then, they have to each pass a cohesive bill before Trump signs it into law.

Goldman Sachs estimates there's a 65-percent chance tax reform will be implemented by 2018. Analysts expect details of the bill will change as pressure from special interest groups and trade associations upset by some of the provisions continues to mount.

I want to encourage anyone unnerved by the House's version of the plan as we know it now. Even if the cap becomes law, it will not have a harmful effect on housing. Let me explain.

No need for deduction woes

- Small businesses may benefit: The plan calls for a cut in the percentage of tax paid by small businesses, which often take the brunt of high taxation and suffer most during a downturn. Granted, slashing taxes will not automatically create an upsurge in hiring. But, it can ease the burden for entrepreneurs and mom and pop shop owners who are the backbone of the American economy. Like I've said before, when businesses are healthy and stable, the economy flourishes. When the economy thrives, more people buy homes.

- Motives don't change: As far as the mortgage interest deduction is concerned, let's keep in mind that it's never been a significant motive for buying a house. Think about it. When you're talking to potential buyers, how many cite taking advantage of the mortgage interest deduction as something influencing their purchasing decision? I'm willing to guess very little. Laurie Goodman, co-director of the Urban Institute's Housing Finance Policy Center, agreed with statements that people don't buy homes because of the deduction. "I think people buy homes because it represents security and a way to build wealth and a sense of stability," she told CNBC. "I don't think the mortgage interest deduction plays a large role in that decision."

- It won't affect everyone: In 2012, only about a quarter of taxpayers claimed the deduction, according to a USA Today analysis of data from the Internal Revenue Service. For many homeowners, the deduction has never been a big factor at tax time. Remember, it's only available to taxpayers who itemize, and most Americans don't (a 2016 study from the Tax Foundation shows that just 30 percent of U.S. households itemize). Plus, homeowners only reap the full benefit of the deduction if their total deductions for mortgage interest, charitable giving and other expenses are worth more than the standard deduction.

The bottom line

Will aspiring homeowners change their minds about buying if the deduction loses its luster? I don't think so.

Richard Green, director of the University of Southern California's Lusk Center for Real Estate, told CNBC that the deduction does encourage people to buy bigger houses than they would normally but it doesn't "flip the switch" between buying and renting. HousingWire suggests reducing the deduction will yield positive results because lower taxes for middle-class renters will help them save for a down payment.

The deduction is most useful in states like California and New York, where home prices and tax rates are significantly higher than the rest of the country. That's probably why the National Association of Realtors has come out against any change to the deduction, saying it feels weakening the deduction will hurt middle-class homeowners.

I agree that tax breaks sweeten the perks of homeownership. But, overall, the deduction benefits Americans in the highest tax bracket with larger loans. Therefore, it's unlikely the deduction will ever be a main driver of homeownership. Thanks to a variety of assistance programs and special loan products, buying a house is accessible to individuals in any social class.