S&P 500 has 50-day run not seen since 1965

The major stock market indexes traded mostly flat to modestly lower to end the week "mixed" with the Nasdaq Composite Index managing to record a gain while the Dow Jones Industrial Average and the S&P 500 Index saw small losses. Trading volumes began to shrink as the week progressed as market participants turned their attention toward the pending Thanksgiving holiday season.

There was one record worth mentioning. The S&P 500 Index had a 50-day run of avoiding a daily decline of greater than 0.50% heading into last Wednesday when it was ended with a 0.55% decline. This was the longest such streak since 1965.

The week's economic reports were mostly favorable for the markets. Retail Sales increased by a greater than expected 0.2% in October while Housing Starts and Permits recorded unexpectedly stronger than forecast gains, rising 13.7% and 5.9%, respectively. The October Producer Price Index increased 0.4% in October, more than the 0.1% expected by economists. However, the Consumer Price Index only increased by 0.1% for October with the core rate (excluding food and energy prices) rising 0.2% to match expectations.

As far as mortgages were concerned, mortgage application volume increased during the week ending November 10. The Mortgage Bankers Association (MBA) reported their overall seasonally adjusted Market Composite Index (application volume) increased 3.1%. The seasonally adjusted Purchase Index increased 0.4% from the prior week while the Refinance Index increased 6.0%.

Overall, the refinance portion of mortgage activity increased to 51.3% of total applications from 49.0% in the prior week. The adjustable-rate mortgage share of activity decreased to 6.4% of total applications from 6.6%. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance remained unchanged at 4.18% with points increasing to 0.40 from 0.38.

For the week, the FNMA 3.5% coupon bond gained 26.5 basis points to close at $102.703. The 10-year Treasury yield decreased 5.68 basis points to end at 2.3452%. The major stock indexes ended the week "mixed."

The Dow Jones Industrial Average fell 63.97 points to close at 23,358.24. The NASDAQ Composite Index gained 31.85 points to close at 6,782.79 and the S&P 500 Index lost 3.45 points to close at 2,578.85. Year to date on a total return basis, the Dow Jones Industrial Average has gained 18.19%, the NASDAQ Composite Index has advanced 26.00%, and the S&P 500 Index has added 15.19%.

This past week, the national average 30-year mortgage rate fell to 3.97% from 4.01%; the 15-year mortgage rate decreased to 3.30% from 3.31%; the 5/1 ARM mortgage rate increased to 3.21% from 3.20% and the FHA 30-year rate remained unchanged at 3.60%. Jumbo 30-year rates decreased to 4.16% from 4.18%.

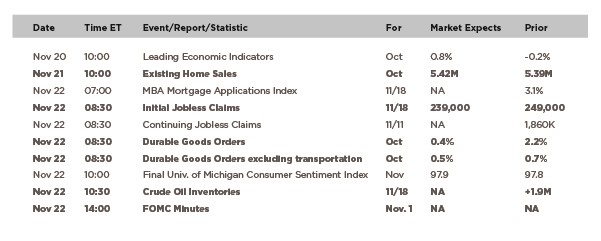

Economic Calendar – for the Week of November 20, 2017

Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

Mortgage Rate Forecast with Chart – FNMA 30-Year 3.5% Coupon Bond

The FNMA 30-year 3.5% coupon bond ($102.703, +26.5 bp) traded within a 42 basis point range between a weekly intraday high of $102.841 on Wednesday and a weekly intraday low of $102.42 on Monday before closing the week at $102.703 on Friday.

Mortgage bond prices successfully tested support on Monday and continued higher during the week to test overhead resistance on Wednesday before pulling back on Thursday and Friday. The bond is not yet overbought and is positioned to make another run higher to further test nearby resistance at $102.77 and $102.806. If the bond can manage to break above the dual levels of resistance it should lead to a slight improvement in mortgage rates. If the bond is turned away from resistance, the bond would likely trade between the resistance and support levels identified on the chart resulting in relatively stable mortgage rates this coming week.