Will Fed's latest move pinch housing market?

The Federal Reserve this week took long-awaited steps to reduce its $4.5 trillion balance sheet, announcing a timeline for when the process will begin while also maintaining its schedule for future rate hikes.

Although markets have anxiously waited for the roll off to begin, housing experts worry that the end of the Fed's historic quantitative easing program may boost interest rates, making homes harder to afford.

The U.S. central bank on Wednesday said it will begin rolling off its bundle of mortgage-backed securities and Treasurys in October. As expected, policymakers left the benchmark interest rate untouched but indicated that a hike is on the horizon in December. The Fed also maintained that it will seek to raise rates three times in 2018 and twice in 2019.

"The basic message here is U.S. economic performance has been good," Fed Chair Janet Yellen's quoted in the Washington Post as telling reporters at a news conference. "The American people should feel the steps we have taken to normalize monetary policy…are well justified given the very substantial progress we've seen in the economy."

In a statement released at the close of its two-day meeting in New York, the Fed expressed confidence in the country's strengthening economy. Consumers continue to spend, employers continue to hire and business investment continues to grow. All this, despite the damage wrought by three major hurricanes within the last month.

While officials expect storm-related disruptions and rebuilding to affect economic activity, they feel the effects from Hurricanes Harvey, Irma and Maria won't "materially alter the course of the national economy over the medium term." The board also expects inflation will reach its 2 percent target in the medium term, even if higher gasoline prices cause inflation to rise.

Stocks and bond yields moved higher after the Fed's meeting, and the dollar rallied against the pound after spending most of Wednesday falling. Yield on the 10-year Treasury increased to 2.28 percent from 2.23 percent ahead of the announcement.

How did we get here?

The reason for the Fed's exorbitant balance sheet stems back to the financial crisis. The Fed began buying bonds in late 2008 when the government's takeover of Fannie Mae and Freddie Mac failed to reinvigorate the mortgage market. The Fed purchased hundreds of billions of dollars of Treasurys and mortgage-backed securities to drive down mortgage rates.

It was called quantitative easing, and it happened at least two other times in 2010 and 2012 as policymakers aimed to keep inflation from falling below zero and stop long-term interest rates from going too high. It made it easier for businesses to borrow money and consumers to purchase goods with credit. Ultimately, the easing spurred economic growth, lifting the economy out of its recession.

What happens to housing?

The start of the Fed's balance sheet roll off brings an end to the saga of a historic policy that lowered borrowing costs for homeowners, businesses and consumers, and was cast as a hail Mary of sorts amid the country's most cataclysmic financial disaster ever.

Earlier this year, the Fed announced it would begin the unwinding process sometime in 2017, with plans to reduce its bond holdings by $10 billion and raise that amount gradually in the coming months.

The unwinding could have some impact for the housing market considering nearly 40 percent of the portfolio is mortgage-backed securities. The key here is how the Fed digests the massive portfolio over time. Yellen and the Fed are very aware of supply and demand and how these investments sold in the markets can have an impact on interest rates. Time will tell on the real impact on rates.

Low inventory and rising prices have already created affordability issues for would-be homebuyers trying to enter the market. The industry's saving grace, so to speak, has been this year's historically low interest rates. The actual price of a home does not determine if it's affordable for a homebuyer — how much a homeowner can afford to borrow is determined by their income and mortgage rate.

Said Danielle Hale, chief economist for Realtor.com: "The Fed's decision…is likely to lead to an uptick in mortgage rates and may mean more volatility in rates. Home shoppers will want to adapt by considering their budget in light of current mortgage rates."

What happens now?

The way the Fed handles the balance sheet reduction may signal cues to other central banks considering similar action. Case in point: the European Central Bank, which is debating whether it should wind down its own asset purchases next year.

Richard Clarida, an economist at Pimco, told the Wall Street Journal that the Fed will likely continue purchasing bonds over the next year since only a small fraction of them will mature without being replaced. The Fed has to weigh how large its balance sheet should be at the end of the unwind since it will still end up with more assets than before the crisis because its liabilities have grown.

"We have never seen a central bank exit out $1 trillion of mortgage-backed securities, so we are concerned about how this is going to go," Matthew Jozoff, J.P. Morgan's mortgage-debt strategist, told the Journal this week.

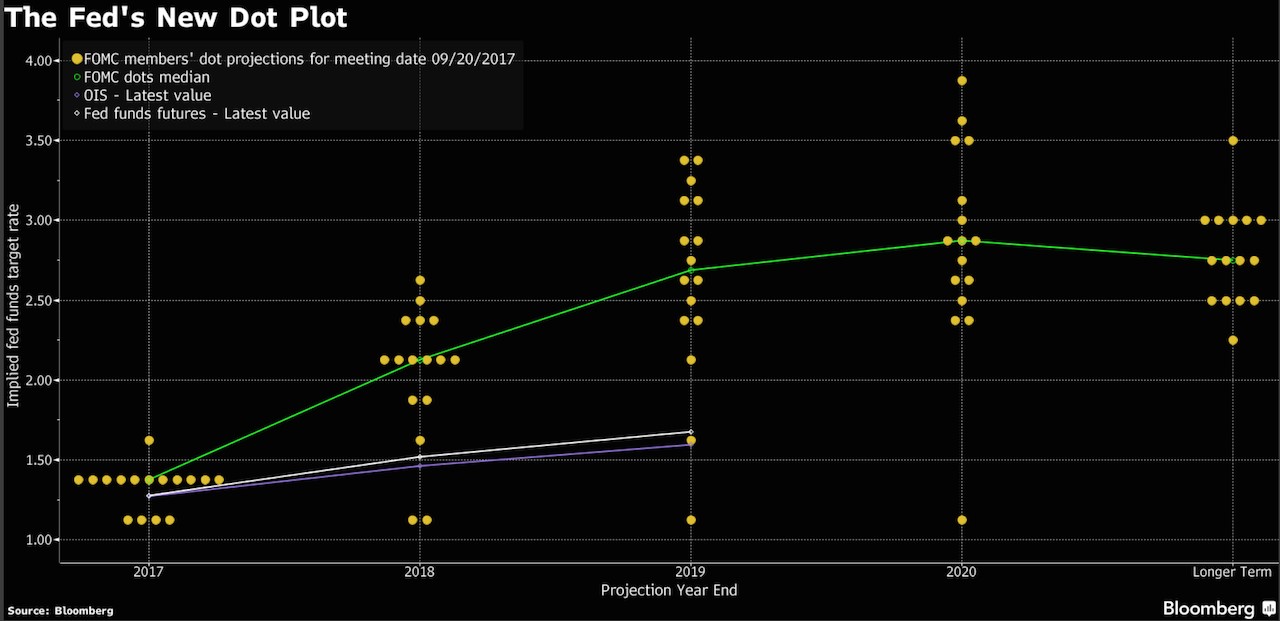

The Fed took a hawkish tone this week as it stood by plans to keep raising interest rates and unfurl its balance sheet this year, as promised. The Fed's dot plot shows that committee members believe rates will continue to rise in the long term, although the forecasts for hikes in 2019 have dropped from three to two.

Published after each Fed meeting, the dot plot provides insight into how the members of the Federal Open Market Committee feel about the federal funds rate and where they feel it should be at the end of each calendar year, and in the long run. Investors like to keep a watch on the dot plot to discern whether the Fed is looking to loosen monetary policy by reducing rates or tighten it by raising them.

Housing starts, home sales fall again

For a second straight month, U.S. housing starts fell as permits for single-family homes dropped while the sale of previously-owned homes tumbled for the fourth time in the last five months.

The Commerce Department said on Tuesday that housing starts dwindled in August by 0.8 percent, following a significant 4.8 percent drop in July. Homebuilding continues to suffer this year thanks to a confluence of factors, including a lack of skilled labor, land shortages and the rising costs of building materials. The slowdown in single-family homebuilding is concerning since that demographic accounts for the largest share of the housing market.

The report notes that Hurricane Harvey, which battered Texas in late August, did little to influence permits. But it's possible homebuilding will dwindle in September as the economy feels the pinch of Harvey and Hurricane Irma, which thrashed across Florida this month. Rebuilding activity will surge during the storm recovery but a deficit of labor could curb the pace of homebuilding.

Some areas of the housing industry already are feeling the squeeze. Houston-area home sales declined by 25 percent year-over-year. That brought down overall existing-home sales, which fell 1.7 percent in August as the median sales price of homes increased 5.6 percent to $253,500, according to the National Association of Realtors.

Even though demand remains steady, the market is still plagued with persistently low inventory. Fewer homes on the market place upward pressure on the sales price.

"The ongoing rise in home prices is straining the budgets of some of these would-be buyers, and what is available for sale is moving off the market quickly," said Lawrence Yun, the NAR's chief economist.