What Is A HECM Debt Consolidation?

For homeowners age 62 and older*, the federally backed Home Equity Conversion Mortgage (HECM) is the most common reverse mortgage product. Over the last 15 years, the HECM has undergone significant changes, becoming a popular tool for retirees seeking assistance with cash flow, liquidity, tax planning and even enhancing their net worth. However, the greatest potential impact of a HECM right now might be Debt Consolidation.

Debt Consolidation is a financial strategy that combines multiple debts into a single loan, often showing eligible borrowers potential for better terms like lower interest rates or lower payments. This can make debt management easier, possibly reduce the risk of default and ultimately save the borrower money.

HECM Debt Consolidation (HDC) uses a reverse mortgage to leverage housing wealth to pay off existing mortgages, liens against the property, installment debt (such as car loans) and revolving consumer debt (such as credit cards). You can consolidate all these debts into a single loan without a required monthly principal or interest mortgage payments.*

Simply occupy the house and pay all property-related charges, such as but not limited to taxes and insurance. The amount that is drawn, plus interest, is generally paid off when the home sells in the future.

Note: The HECM is not able to pay off consumer debt directly at closing. Instead, it provides the cash proceeds for those payoffs. Other products known as “proprietary reverse mortgages” may pay the debts directly when the loan funds.

IS NOW THE TIME?

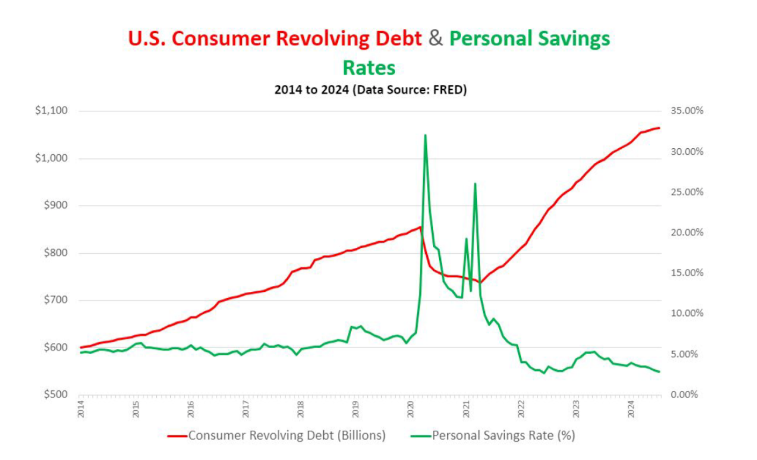

During the Federal stimulus response to COVID-19, consumer debt decreased, and personal savings rates increased. However, that relief was temporary, as shown below:

The bad news is that consumers are taking on too much debt and not saving enough. Over the last 10 years, consumer revolving debt has increased by over 77%, while the personal savings rate has decreased by over 44%. The good news for older homeowners is that home values have appreciated an

average of 106% over the last 10 years. So, this could be a great time for an HDC.

BASELESS CONCERNS

Foreclosure: According to conventional wisdom, this strategy increases the risk of foreclosure. Even the Consumer Financial Protection Bureau (CFPB) discourages reverse mortgages for this very reason. However, there is a clear reduction in the risk of foreclosure.

The primary reason for home foreclosures is non-payment (e.g., mortgage payment or property tax payment). But remember, the reverse mortgage does not require monthly principal or interest payments*.

Debt: Dave Ramsey supporters steer clear of this strategy because they view mortgages as debt instruments and believe that "all debt is bad." However, the math is clear: the Ramsey “debt snowball” process isn’t very efficient when paying revolving debt interest rates of 20–30% while making a required monthly mortgage payment. In as little as 30 days, a Retirement Mortgage Professional from Movement Mortgage could complete the debt snowball process.

WHY NOT USE A CASH-OUT REFINANCE?

Traditional (forward) debt consolidation loans may not work in today’s higher interest rate environment. It may be risky to double a homeowner's mortgage rate to pay off revolving debt, such as credit cards. Even if the weighted average interest rate (blended rate) decreases, this might not make sense for the following reasons:

- It converts unsecured debt into secured debt (your home).

- It increases your monthly mortgage payment.

- Non-payment of a mortgage often results in foreclosure.

Homeowners who implement this HDC strategy are thrilled to have a mortgage without a monthly bill*. If, however, the homeowner is concerned about interest accruals on their monthly statement, they can make optional payments whenever they wish. The HECM product offers an advantage in that voluntary payments not only lower the loan balance but also expand the available credit line for future use.

A HECM debt consolidation requires discipline and a solid plan. But in today’s high-rate environment, a reverse mortgage could be used for a wide spectrum of financial planning purposes, like tax strategies, ROTH conversions, Social Security filing decisions, long-term care planning, portfolio optimization andyes, debt consolidation**.

Reach out to a Movement Mortgage loan officer today to discuss your options.

Sources: https://fred.stlouisfed.org/series/PSAVERT, https://fred.stlouisfed.org/series/USSTHPI

*For qualified borrowers. Additional restrictions apply. Reach out to a Retirement Mortgage Professional for more information. Borrower is required to pay all property charges including, but not limited to, property taxes, insurance and maintenance. This material has not been reviewed, approved, or issued by HUD, FHA, or any government agency. **Not tax advice. Please consult a tax professional.