How millennials are reshaping the housing market

Stop me if you've heard this one before: One day Millennials will be a major force in the housing market.

That era may be dawning. Seriously.

I know what you're thinking. Changing demographics, cultural shifts, student debt and the Great Recession have all undermined Millennials' interest in owning homes. They just aren't getting married, having kids and buying houses because they're too busy drinking craft beer in their rental loft apartments — or Mom's basement.

That stereotype won't last.

There are more than 92 million Millennials — the largest generation in American history — and millions of Millennials are now in their 30s and beginning to form households.

Today's millennials – seeking employment, adventure and purpose – are moving outside their homes and college towns, and are poised to drive the housing market for years to come.

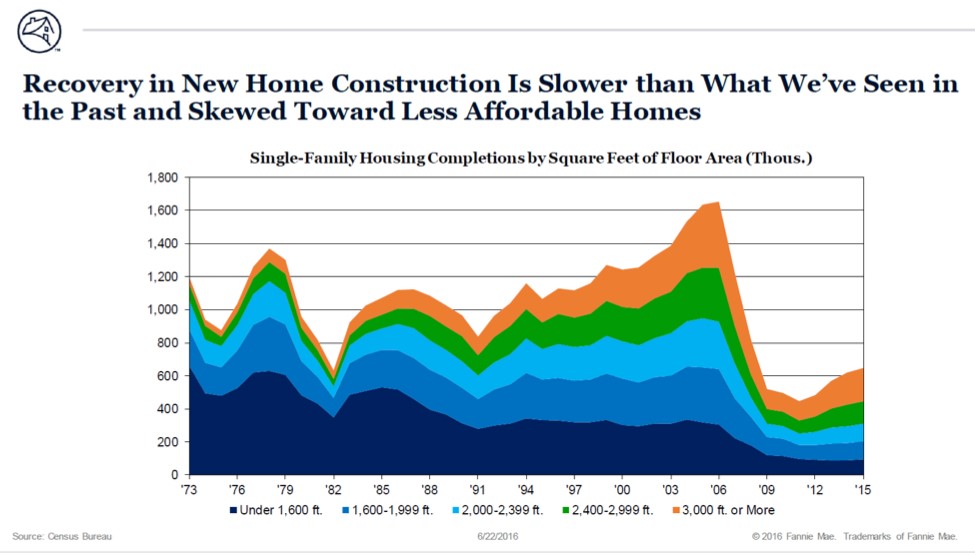

The current new homebuilding pace of 629,000 units in 2016, is projected to grow to a 1.5 million unit run-rate within five years, driven by older Millennials, according to Fannie Mae. This would truly be a boom and could carry the U.S. economy along with it.

What's the reason for the shift? For starters, these young adults are simply growing up. This generation never fully rejected the idea of family and homeownership. They've just delayed these traditions for a variety of financial and cultural reasons. As they age into their 30s, that is changing.

"Last year, the median age of the millennial homebuyer was 30, and there were 4.4 million people turning 30 this year," Realtor.com economist Jonathan Smoke said recently. "We're seeing more people now forming households, getting married, having children or a second child."

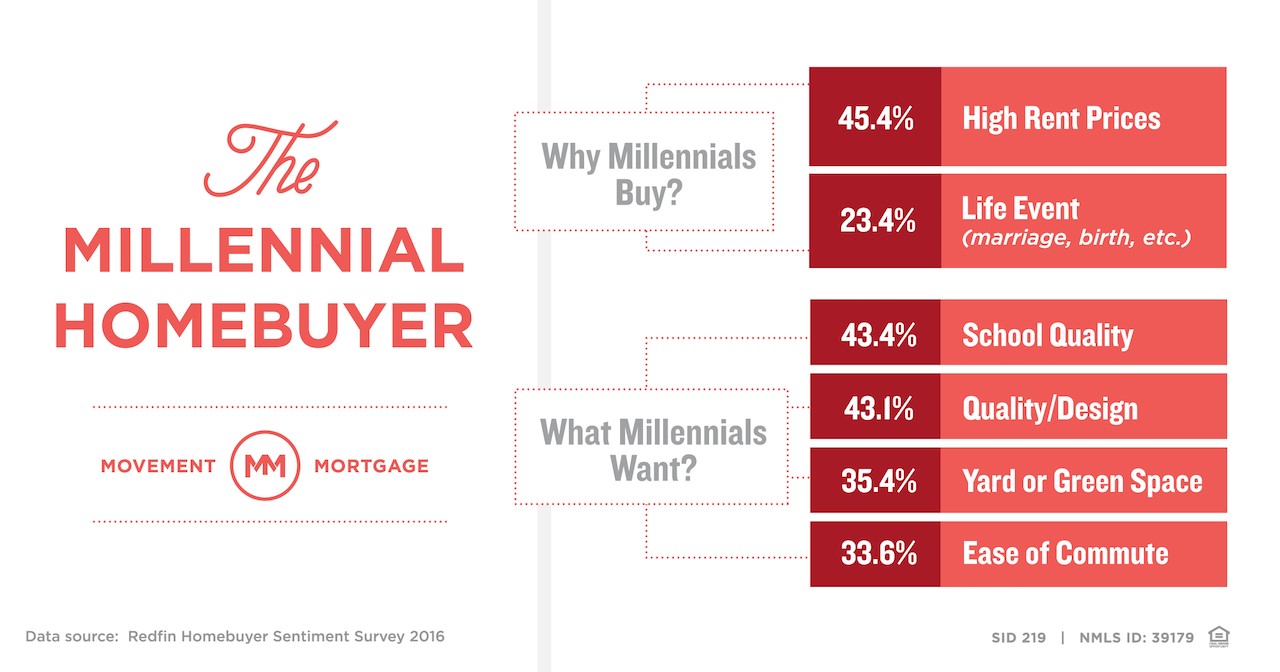

Plus, rising rent is pushing more to consider buying. More than 11 million Americans now spend more than 50 percent of their income on rent, according to Redfin. We also have seen surveys that indicate 93 percent of renters age 24 to 35 intend to buy in the future.

There's a massive opportunity.

Of course, there are still headwinds. The biggest impediments to Millennial homeownership is affordability and housing stock. For years now in this economic recovery, homebuilders have focused upstream, rather than building smaller more affordable homes. This has left millennials with fewer options when looking for a first home than prior generations.

At the same time, millennials' desire to live in cities with short commutes with walkable neighborhoods close to amenities. Historically, starter homes have been built further out in suburban America.

The good news is employment among millennials, especially the older ones, has been strong for several years now with wage growth kicking in as well. That has reduced some of the affordability concerns millennials faced a few years ago. Plus, as more housing options come online — affordable townhomes and single-family infill — and more GenXers vacate starter neighborhoods, the millennial homebuyer will be a force for years to come.