Volatile markets holding rates low

Rates hold steady in volatile economy. Signals of a recession continue to loom for the United States economy as the bond market yields struggle against the continued trade war with China and slowing global growth.

Right now, investors are making more money off short-term stock investments than they are on long-term Treasury bonds. We are seeing a consistent yield curve inversion between the benchmark 10-year Treasury note and the 2-year note, which is seen as a good indicator of a future recession. The last time we consistently saw this happen was two years before the 2008 financial crisis. That yield curve worsened Wednesday with the 10- and 2-year notes sitting at 1.454% and 1.5% respectively.

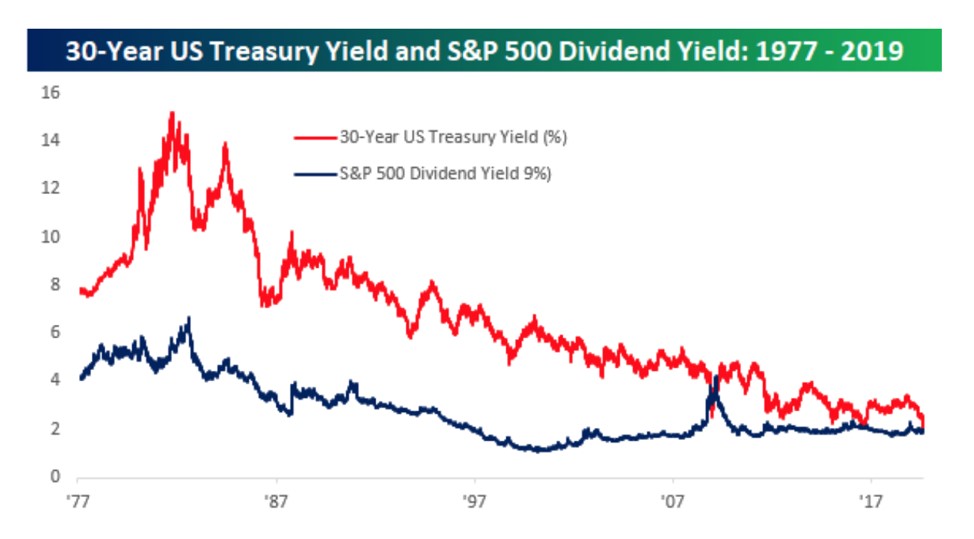

The 30-year Treasury note yield also fell to its all-time lowest trading point early Wednesday at 1.907%, dropping it below the dividend yield for the S&P 500. On Tuesday this week, the 30-year note yield was set to close below the 3-month bill yield for the first time since 2007. The chart below from CNBC shows the pattern of the 30-year Treasury note yield and the S&P 500 dividend yield going back to 1977. That close dip just before 2017 was the Brexit vote in June of 2016.

Essentially, the problems are feeding off of each other. We have a global economic slowdown that spurred investors to put their money into the relative safety of U.S. government bonds. That caused yields to go down and bond prices to go up. Now, the short-term investments are producing the yield (earning money for investors) while the bonds are being seen as capital appreciation purchases. Currently, investors are finding that putting their money into a company stock that pays more than the 30-year note will be more lucrative for them.

Earlier this week we did see an uptick in equities with the Dow showing a hopeful 250 point jump on the heels of news that the U.S. and China were going to restart trade talks. Each side continues to trade punches as last week China unveiled their own new tariffs on $75 million worth of American products including cars.

On Thursday, China announced that the country was willing to negotiate with a "calm attitude." That prompted the Dow to jump by 300 points at the start of trading Thursday. A spokesman for China's Ministry of Commerce, Gao Feng, says although the country does have options for countermeasures, their main goal is to negotiate the $550 billion worth of U.S. tariffs on Chinese goods.

In the midst of the trade war, China's economy is slowing down and their pricing of the yuan reflects that. As we've mentioned before, the People's Bank of China closely monitors their on-shore currency and sets a daily midpoint. That midpoint is controlled by the bank, and in essence the Chinese government, and the PBOC will step in and buy or sell depending on where it deviates.

Recently, the yuan was allowed to weaken below the 7 level against the dollar, which is a psychological marker, for the first time since 2008. That move prompted the U.S. Treasury Department to label China a currency manipulator, saying the country intentionally allowed its currency to weaken in order to counteract the trade tariffs put in place by the Trump administration. A weaker yuan would make Chinese goods less expensive to the rest of the world, essentially negating any expense incurred by trade issues with the U.S. As we mentioned before, expect stock market volatility to continue until a trade deal is reached between the two countries

The saga of Brexit took another turn this week as British Prime Minister Boris Johnson scheduled Parliament to reconvene on Oct. 14, just 17 days before the Oct. 31 Brexit deadline. That has heightened the chance of there being a hard Brexit, meaning one with no deal in place to soften the transition. The latest snarl has simply added another twist to the Brexit timeline that's been hindered by delays since the original vote more than three years ago.

Brexit plans and subsequent delays have spurred a lot of economic issues including the most recent drop in the value of the Sterling. On the news of the delay in convening Parliament, the pound dropped by 1%, falling below the $1.22 mark. It went back up slightly on Wednesday but is still trading right around the $1.22 mark against the dollar.

Higher price tags, more affordability?

There's an interesting trend happening in the real estate world as first-time homebuyers are struggling with a lack of inventory in their price range while luxury real estate is struggling to find buyers. The latest data from Redfin shows that sales of homes priced at $1.5 million or more fell 5% in Q2 in the U.S.

Home prices are still on the rise, albeit at a significantly slower pace than we saw even a year ago. The latest Case-Shiller Home Price Index From S&P Dow Jones and CoreLogic showed that, in June, we had a year-over-year price increase of 3.1% nationwide. That was down 0.2% from the previous month's pace. In June of 2018, the year-over-year increase was 6.2%. According to the latest data from the National Association of Realtors, the median price for a single-family home in the second quarter of this year is $279,600.

According to First American Financial Corp., however, home affordability is increasing despite those rising prices. Their data, which they've named "real house prices," is a metric that measures home prices adjusted for other economic factors. Their home-price index shows that, all things considered, home prices have actually fallen by 4.6% in June year-over-year.

Their metric shows that household income, combined with lower mortgage rates, have made homes more affordable despite the price tags going up. As of Thursday morning, the 30-year fixed-rate average was at 3.55% according to Freddie Mac. Looking at the stats for Freddie Mac going back to 1971, the all-time lowest mortgage-rate average on a 30-year fixed-rate mortgage was 3.31% in 2012.

First American chief economist Mark Fleming says that right now, homebuying power is at its highest rate since 1991, when the group first started measuring affordability. Not only do they have the power, the Conference Board's index shows American consumers also have the confidence.

Despite signals of a recession in the economy, the Conference Board index's gauge of consumer confidence about the economy and the labor market is at its highest level in almost two decades. Granted, the cut-off date for surveys was mid-August, so it did not necessarily include people's reactions to increased trade tension. One economist was quick to point out that the current conditions index was fairly different from the reading of the expectations index which asks consumers how things will be in six months. That reading declined month-over-month.