Tax reform sparks optimism

The song remains the same. The stock market again ended "mixed" this past week with the Dow Jones Industrial Average and S&P 500 Index setting new all-time highs. Meanwhile, the NASDAQ Composite Index stumbled very slightly to close the week seven and a half points lower. The optimism seen in the equity markets began when the markets opened on Monday after the U.S. Senate passed their version of a tax reform bill over the weekend. The final bill is presently undergoing a reconciliation process between the House and Senate with expectations for passage on or before December 22.

Economic news was generally supportive for the financial markets with the Employment Situation Summary (Jobs Report) for November showing there were 228,000 new jobs created during the month. While this was higher than the consensus forecast of 190,000 jobs, a smaller-than-expected increase in average hourly earnings (+0.2% vs. forecast of +0.3%) helped to support the bond market. The key takeaway here is job growth remains strong while wages, which are positively correlated with inflation, continue to be checked. This scenario can be beneficial for both stocks and bonds as it suggests there can be stable economic growth without the inflationary fears that normally go along with such growth.

In housing, mortgage application volume increased during the week ending December 1. The Mortgage Bankers Association (MBA) reported their overall seasonally adjusted Market Composite Index (application volume) increased 4.7%. The seasonally adjusted Purchase Index increased 2.0% from the prior week while the Refinance Index increased by 9.0%.

Overall, the refinance portion of mortgage activity increased to 51.6% of total applications from 48.7% in the prior week. The adjustable-rate mortgage share of activity decreased to 5.7% of total applications from 6.2%. According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance fell to 4.19% from 4.20% with points increasing to 0.40 from 0.34.

For the week, the FNMA 3.5% coupon bond gained 15.7 basis points to close at $102.813. The 10-year Treasury yield increased 1.45 basis points to end at 2.3778%. The major stock indexes ended the week "mixed" with the Dow and S&P 500 both moving higher while the NASADQ Composite Index slightly declined.

The Dow Jones Industrial Average added 97.57 points to close at 24,329.16. The NASDAQ Composite Index lost 7.51 points to close at 6,840.08 and the S&P 500 Index gained 9.28 points to close at 2,651.50. Year to date on a total return basis, the Dow Jones Industrial Average has gained 23.1%, the NASDAQ Composite Index has advanced 27.1%, and the S&P 500 Index has added 18.4%.

This past week, the national average 30-year mortgage rate fell to 3.97% from 3.98%; the 15-year mortgage rate decreased to 3.31% from 3.32%; the 5/1 ARM mortgage rate increased to 3.21% from 3.20% and the FHA 30-year rate remained unchanged at 3.60%. Jumbo 30-year rates decreased to 4.14% from 4.16%.

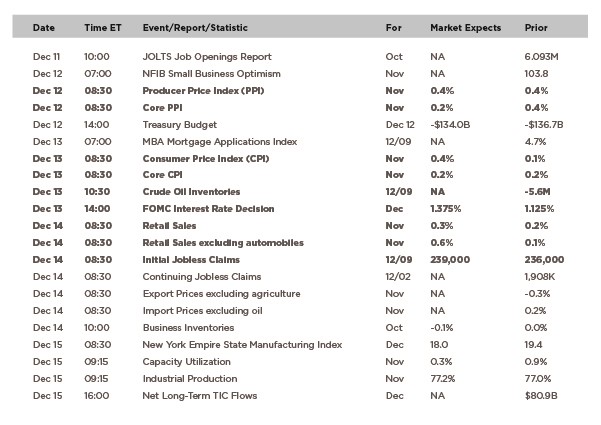

Economic Calendar – for the Week of December 11, 2017

Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

Mortgage Rate Forecast with Chart – FNMA 30-Year 3.5% Coupon Bond

The FNMA 30-year 3.5% coupon bond ($102.81, +15.70 bp) traded within a 51.5 basis point range between a weekly intraday high of $102.984 on Thursday and a weekly intraday low of $102.469 on Monday before closing the week at $102.813 on Friday.

After opening -18.7 basis points lower on Monday as stocks rallied, the bond strongly recovered to post a 3.2 basis point gain on the day. Positive movement continued on Tuesday and Wednesday as the bond powered above multiple resistance levels, closing above the 25-day and 50-day moving averages. These levels now become a zone of support. Although the bond then slipped lower on Thursday and Friday, it remains at support. There was a new buy signal last Tuesday and with the bond trading at support but not "overbought," we could see a bounce higher off of support toward resistance located at $103.03. Should this occur as the chart suggests it could result in slightly lower mortgage rates.