Has the jobs market peaked? August report shows slower hiring

Investors are trying to make sense of an August jobs report that shows a slowdown in hiring, but a record number of people working, increases in wages and an unemployment rate remaining historically low at 3.7%.

The Labor Department reported Friday that the U.S. economy created just 130,000 new jobs, which missed estimates of 150,000 jobs and was helped along by the hiring of temporary Census workers. Meanwhile, wage growth continued its healthy pace. Wages increased 0.4% in the month of August and are growing at a 3.4% clip year-over-year, an indication of a healthy job market. The total number of Americans working improved to a new record of more than 157 million people, according to another survey.

However, the reports also had some concerning numbers. The number of people who are working part-time because of economic reasons increased and the wider unemployment rate, which includes these people, increased to 7.2% from 7%.

The separate ADP survey of payrolls on Thursday showed hiring increases of 195,000, better than expected, and a low number of layoffs. That report suggests a healthy job market.

Taken together, the job reports likely show a labor market at its peak. Employment remains strong thanks to a strong consumer economy. But further growth may be restricted by global concerns, trade disputes with China and weaknesses developing in manufacturing and agriculture as a result.

WHAT ABOUT RECESSION FEARS?

Signs of a recession on the horizon continue to add up across the board. The repeated inverting of the 10- and 2-year Treasury note yields, decreased gross domestic product and corporate profits that are tanking are just a few of the examples leading many to believe we are heading into an economic recession. But how far off is it?

We've explained the yield curve inversion over the last couple of weeks and that curve has remained either nearly flat or inverted since Aug. 14. This phenomenon has preceded the last seven recessions in America. According to data from Credit Suisse, the recession follows about 22 months after the yield curve inversion.

While not as low of a reading as Q4 2018, Q2 2019 GDP expanded by just 2%. That's well below the 3% reading in Q1 and the 3.5% we saw a year ago. That slowing growth is supported by data showing corporate profit estimates are down considerably. Analysts for Goldman Sachs recently reduced earnings estimates for the S&P 500.

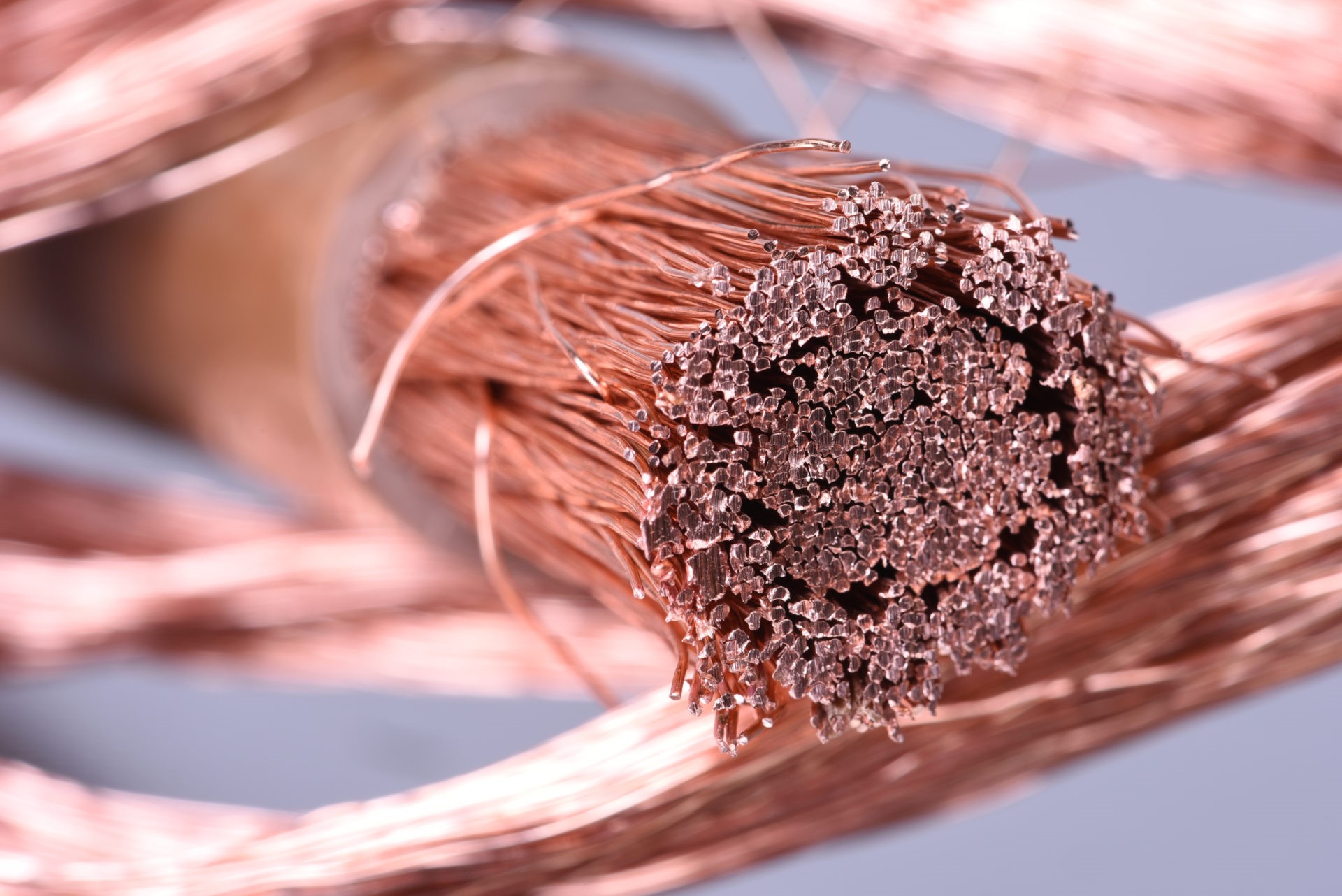

Gold and copper are also showing signs of a looming recession, as copper has dropped more than 13% year-over-year while the price of gold has gone up more than 20% since the trade war began. Copper is used in homebuilding and construction, so seeing the price go down means supply is up and not being purchased for new construction.

On the flipside, gold is seen as a sort of safe-haven during times of economic insecurity, much like Treasurys and bonds. So when the price goes up as it has, it shows more people are investing in the security of gold as a way to protect their money.

Another major piece of data, the manufacturing index, showed that manufacturing activity in America fell below 50.0 to 49.1. That has signaled a contraction in American factory activity for the first time since 2016. Those surveyed in the study done by the Institute for Supply Management said that the trade dispute has lessened export orders and the trade war has made it difficult as they're having to find new supply chains beyond China to avoid the tariffs.

On Monday, China said it would file a complaint about the tariffs at the World Trade Organization. China is also dealing with the continued protests in Hong Kong, although that situation was met with some resolve this week.

Hong Kong's Chief Executive Carrie Lam has fully withdrawn a bill that would've allowed extradition to mainland China. Lam originally suspended the bill in June. The bill sparked protests that added strain to China's already volatile economy. Suspending the bill, however, would satisfy just one of the five core demands being made by protestors. The other demands include greater democracy for the city and an independent commission into police conduct. That leads many to believe that simply withdrawing the bill will not ease tensions entirely as this has become bigger than just the extradition bill.

The announcement of the bill withdrawal caused a jump in Hong Kong's stock market as it closed nearly 4% higher. Stocks in China also saw some jumps on the news. American markets also saw a positive response due to the Hong Kong news with Dow futures seeing a more than 200 point bump Wednesday morning.

INFLATION IS THE KEY

This week former Federal Reserve Chairman Alan Greenspan warned that the negative interest rates we are seeing globally will eventually come to the United States. A dire warning in advance of the Federal Open Market Committee's September meeting where the group is once again expected to ease interest rates. New York Fed President John Williams said this week that inflation is the problem putting the most pressure on the central bank. Currently, the FOMC is split on whether further cuts to the overnight lending rate are needed.

In his statement, Williams said, "While there's not been a dramatic change seen in the overall numbers yet, the more detailed picture that emerged by summer of this year pointed to an outlook of slowing growth and inflation falling short of our goal."

HOME PRICES MAY HAVE HIT THEIR BOTTOM

The latest forecast from CoreLogic predicts that home prices are going to start heating back up into 2020. They're expecting a 5.4% jump year-over-year from July 2019, a much faster pace than the current 3.6% annualized increase we are seeing right now.

Frank Nothaft, CoreLogic's chief economist, said, "If low-interest rates and rising income continue, then we expect home-price growth will strengthen over the coming year."

The latest jobs report out today shows that unemployment is at 3.7%. When the rate is that low, employers are forced to pay higher wages to keep their good workers. June's annual household income was 1.8% higher year-over-year. That increase in income and employment gives buyers more spending power, especially with interest rates sitting at near all-time lows of 3.49% on average, according to Freddie Mac's weekly survey.

However, inventory is the consistent headwind as lower-price segments of the housing market continue to lack enough homes. That means, sellers now have the chance to hold out a little longer to get the price they want, increasing competition.