Fed changing strategy, rate cuts expected in July

The Federal Reserve did not take action on interest rates this week, keeping their fed funds target rate unchanged at 2.25% to 2.50%. However, their language used during the meeting prompted market participants to predict a 100% chance of "at least one" rate cut in July.

Equities saw a strong rally on the Fed news this week with the S&P 500 surging by 1%, closing at a new record high. The Dow also closed 250 points higher as traders cheered the likelihood of a rate cut.

Economic analysts at Goldman Sachs offer a similar prediction with one rate cut believed to happen in July and another potentially in September. These predictions are based on a couple of different factors gleaned from Wednesday's Federal Open Market Committee meeting.

Wednesday's FOMC meeting gave us a glimpse inside the changing sentiment from voting members. Gone is the "patient" attitude they've been taking the last few months. This month's meeting focused on being "accommodative" with one member voting in favor of a rate cut now.

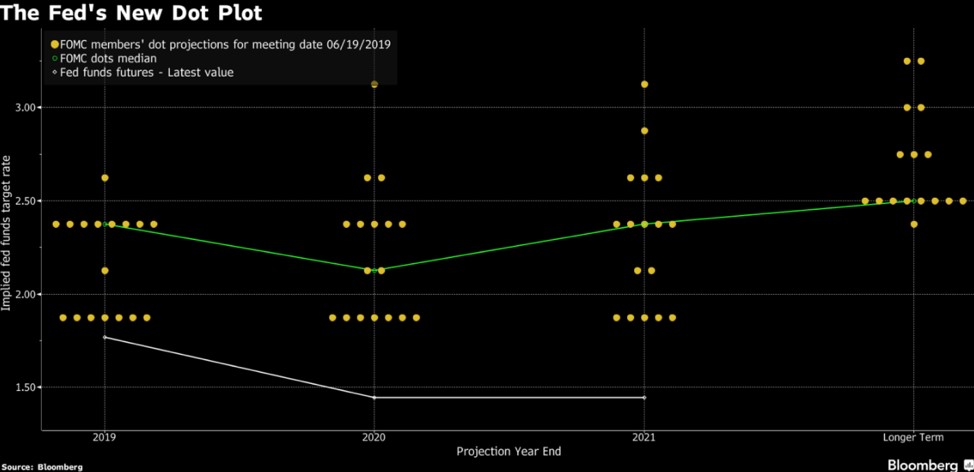

One way the Fed has tried to be more transparent about its discussions is to release a dot plot after each meeting. You can see their most recent dot plot below. Each dot on the chart represents a prediction from the president of each Federal Reserve bank across the United States. Each yellow dot on this chart from Bloomberg shows where each of the 17 members believe rates should be at the end of the calendar year. You can see clearly on this chart, the first set of yellow dots shows eight members believe rates should be cut by year's end.

Treasury yields drop

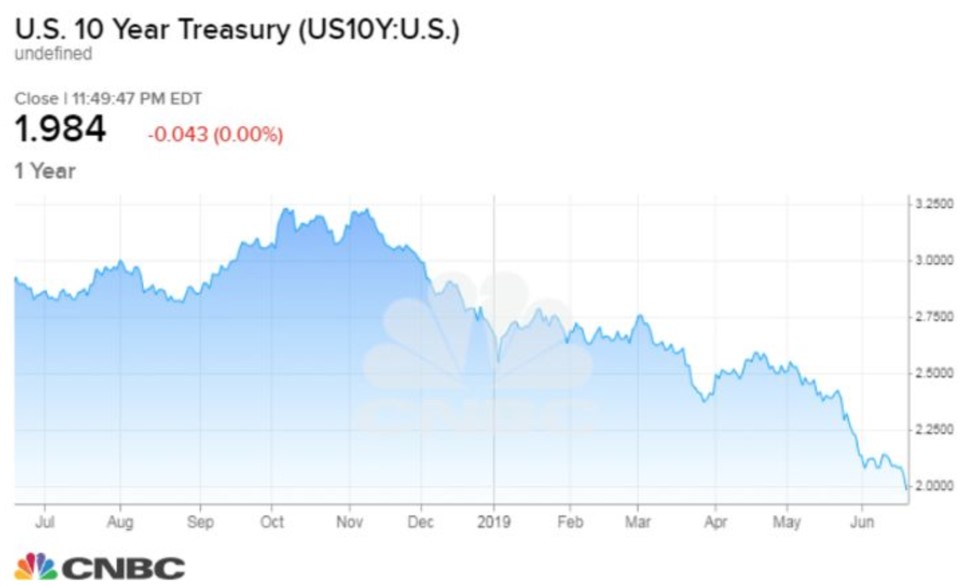

Close to midnight Wednesday, the 10-year Treasury note yield dropped below 2% hitting 1.97%. It has not fallen to that level since November of 2016. Yields on the 2-year and 3-month notes also dropped. The 2-year hit its lowest level since 2017. Expect the trend to lower rates to continue for the foreseeable future.

For some industries, like mortgages, this is a good sign because it signals lower interest rates. Right now, the 30-year fixed-rate average is holding steady at 3.84% according to Freddie Mac.

The concern from key investors is that this is yet another signal of a decelerating economy and stunted GDP growth. A lot will be dependent on the next jobs report in July, to see if the May report of significantly halted job growth was a one-time thing or a sign of bigger problems ahead.

The chart to the right from CNBC shows the trajectory of the 10-year Treasury note from the recent high of 3.25% in November to the much lower long-term rates we have now.

Fannie Mae: Housing will provide economic cushion

With the data pointing to a deceleration in the economy, Fannie Mae's Economic and Strategic Research Group downgraded it's projections for 2019 growth to 2.1% and 1.5% for 2020 growth. The group's analysts believe trade tensions with China, along with slowing job growth and declining consumer confidence, will stymie the U.S. economy.

However, the group also continues to believe that low, stable mortgage rates, along with a "modest rise in the inventory of homes available for sale," could help the housing market "provide an economic cushion" to the slowing growth.

Fannie Mae Senior Vice President and Chief Economist Doug Duncan said in the press release that "Despite a strong start to the year, we expect growth to slow beginning in the second quarter as macro-level uncertainty disincentivizes business fixed investment and starts to weigh on consumer spending. In order to sustain the longest expansion in more than 70 years, we expect the Fed to once again begin easing monetary policy and to cut its interest rate target by 25 basis points in September."

Duncan continued on to say, "We expect housing to add to growth for the foreseeable future, and our projection of a 1.0 percent year-over-year increase in home sales in 2019 remains unchanged," adding, "Moderating home price appreciation and attractive mortgage rates continue to support affordability, particularly as home builders are now paying more attention to the entry-level portion of the housing market."

Housing demand is there, but too costly

Between trade issues, the high cost of construction and the lack of skilled labor, homebuilder confidence dropped in June. The Housing Market Index showed a drop of two points down to 64 in June, a year-over-year drop of four points.

The problems are pretty clear cut according to the National Association of Homebuilders Chief Economist Robert Dietz. "Despite lower mortgage rates, home prices remain somewhat high relative to incomes, which is particularly challenging for entry-level buyers. And while new home sales picked up in March and April, builders continue to grapple with excessive regulations, a shortage of lots and lack of skilled labor that are hurting affordability and depressing supply."

Global tensions bubbling up

Two big stories this morning are affecting the market and oil prices. First, The New York Times is reporting that President Trump approved a military strike against Iran then pulled back on that decision. Second, an explosion at the largest oil refinery on the east coast has pushed oil prices higher this morning. These are both developing stories that we will be watching over the next few weeks.

Earlier this week it was reported that Iran shot down an unarmed United States' surveillance drone near the Strait of Hormuz. Iran claims it was on a spy mission while the United States claims the drone was in international airspace. Although he said "This country will not stand for it," Mr. Trump also seemed to downplay the act saying he thinks it could have been a mistake.

Directly after his comments about the strike, oil markets started moving up after a couple weeks of decline. In fact, U.S. oil prices saw their biggest score of the year after the President's comments. The rise was bolstered by the Fed's language in their meeting hinting at cutting rates to boost energy demand.

The location of the drone is the most important factor. The Strait of Hormuz provides the only passageway for a ship going from the Gulf of Oman to the open ocean, making it a crucial area for the oil trade. This underlying tension with Iran, coupled with the trade tariff issues with China and the 2020 campaign looming, will provide for some interesting effects on the markets in the coming months.