Jobs report falls short; Fed weighs raising rates

The U.S. economy created 156,000 new jobs in September falling short of the 176,000-job expectations on Wall Street. This unexpected number may now raise questions for the Federal Reserve's Open Market Committee on whether an interest rate hike is appropriate or not before the end of the year.

Friday's nonfarm payrolls data showed the professional services, healthcare and hospitality industries gained the most jobs in September. The unemployment rate now stands at 5 percent, compared to 4.9 percent a month ago.

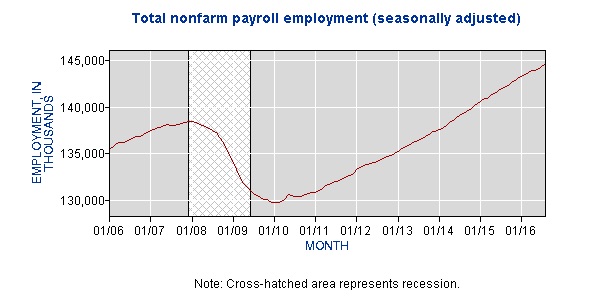

The results were mostly received with a ho-hum as analysts Friday morning said the number still signals a slow, but steady job market. Still, some investors may question the health of the U.S. labor market. Since the 2008 recession, employers have steadily added jobs as the economy recovered. Friday's numbers raises an important question: Is the jobs expansion we've seen for several years slowing down?

The Federal Reserve weighs employment and inflation as it determines interest rate policy. Rates have been kept extremely low for almost a decade as central bankers tried to coax investment and job creation.

Fed officials were expected to raise rates slowly to head off any inflation concerns and wind down a historic period of accommodative monetary policy.

"Conditions in the labor market have strengthened and we expect that to continue," Fed Chair Janet Yellen said at her September press conference. She told investors to expect an interest rate hike before the end of the year if trends continue. This would affect mortgage rates, bond prices and yields, and a number of other market prices.

The question to ask now is whether or not September's jobs number is a blip on the radar or a sign of weakness that could change Yellen's plans.

A small increase is still possible in December. But more weak jobs reports for October and November could change that course. It's worth watching.

Mortgage rates this week on average remained unchanged from a week ago, according to Freddie Mac's weekly survey.