To build or to buy (a house)? That is the question

So you're ready for a house. Maybe you've outgrown your current abode, or you're taking a first stab at homeownership. You want a home that feels like yours, from the decorations to the details. So should you buy a house and transform it? Or build it from the ground up? With a decision this tough, we can't choose for you. But we can help. We've broken down the pros and cons of each option for you.

Dolla, dolla bills, y'all

To Buy? Cost is subjective in all scenarios, depending on what you're looking for. But in general, it tends to be cheaper upfront to buy an existing house. Mortgages for existing homes are generally easier to secure than construction loans, and the down payments required are sometimes smaller.

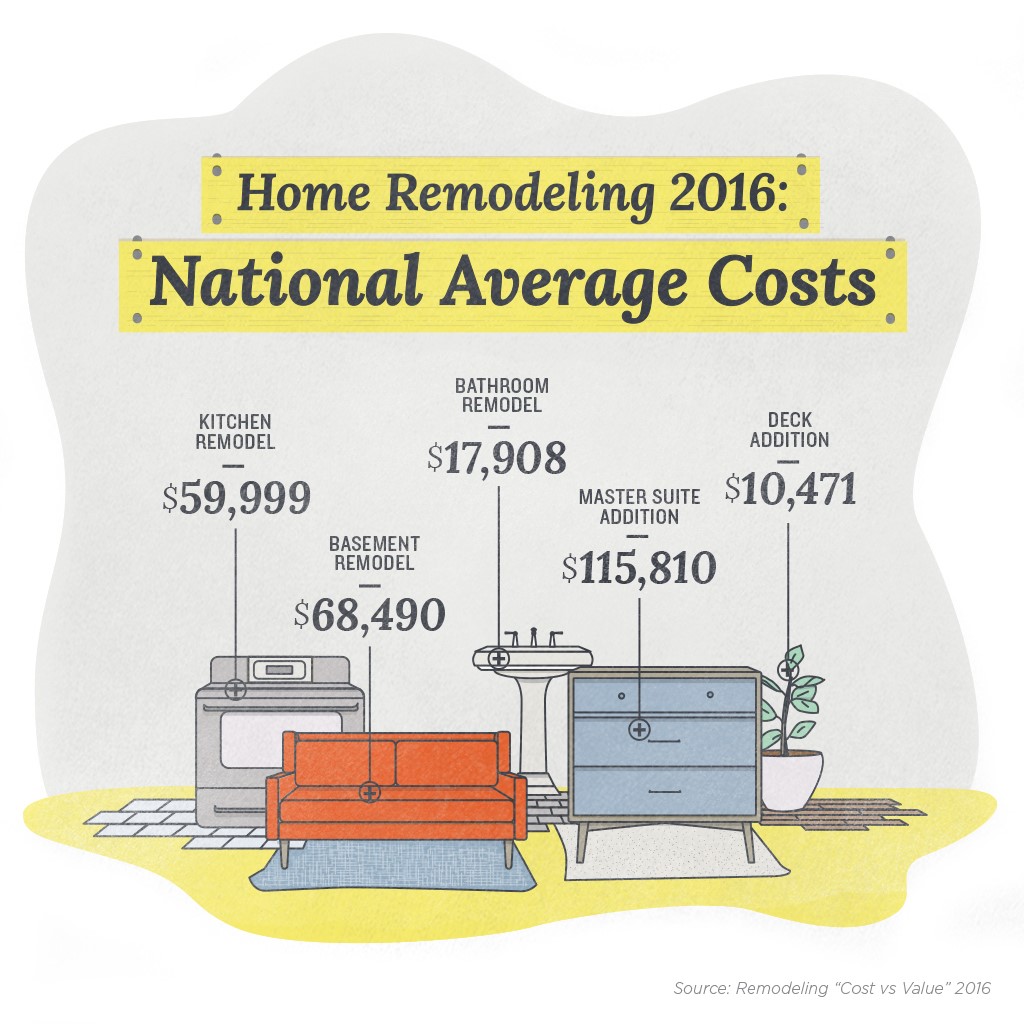

However, buying an existing house may mean sacrificing aesthetic elements or necessities, or a major remodel after the purchase. Older houses also tend to come with a variety of repairs or upgrades that are needed, if not right away, soon after occupancy. When comparing price tags, any substantial remodels should be added onto the cost of the home when comparing to a build price.

Health hazards like lead paint (essential to remove if you have children who might lick the windowsills), mold and asbestos (gross, but fairly common) can also require costly repairs. Before settling on an existing house as the cheaper option, check to make sure none of these are present, or factor those repairs into your overall cost.

To Build? While building a house carries a heftier price tag upfront, not to mention the cost of alternate housing until the home is finished, you can often recoup your investment in resale value. Because your amenities will be new and your layout more contemporary, custom-built homes tend to carry a heftier price tag. Plus, you'll save on the cost of repairs for the first few years and benefit from lower energy bills from new insulation, heating and cooling systems.

The down side? Building a house also comes with the risk of delays, unexpected fees, high material costs and budget constraints.

Conclusion: Spend some quality time with your computer and a calculator before letting a price tag sway you.

Time is money

To Buy? In terms of overall timelines, buying an existing house can definitely come out on top. From the start of the housing search to closing on your new home, the process can take as little as one to two months, depending on your criteria, area and ability to make a down payment. That's less time than it takes to find new back-to-school clothes for Junior.

On the other hand, the actual move-in takes a little more time, plus decorating, and any remodeling that needs to be done. But painting, detailing and more can be completed once you're inside.

To Build? If you have a longer timeline to work with, building a house to your specifications may be the way to go. You'll be able to decorate and furnish as you go, eliminating the dreaded "moving day." Plus, you won't have to worry about remodels – you designed it all!

Mother Nature is fickle, though, and unexpected delays, inclement weather or natural disasters could throw your timeline way off. Be sure to include a buffer in your budget and timeline on either end, and prepare temporary housing just in case your new home isn't ready quite on time.

Conclusion: Buying an existing house definitely comes out on top.

Location, location, location

To Buy? Neighborhood matters – that's just a fact. You want to be near good schools, with enough access to restaurants and necessities (i.e. a grocery store, your local Target, a place to get good wine…) but not so close that you feel like you live in a strip mall.

When you buy an existing house, you can investigate the scene, scope out the neighbors, check out the nightlife (or lack thereof) and ask for first-hand reviews. As long as one or two of the neighbors have kids, you can get the scoop on the school, teachers, bus rides and routes and more. Plus, you can spend some time learning about the dynamic of the neighborhood and getting a feel for its daily rhythm. Is there a neighbor who routinely mows his lawn stripped down to nothing but his (too small) gym shorts? A drive-by on Saturday morning will show you.

Another plus? The previous owners (probably) took care of the yard. Even if it's not up to your green-thumb standards, you likely won't have to nurture new grass from infanthood. If you want to upgrade the yard, though, be sure to check with your HOA. Restrictions can include everything from front door colors to where you can add a pool or swing set.

To Build? Generally speaking, established, popular neighborhoods don't have plots available. To build your own house, you may have to start your own neighborhood, or join one that's still growing. You won't have the same knowledge moving in as your friends in existing houses, but you can help shape the area. Join the local HOA (or start one) and you'll be able to influence the neighborhood as it booms.

New houses may also lack access to cable and Internet companies, depending on the development. If you're worried about access to technology (aka the world), check with your local providers before beginning construction.

Conclusion: Google is your friend. Research, read up and ask around before making a decision.

Giving in isn't giving up

To Buy? If you're like me, you've been dreaming about your perfect house since you were little. But when you buy an existing house, you sacrifice some of that dream.

Instead, you settle for something similar, or pick out key features that are the most important, and focus on finding those instead. Once you move in, you can customize the place but budget and reality might confine you to a house that's less-than-perfect when compared to the picture in your head.

To Build? Customizing your house from scratch offers a lot more freedom over the design aesthetic. However, budget and geographical constraints may prevent desired features, like basements or certain framework. Plus, if you build in a neighborhood with an established HOA, their restrictions might hinder building your house beyond a certain height, or with unusual aesthetics.

Conclusion: No one escapes sacrifice.

Bring home the bacon

To Buy? When you buy a house, selling it is probably not high on your priority list. But the reality is that you should treat your house like any other asset, and think about its appreciation potential. Any upgrades, additions or remodels you make will increase the resale value. An up-and-coming neighborhood could help boost the property value, as well as the dynamic of the residents. Although you may plan on calling that house home for a while to come, it doesn't hurt to keep resale potential in the back of your mind.

To Build? If you start from scratch, your brand new home with new appliances, energy efficient upgrades and a modern floor plan can attract a high price point. However, like a new car, the value will depreciate as it ages. Keeping your pulse on repairs, addressing problem issues early on and updating appliances will help keep the value high. Building in a good neighborhood or up-and-coming area will help increase the resale value as well.

Conclusion: Make your home do the work. You just sit back and reap the rewards.

The bottom line

Whether you choose to buy or build, there are lots of factors to take into consideration. Before you start your housing search, make a list of non-negotiables and figure out what you're willing to compromise on. Talk to your loan officer and real estate agent for guidance.