U.S. economy unshaken despite disputes with China, North Korea

Geopolitical tensions have taken center stage this week with multiple incidents affecting the markets.

President Trump visited Vietnam earlier this week to meet with North Korean dictator Kim Jong-Un in an effort to de-escalate nuclear growth in the country. In a move that was a surprise to everyone, Trump did not agree to anything. Instead, Mr. Trump walked away and then canceled a pre-planned agreement signing. President Trump pointed to North Korea's desire to lift sanctions which he said he would not be willing to do completely, noting North Korea's lack of desire to play ball.

Meanwhile, U.S. Trade Representative Robert Lighthizer intimated in his testimony to the House Ways and Means committee that there is still a lot of work to be done to reach a trade deal with China. Lighthizer says any agreement would hinge on a lot more than just a promise from China to purchase more U.S. goods.

In addition to that, oil prices surged on Wednesday in reaction to Saudi Arabia generally ignoring a tweet from President Trump saying OPEC needed to ease up on oil production restrictions. According to the Energy Information Administration, U.S. crude stockpiles dropped by 8.6 million barrels last week.

World markets also reacted to a clash between Pakistan and India. Two Pakistani fighter jets shot down two Indian aircraft over Kashmir while India claims airstrikes killed more than 300 terrorists at a training camp. This escalation will be closely watched by the world as this is the highest strain has been between these two countries since their war in 1971.

A CLOSER LOOK AT A SLOWING ECONOMY

The United States economy is still growing but not at the same pace we've seen over the last couple of years. Federal Reserve Chairman Jerome Powell confirmed as much this week in his testimony to the Senate Banking Committee. He does expect solid growth, just not as fast as it has been. "The baseline outlook is a good one," said Powell, adding that the world markets slowing down might end up dragging us down in the process.

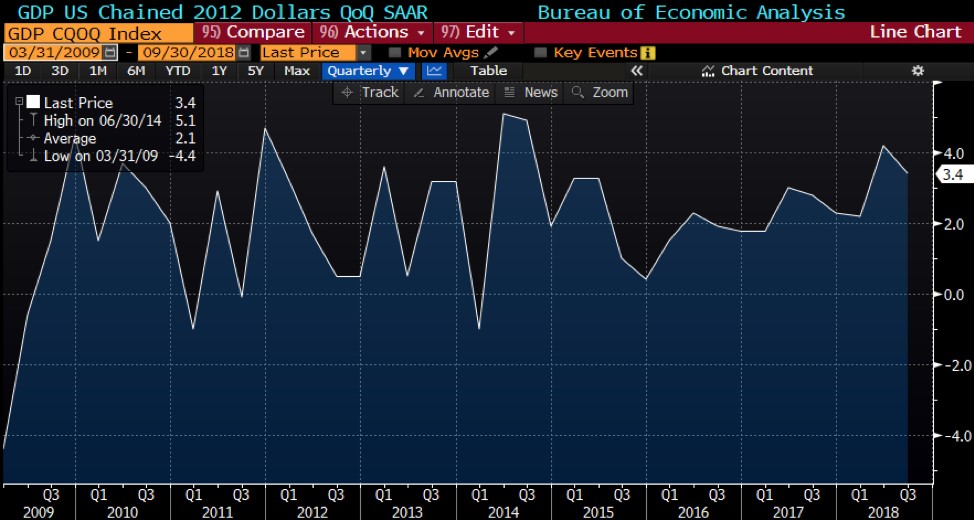

While that may send up red flags for some people, and world markets will certainly have an effect in the coming months, you have to take a look at the context of this slowdown in growth. Many analysts are expecting 2 percent growth this year, down from the 3 percent growth estimation for 2018. The chart below shows the US Gross Domestic Product, or GDP, over the last ten years. Currently, the United States is the world's leading economy with regard to GDP.

It's important to note that data this week showed the real GDP up by 2.6 percent, well above expectations. Consumer spending was up because of a strong labor market and tax cuts, as reported by the Wall Street Journal. Analysts from Goldman Sachs say private business investments also bolstered these numbers, increasing the odds that 2019's expected slowdown should be manageable.

The chart below from Bloomberg clearly outlines where we are relative to the recession 10 years ago. The far left side of the chart shows the beginnings of growth after the 2008 recession. The far right shows where we are today. While our economy is slowing, you can see just how strong it still is and how far removed we are from the low of 2008. The quarterly average over the last 10 years is 2.1 percent. There is nothing wrong with moderate growth rates. This means now is not a time to panic, rather it's a time to potentially take advantage, especially in the mortgage industry where rates have moved significantly lower since the beginning of the year. This, couple with a weakening housing market, allows for more affordable financing.

RATES REMAIN LOW, WILL HOUSING MARKET REBOUND?

With rates remaining low and stable, housing inventory increasing and home prices growing at their slowest pace in nearly four years, there is potential for 2019 to be a boom for the housing market.

Fed Chair Jerome Powell continues to reiterate his stance of patience with regard to the Fed's approach on rate hikes. It's expected that if there is a rate hike this year, it will be singular.

That stability is translating to a spike in mortgage applications as we get into the spring buying season. According to the Mortgage Bankers Association, mortgage applications were up 5.3 percent week-to-week and were 0.4 percent higher than a year ago at this time.

Home prices are still historically high right now but are also continuing their lean toward the favor of the homebuyer. According to the S&P Case-Shiller index, home prices are growing at their slowest rate since August of 2015 (4.7 percent in December 2018 down from 5.1 percent in November 2018).

The interesting part of that is, despite rates going down and home price growth slowing, that was not enough to offset the fact that homes are still not affordable for most Americans. Wage gains simply aren't on the same level.

December's housing start numbers were rough, down to their lowest level in two years. According to the Commerce Department's numbers, new home construction is at its slowest pace since September of 2016. The data shows new home starts were down 11.2 percent from November. Permits to build housing were up slightly, just 0.3 percent in December.

Another thing that might help the spring buying season is a positive with regard to tax returns. Initial reports were showing frustrated people who were getting less in their return or having to pay out instead of getting a rebate. Now, after a four weeks of filing data, people are reporting better tax returns than previous years with the average tax return up 1.3 percent from a year ago according to IRS data.