Why Falling Home Sales Headlines Don’t Tell the Whole Story

Why Falling Home Sales Headlines Don’t Tell the Whole Story

If you’ve seen the recent headlines about new home sales dropping 10.5% in January, you might be wondering, “should we be worried?” The short answer? Not really.

While a decline in sales might seem like a red flag, the reality behind the numbers tells a different story. Let’s break down the Census Bureau’s January 2025 New Residential Sales Report.

A Closer Look at the Numbers

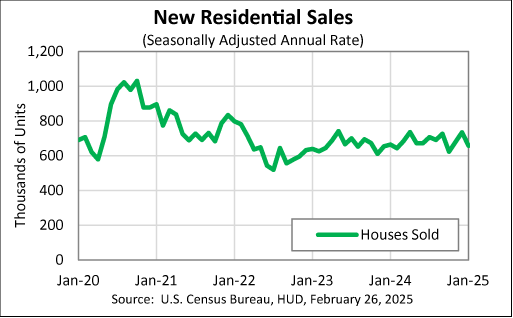

New home sales were at a seasonally adjusted annual rate of 657,000 units—a drop from December’s revised 734,000 units.

However, these numbers come with a ±19.9% margin of error, meaning the actual decline could be smaller—or even nonexistent.

Compared to last year, sales were only 1.1% lower than January 2024’s figure of 664,000, a change well within the ±15.3% margin of error.

The Market Is Returning to Pre-Pandemic Norms

When looking at long-term trends, new home sales are still performing well. If we remove the pandemic-driven housing surge, current sales levels remain in line with pre-2020 trends.

The Census Bureau also reports that the inventory of new homes remains high at 495,000, the largest supply since 2008. That represents a 9-month supply at the current sales pace, giving buyers more choices and potentially better negotiating power.

Regional Differences Matter

Not every market is experiencing the same trend. The Northeast and Midwest saw the biggest sales drops, down 20% and 16.7%, while the West actually saw a 7.7% increase in new home sales.

For buyers and agents, this means opportunities vary by location. Some markets may still be competitive, while others could offer more favorable conditions for buyers.

What This Means for You

- Buyers: Less competition and more options could make this a great time to start looking. With mortgage rates easing, affordability may improve.

- Sellers & Builders: The demand for new homes remains steady, but pricing strategically will be key in markets with higher inventory.

- Real Estate Agents: Look past the headlines and focus on trends. Clients will benefit from guidance based on local conditions, not just national news.

The Bottom Line

A month-over-month dip in new home sales may not be a sign of trouble. The market is adjusting to a more sustainable pace, not crashing. With stable demand, strong inventory and regional opportunities, the focus should be on long-term trends rather than short-term fluctuations.

The best time to buy isn’t dictated by headlines—it’s when you’re financially ready. If you have questions about what today’s market means for you, reach out to your Movement loan officer for guidance.