Fed talks raising rates; government shutdown threatens economy

The minutes from December's Federal Open Market Committee meeting show that the Fed's stance on raising rates may be even softer than previously believed.

While December's vote to raise rates was unanimous, there were a few people present who believed there should be no change.

According to the minutes, "Participants expressed that recent developments, including the volatility in financial markets and the increased concerns about global growth, made the appropriate extent and timing of future policy firming less clear than earlier."

The minutes also showed some participants believe they should "remove forward guidance entirely" and instead use language to emphasize "the data-dependent nature" of their choices.

This week, Chicago's Fed President Charles Evans said he felt the Fed could stand to wait a few months to evaluate the evolving economic situation and then make the decision whether or not to raise rates.

Meanwhile, St. Louis' Fed President James Bullard, who is a voting member on this year's FOMC, said this week there was no urgent need to go higher with rates because "We've got a good level of the policy rate today."

Mortgage rates have moved lower over the last several weeks. The minutes more or less confirm that the Fed will hit the pause button for now and evaluate economic conditions over the next several months to determine the next move. For now, I would expect rates not to move too much to the higher side until the markets gain more clarity as to the direction of the Fed.

Political impact

That patience instilled confidence in equities as the Dow posted a 5-day win streak as of Thursday. That was quickly muted when President Trump's meeting with Democratic leaders Chuck Schumer and Nancy Pelosi turned sour. Trump reportedly walked out of the meeting and called it "a total waste of time."

We are now three weeks into the partial government shutdown as President Trump continues to make his case for funding for a border wall.

Fed Chair Jerome Powell, speaking on Thursday, noted that while short-term shutdowns typically don't have a big effect on the markets, "A longer shutdown is something we haven't had." He went on to say, "If we do have an extended shutdown, I do think that would show up in the data pretty clear." He believes that a prolonged government shutdown could negatively impact the US economy.

Trade talks between the United States and China came to a close on Wednesday, lasting a day longer than was expected. Details on the discussions have yet to be released. When asked why talks were extended beyond what was scheduled, China's Foreign Ministry spokesman Lu Kang said, "I can only say that extending the consultations shows that the two sides were indeed very serious in conducting the consultations."

The overall takeaway was positive for both U.S. and Asian markets, both rising in the days following the trade talks.

Oil takes center stage

The sharp drop in the cost of gasoline is a large part of the reason consumer prices fell for the first time in nine months. December's consumer price index, released by the Labor Department, showed a drop of 0.1 percent after being unchanged in November. Over the 12 months through December, the CPI went up by 1.9 percent.

The core CPI, which takes out energy and food costs, did rise by 0.2 percent. According to the report, the costs of rent of healthcare are the current inflationary pressures people are facing.

The Federal reserve closely watches the core CPI as well as the core personal consumption expenditures (PCE) to gauge inflation. The drop in gas prices has helped to steady the inflation caused by rent and healthcare expenditures, keeping that core PCE right around the Fed's ideal 2 percent.

Fed Chair Powell made mention of inflation on Thursday saying "With inflation low and under control we have the ability to be patient and watch patiently and carefully."

Oil and mortgage rates

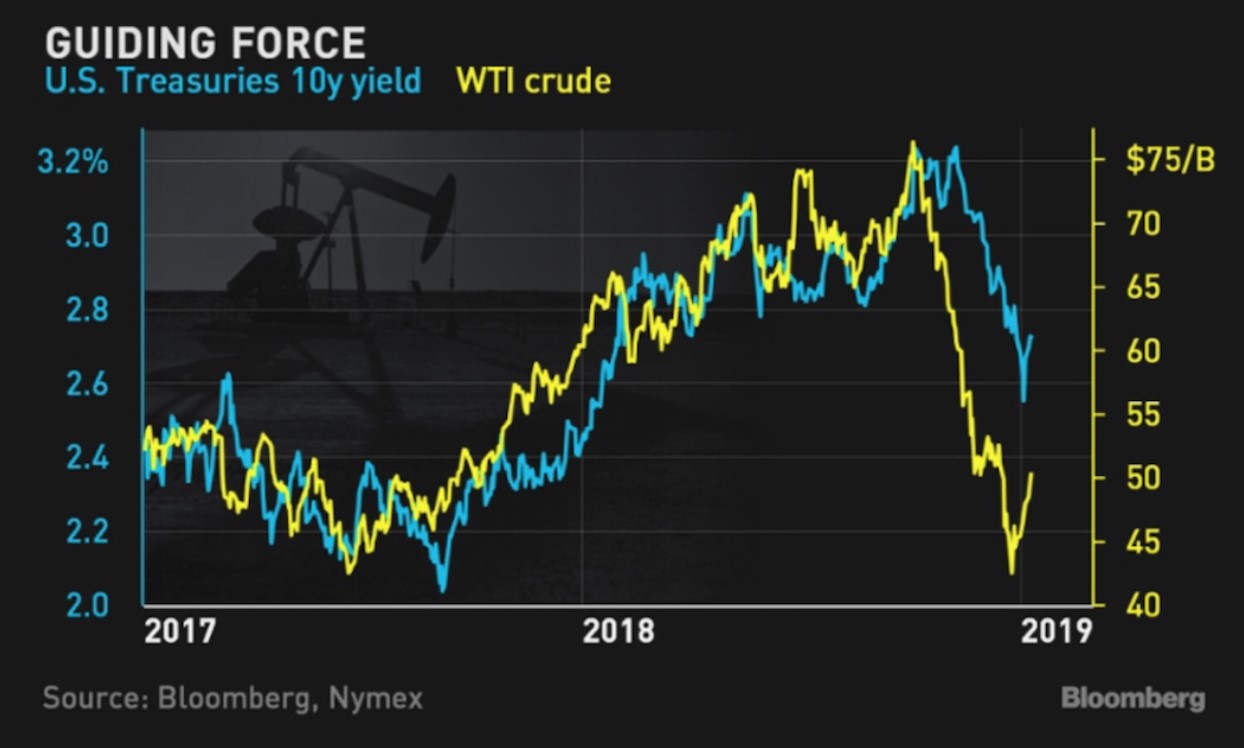

While the oil market and bond market may seem mutually exclusive on the outside, they can sometimes be more in step than you would think. We are seeing that right now as the 10-year Treasury note yield is nearly on par with trends in WTI crude oil. The chart below from Bloomberg shows similar peaks and valleys from 2017 to now between the two markets.

Oil will be interesting to watch for the next few months as OPEC plans to cut production while U.S. oil producers claim to have discovered oil fields that could potentially produce billions of barrels.

Refinances spikes in 2019

Mortgage applications took off in a big way in 2019. According to new data from the Mortgage Bankers Association's weekly survey, applications rose 23.5 percent in the first week of the new year. Refinancers led the way, taking advantage of a 30-year fixed-rate mortgage that was 10 basis points lower than peaks in 2018.

According to MBA Associate Vice President of Economic and Industry Forecasting, Joel Kan, "This drop in rates spurred a flurry of refinance activity, particularly for borrowers with larger loans, and pushed the average loan size on refinance applications to the highest in the survey."

Purchase applications were also up slightly, 4 percent higher than a year ago. Applications for the Federal Housing Administration and Veterans Affairs also rose with Department of Agriculture loans holding steady.