Oil’s up, bitcoin’s down, equities fly and bonds cry

Limited supply and increased demand pushed oil to its highest price in more than three years this week while fear and uncertainty knocked bitcoin to its lowest level in six weeks.

Crude oil prices were trading close to $70 a barrel earlier this week — a high last seen in December 2014 when the oil market was on the verge of a three-year decline. Meanwhile, prices for bitcoin, the popular cryptocurrency grabbing headlines, fell below $12,000 for the first time since Dec. 5, according to CoinDesk data cited by CNBC.

As the week wore on, bitcoin behaved as it often does — inconsistently — and began to rebound Thursday morning, rising to more than $11,700 after dipping to $9,199 a day earlier.

Before we get into the latest bitcoin pricing frenzy, let's talk about oil and why mortgage professionals should pay close attention to the rise in prices.

Oil on a high

The relationship between oil and mortgage rates isn't easy to define but one does exist, albeit indirectly.

When oil prices rise, so does the price of fuel. The uptick puts upward pressure on the costs of goods and services (i.e., inflation), which results in a rise in mortgage rates.

But when oil prices fall, the opposite happens. Low oil prices distress the economies of oil-producing countries such as Venezuela, Russia and much of the Middle East. When those economies begin to suffer from cheap oil, global investors begin to panic and look for safe havens to store their money.

Why are prices going up now?

In the early 2000s, the global oil market experienced overwhelming demand from developing countries with economies growing at an exponential rate. After the recession, oil prices began trickling upward at the same time that ravenous demand began to subside. By the fourth quarter 2014, oil prices fell sharply as production exceeded demand, creating a glut in the oil supply.

To stem the tide, the Organization of the Petroleum Exporting Countries (OPEC) made a deal with Russia and other non-OPEC producers to limit oil output and production until the end of 2018. The aim was to reduce oil inventories in developed economies to the level of the five-year average and revive depressed crude prices.

Now that the economy is growing healthier and limited supply is creating greater demand, prices are increasing again.

Bonds slide

The rise of oil prices is fueling investor demand.

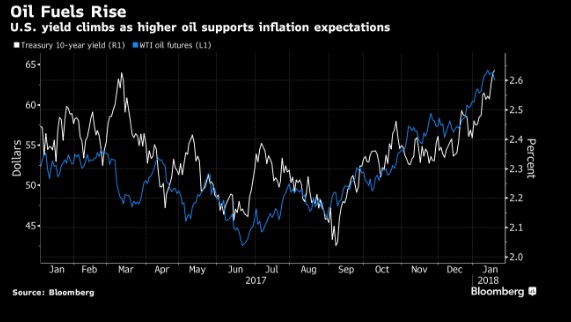

The 10 year Treasury yield rose to its highest level in several years. As of Friday morning, the yield on the 10 year traded at 2.64%. We haven't seen a yield this high since September 2014. Yields have been rising on the prospects of Fed rate hikes and increased government debt issuance to deal with the U.S. widening budget deficit.

"Rising oil and equities have fanned speculation that break-even inflation will climb," Makoto Noji, chief foreign-exchange and foreign bond strategist at SMBC Nikko Securities Inc., told Bloomberg. "While investors are buying oil and stocks ahead of the announcement on the Trump administration's infrastructure plan, the yield is more likely to extend its advance" to 2.75 percent.

The yield advance on Friday came as the House passed a spending bill to avoid a U.S. government shutdown, though Senate Democrats said they have the votes to block the measure.

The U.S. two-year yield has been climbing since September and on Jan. 12 topped 2 percent for the first time since 2008, reflecting expectations for Fed policy tightening. Longer-term yields are on a gentler slope, a function of inflation struggling to meet the Fed's 2 percent target.

The long end has also been weighed down by low rates elsewhere, which have enhanced the appeal of U.S. debt. The result has been a marked flattening of the yield curve — seen by some as a potential harbinger of economic weakness.

As we all know, mortgage rates follow the 10 year treasury and have headed higher as well. The flattening of the yield curve has kept a ceiling to date on longer term mortgage rates. A flattening yield curve results in higher coupon mortgages underperforming lower coupons. This compression of the MBS coupon stack decreases the price benefit of higher note rates, reducing the amount of premium pricing originators are able to offer. I expect this continue throughout the remainder of the year. The key driver here is what happens with inflation. We all need to keep a watchful eye on this.

Oil vs. 10 year Treasuries

Bitcoin takes a tumble

Like it's done for much of January, bitcoin's value plunged this week as new reports emerged suggesting that major economies are mulling moves to block trading digital currency.

After hitting its peak near the end of 2017, the price of bitcoin and other cryptocurrencies has gone up and down rather dramatically. The latest volatility is mostly driven by investors' concerns that government crackdowns and stricter regulation on trading is imminent.

That's what happened this week as comments from government officials in China and South Korea implied tougher rules for bitcoin trading are on the horizon. South Korea is the world's third-largest cryptocurrency trading market, and digital currency exchanges have grown popular in China.

Still, some speculators say bitcoin's price fall does not signal a bubble burst. Michael Jackson, a cryptocurrency analyst and former chief operating officer of Skype, told Newsweek the drop was "just a blip."

In other mortgage news…

- The Federal Reserve on Wednesday released its beige book showing that inflation is growing at a modest-to-moderate rate while wages move higher. The beige book is the Fed's summary of economic conditions compiled by the regional Reserve Banks. It also showed that higher-than-expected retail sales boosted consumer spending while manufacturing activity grew modestly and labor market conditions tightened.

- Policymakers still expect to raise interest rates three times this year.

- Mortgage applications increased 4.1 percent from last week while rates for 30-year fixed-rate mortgages with conforming loan balances also increased, according to the Mortgage Bankers Association.

- Goldman Sachs is now offering home improvement loans, which range from $3,500 to $40,000 for periods of three to six years, and don't require a home appraisal or borrowing against the borrower's home.

- Builder confidence in the market for newly-built single-family homes fell in January, although builders are confident tax reform legislation will boost economic growth.

- New home construction increased last year with privately-owned housing starts up 2.4 percent, housing completions up 7.4 percent and building permits up 2.8 percent.