Fed feeling pressure to cut interest rates in 2019

There is a strong indication that the Federal Reserve will cut interest rates in 2019 and potentially in 2020, too. The problem is, they are in a sort of chess match right now and are hesitant to make the first move.

Recently, Fed Chair Jerome Powell said in a speech that the Federal Open Market Committee (FOMC) "will act as appropriate to sustain the expansion," meaning the expansion of the United States' economy. A former board member, Sarah Bloom Raskin, believes that means the Fed is strongly leaning toward cutting rates in 2019. Speaking to CNBC this week, Raskin said, "I think Chairman Powell has given a message to markets that's indicating that a rate cut is coming. This is, in essence, a very strong signal that the FOMC is actually ready to talk about cutting rates."

The next meeting for the FOMC is June 18-19 where a potential rate cut will more than likely be discussed. The attitude of the committee this year has been patience, emphasizing a reliance on data, before making moves. However, their hand may be forced by a slowing economy and international issues.

The lingering issue is the trade war with China. Any pre-emptive move made by the Fed could have unwanted, and potentially harsh, effects, according to Morgan Stanley Chief Economist Chetan Ahya. It's believed that any move made by the Fed to cut rates will be in reaction to policy from President Trump, not the other way around.

The stock market continued to move higher on the week on Thursday when it was announced that trade talks between the United States and Mexico would resume. The Dow's nearly 200 point jump Thursday came on the heels of a 700 point gain during the first three days of trading this week. It was up 3.7% through Thursday's close. For the week, the S&P 500 also increased by 3.3% with the Nasdaq Composite gaining 2.2%.

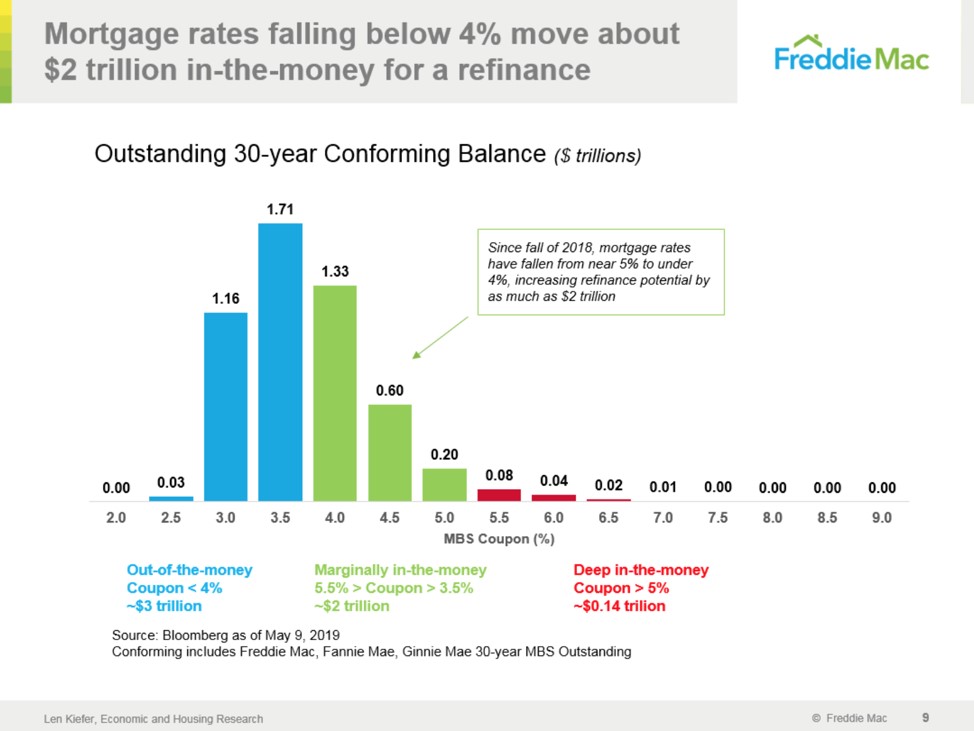

In the meantime, long-term rates continue to drop. The Freddie Mac average on a 30-year fixed-rate mortgage dropped again this week, down to 3.812%. That's close to a two-year low. According to Freddie Mac, there are "more than $2 trillion of outstanding conforming conventional mortgages eligible to be refinanced ––meaning the majority of what was originated in 2018 is now eligible."

Investors move to treasuries

The belief that the Fed will cut rates this year has investors rushing toward Treasuries, particularly short-term notes. The two-year yield hit its lowest level since December 2017, tumbling by more than a quarter-point since last week. The Benchmark 10-year yield also dropped to 2.06%, its lowest level since September of 2017.

The trade war with China is a large part of this, but investors are also monitoring a bleak manufacturing report. The ISM Manufacturing index was expected to show a small gain but instead declined by 0.7 points. New orders increased, but production level went down contributing to the decline.

All of this has led investors to believe that not only will the Fed cut rates in 2019, and cut them soon, but that they'll also cut rates in the first quarter of 2020.

Job market update

There was a big surprise this morning from the Labor Department showing dramatically slowed job growth. Analysts were expecting job growth numbers around 180,000 for nonfarm payrolls. Instead, jobs increased by just 75,000 in the month of April. The job count for March was also revised down. The unemployment rate has remained unchanged at a 50-year low of 3.6%. Wages saw a small increase but that growth has also slowed.

Private payrolls showed a surprising slow down this week. The ADP and Moody's Analytics data shows payrolls going up by just 27,000. It was estimated that number would be closer to 173,000. That's the worst reading since March of 2010, the time that the economy was climbing out of the nadir of the recession.

The data shows that large companies (50-499 employees) fared pretty well in May. However, it was the small companies, with fewer than 50 employees, that took the brunt of it reporting a loss of 52,000 jobs. Almost all of that small business loss came at firms with fewer than 20 people.

Weekly jobless claims were unchanged for this week, according to the Labor Department. This still indicates labor market strength, despite the losses in the private sector, which is essential for economic growth.

Oil tanks again

Oil prices have dropped to their lowest levels since January of this year, thanks to a surging stockpile. The U.S. Energy Information Administration reports that crude inventories jumped by 6.8 million barrels for the week ending May 31. The chart below from CNBC shows just how quickly the price of oil shares dropped off after the news of the stockpile was reported.

In addition to this, U.S. weekly production also rose to an all-time high 12.4 million bpd, according to a preliminary reading from EIA. The market will likely shift again in the coming weeks as OPEC and its oil market allies are expected to discuss production policy in their upcoming meeting.