Inflation: New Fed chief’s prickly problem

When he steps into his new role as leader of the Federal Reserve, incoming Chairman Jerome Powell will face a significant challenge: how to manage a healthy economy without any significant inflation.

Soft inflation has been a prickly problem for the Fed for the last five years, and 2017 didn't buck the trend. Inflation, which is a measure of the gradual rise in the price of goods and services, has failed to hit the Fed's 2 percent target even as the labor market expands and the economy grows stronger.

The poor performance has puzzled Fed policymakers who have steadily raised interest rates despite inflation's missing the mark. Predictions from central bank presidents that higher inflation is on the horizon have yet to materialize.

The Fed is the nation's most powerful financial regulator. Its actions directly influence the rise and fall of interest rates, which in turn affect the cost of mortgages, access to credit and how easily consumers can borrow money. How the central bank handles stagnant inflation, or stagflation, over the next year is paramount to our industry's performance.

Three key inflationary measures released this week illustrate the subdued state of inflation today:

- In December, the Producer Price Index, or PPI, fell 0.1 percent, slipping for the first time since August 2016. Economists expected the PPI, the average change in prices that domestic producers of goods receive for their products, to rise by 0.2 percent. The fall suggests that economists should temper expectations that inflation will gain more momentum anytime soon.

- The Consumer Price Index, or CPI, rose 0.1 percent last month — excluding the volatile food and energy sectors, prices increased 0.3 percent in December. The CPI, which measures changes in the prices Americans pay for goods and services, matched economists' expectations and suggests inflation ticked higher at the close of last year than originally believed.

- Steady holiday shopping boosted retail sales 0.4 percent last month after a 0.9 percent surge in November. This shows that Americans remain confident about the economy and are comfortable with spending.

- While the CPI and retail sales indices show signs of accelerating inflation, we should take into account that last month's recordings reflect holiday shopping. Therefore, it makes sense that prices would increase and consumers would spend more given the time of year.

In February, Powell will take on the mantle of Fed chief after current Chair Janet Yellen leaves the job after only one term. Once he takes over, Powell, a past Fed governor and equity banker, will face internal pressure from fellow policymakers concerned about the state of inflation.

Already, the heat is on. One Fed president urged the central bank to focus on achieving an inflation range instead of hitting a specific target. Others have suggested the Fed target another economic measure, such as nominal gross domestic product, which includes inflation and the rate at which the country's GDP changes year over year.

Using today's framework, the Fed moderates economic growth by raising and lowering borrowing costs (i.e., the benchmark interest rate). It does this to maximize employment and manage inflation to prevent the economy from growing too quickly.

Things have gone well on the employment front but inflation remains worrisome, and some Fed policymakers are ready to change their modus operandi.

In a New York Times piece about the Fed pondering a new approach to managing the economy, Patrick Harker, president of the Federal Reserve Bank of Philadelphia, is quoted saying there's a need for better research on available alternatives to how the central bank pursues its inflation target. "We need to consider the possibility of a new economic normal that forces us to reevaluate our targets," he said.

What this means for the rate environment

Mortgage rates are projected to rise in 2018 but should remain below 5 percent on a 30-year conventional fixed mortgage.

As the new GOP tax plan begins to influence economic conditions, the Federal Reserve will likely raise the benchmark interest rate three to four times this year.

The market expects Powell to follow in the vein of his predecessor and remain cautious with hiking interest rates even as employment improves and the economy grows stronger.

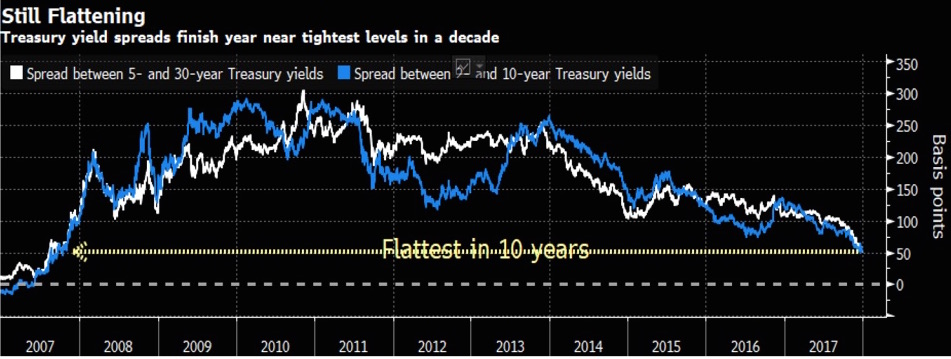

Powell, the Fed and the markets will keep a watchful eye on inflation and look for any triggers that may influence inflation above its 2-percent target rate. Because the Fed has been raising short-term rates, the longer end of the yield curve on the 10-year Treasury has not risen as rapidly.(See chart below) This flattening should remain in place for the rest of 2018, creating a ceiling on how much higher mortgage rates will rise.

Any hint of inflation approaching or exceeding the Fed's target rate will reverse the flattening trend and move rates higher.

In other mortgage news…

- The yield on the 10-year Treasury this week soared to its highest level in more than nine months during a bond market selloff. The 10-year treasury yield is currently trading at 2.56%. Because mortgage interest rates move in the same direction as Treasury yields, the surge will also have an impact on mortgage rates.

- On the heels of a slump at the end of 2017, mortgage applications surged the first week of 2018, going up 8.3 percent, according to the Mortgage Bankers Association. Refinance applications increased 11 percent.

Re/Max Co-CEO Adam Contos said this week he expects existing home sales to increase, more home sales in the suburbs and less-populated markets and technology and tools that make home buying easier and convenient to evolve in 2018.