Recession or not? Making sense of mixed signals

This week the stock market volatility continued as major signals of an upcoming recession shook investor's confidence, pushing the Dow Jones index to its worst day of 2019. The 10-year Treasury note hit a three-year low of 1.475% on Thursday. Earlier in the week, the 10-year yield dropped below the 2-year yield reflecting an inversion not seen in quite some time. That is a major indicator of an upcoming recession. The yield on the 30-year Treasury note also hit an all-time low of 1.9689%, the first time it has ever dipped below 2%.

When the 10-year Treasury note yield drops below the yield for the 2-year Treasury note, that is called a yield curve inversion. This occurred earlier this year on shorter-term maturities.The last time the 10- and 2-year Treasuries inverted was Dec. 2005, just before the financial crisis and the Great Recession. On average, once the 10- and 2-year yield curve inversion happens, a recession follows 22 months later, according to data from Credit Suisse.

The inversion caused a domino effect to ripple through the stock market as the Dow dropped 800 points on Wednesday as investors feared an oncoming recession. The volatility was also spurred by global political concerns in Hong Kong and China along with global economies continuing to falter.

The silver lining in the economy right now is the confidence of American consumers. The Dow made some gains Thursday as Walmart's earnings gave investors confidence about American consumers' purchasing power. According to the Commerce Department, retail sales went up 0.7% in July as consumers spent more at restaurants and retail stores. Based on the data from the Commerce Department, some analysts have raised their gross domestic product forecasts for the third quarter by 0.2%.

Head of global markets at Citizens Bank, Tony Bedikian, told CNBC, "The U.S. is pretty strong actually. The markets are trading more off the headline risk, particularly around tariffs, than the actual fundamentals, at least from the U.S. data. The jury is still out whether the market is going to be correct here, and whether we are going to see a slowdown. We're not seeing that in the data. Broadly, we've seen some slower growth, but it's still growth. It's waning a bit but it's still kind of a Goldilocks scenario."

MUFG's chief financial economist Chris Rupkey said the current bond market is a direct reflection of the trade issue with China. "If you look at retail sales, one of the signs of a recession is three consecutive monthly declines in retail sales, and we're seeing just the opposite."

The trade war with China did take a turn this week, as the U.S. announced a delay on tariffs for some items on the list of Chinese goods to be taxed. Some items were removed from the lists outright.

Citing health, safety and national security concerns, items like cellphones, laptops, videogame consoles and clothing items like footwear, have all been put on a delayed tariff schedule until Dec. 15. They were originally going to be taxed starting Sept. 1. The U.S. Trade Representative office did not specify which items would be removed from the tariff list. The decision to delay those items, according to President Trump, was to help alleviate any stress during the holiday shopping season.

At the beginning of the week, protests in Hong Kong were partly to blame for the steep drop in equities. The main airport was shut down as protestors rallied against a recent law that was proposed and subsequently shelved. The law would have allowed extradition to mainland China for people suspected of certain crimes. Hong Kong is technically under the control of China in a "one country, two systems" agreement for the next few decades. That was part of a deal struck in the mid-1980s when Great Britain gave up control of Hong Kong as a colony. Now, protestors are pushing for a democratic government and causing an upheaval in the small country.

Meanwhile, a massive stock selloff in Argentina after the country's primary elections added a wrinkle to global economy issues. The surprise election outcome caused the country's market to drop 48% in dollar terms. According to Bloomberg, that was the "second-biggest one-day rout on any of the 94 stock exchanges tracked by Bloomberg going back to 1950. Sri Lanka's bourse tumbled more than 60% in June 1989 as the nation was engulfed in a civil war."

Elsewhere in the world, a Danish bank has just implemented the world's first negative rate mortgage. Loans to homeowners can now have a charge of minus 0.5% a year. That means that the bank is paying the borrower to take money and the borrower ends up paying back less than they've been loaned. Basically, the monthly payments are reduced each month. This is another sign of a weakening global economy.

STRONG LABOR MARKET ALSO SIGNAL OF RECESSION

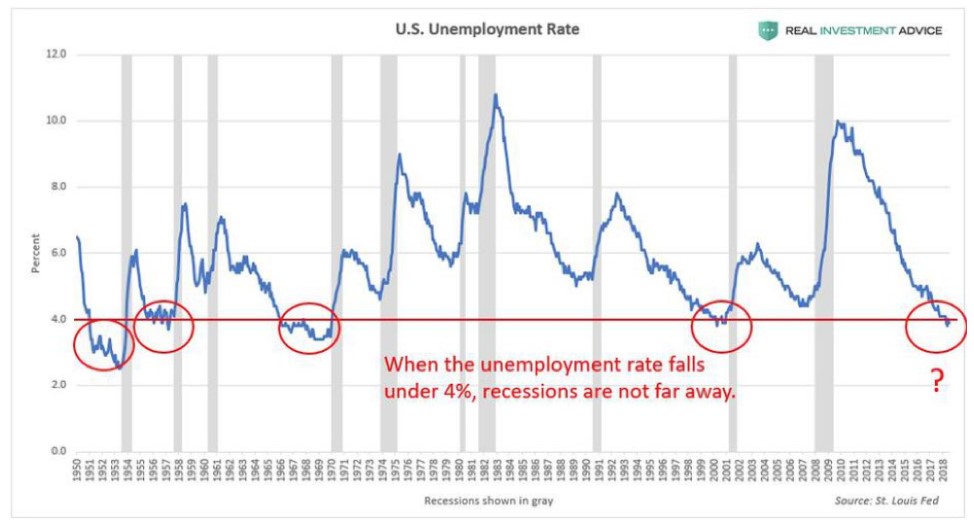

The piece that doesn't seem to fit in the current economic situation is the strong labor market. Just last week the Bureau of Labor Statistics showed a strong market with historically low unemployment being the norm and wages rising. Unemployment has been sitting at or below 4% since fall of 2018. The most recent jobs report showed a rate of 3.7%. That has boosted consumer confidence, but many economists see that as being a sign that the economy has hit peak maturation and is likely to experience a recession.

This chart below, put together by Real Investment Advice and Forbes, shows the U.S. unemployment rate (blue line) and subsequent recessions (gray bars). You can see the pattern clearly.

While these are all indicators of a recession, they do not mean that it is a certainty. If the Credit Suisse estimate of a 22 month period between yield curve inversion and recession holds true, that still allows for the potential impact of an election season in 2020 that could change the trajectory.

MORTGAGES HIT A HIGH POINT

As interest rates have dropped significantly, the mortgage business has seen a big time rebound from the first quarter of 2019. As of this week, the Freddie Mac 30-year fixed-rate mortgage average is 3.6%. One year ago, the average was 4.53%.

Mortgage originations are at their highest level since the third quarter of 2017, according to the Federal Reserve Bank of New York's Center for Microeconomic Data. Including refinances, mortgage originations in the second quarter of 2019 increased by $130 billion over last quarter's total. We are now sitting at $474 billion in originations which, again, is the highest volume since the third quarter of 2017.

The report from the NY Fed also shows that mortgage underwriting was still fairly strict, with the average credit score for borrowers sitting at 759. Less than 10% of mortgages were given to borrowers with a credit score under 651.

As you'd expect with more mortgage originations, mortgage debt also increased across the board. Mortgage balances, the largest component of household debt, increased to $9.4 trillion after the second quarter of 2019. We saw a balance of $9.3 trillion in the third quarter of 2008. However, the Fed report shows that mortgage delinquencies have gone down. The second quarter saw a drop from 1% to 0.9% of mortgages delinquent for more than 90 days.

We might also see another boost in the fourth quarter as the Department of Housing and Urban Development is looking to make it easier for first-time condominium buyers to get financing through the Federal Housing Administration. Effective Oct. 15, the FHA will start backing mortgages for individual condo units. FHA mortgages require just 3.5% down payments as opposed to the conventional mortgage that requires 20% down. Right now, just 6.5% of the 150,000 condominium developments in the U.S. were eligible for an FHA loan.

Housing starts continue to struggle as new home builders face labor shortages and higher costs with tariffs. July's housing starts were 4% below the revised June estimate, according to the Census Bureau and HUD. However, year-over-year housing starts are up. Housing permits are also up year-over-year and month-over-month which indicates future housing starts should be in the positive as well. New home completions are also up year-over-year which is another positive for future housing inventory.