Ready to retire? Movement employees will be.

Movement Mortgage team members are doing something most American workers aren't: Saving for retirement.

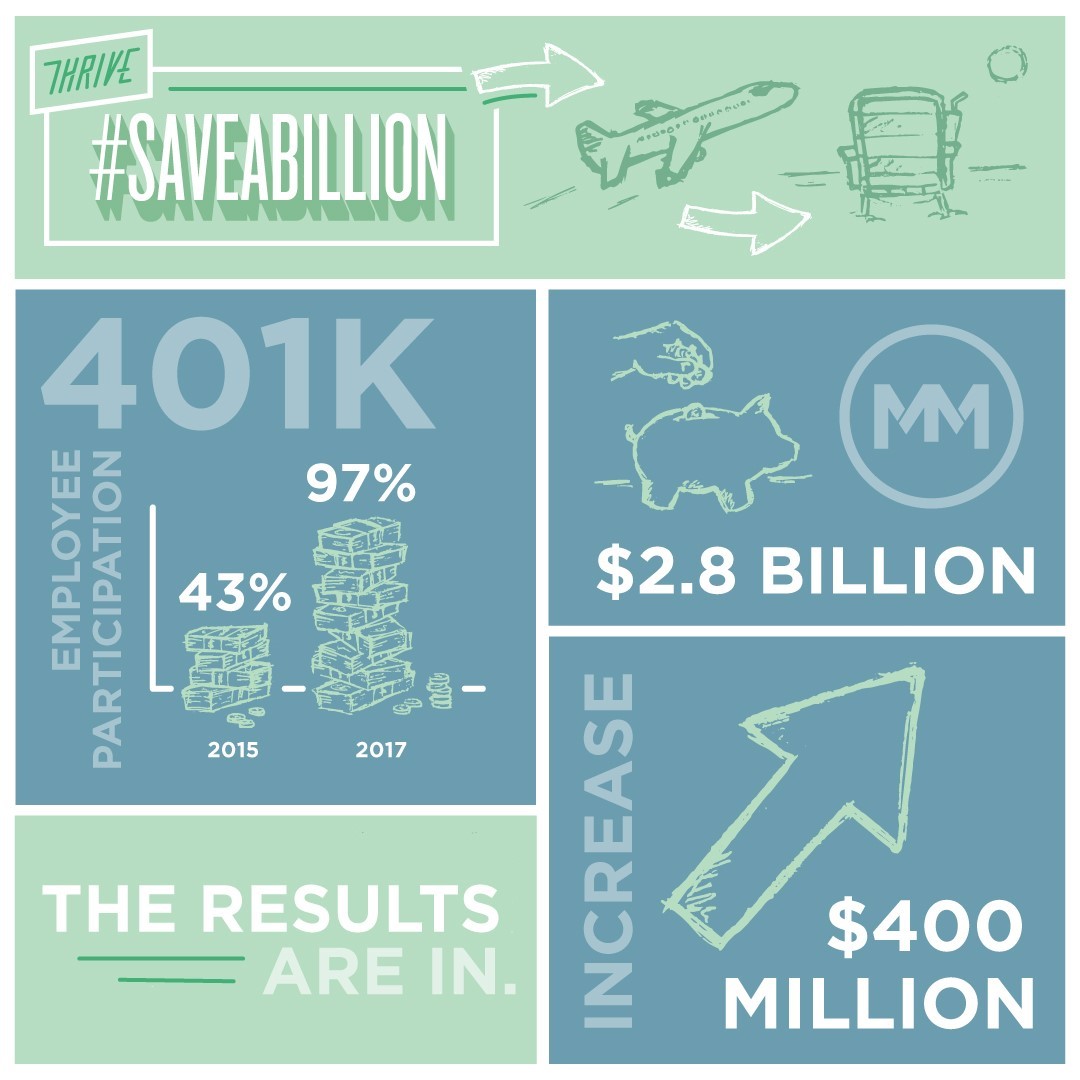

Thanks to a recent employee campaign, #SaveABillion, 97 percent of eligible Movement staff are now contributing to the company's 401(k) program at some level. The company recently undertook the 90-day challenge to encourage all team members to save more for their retirement in their 401(k). The campaign began when Movement's leaders at the end of 2015 realized only 43 percent of workers participated in the retirement plan, and just 25 percent contributed 6 percent or more. Movement matches employee contributions 100 percent up to six percent of their salary.

"Employees were asked to take a hard look at their current financial situation and make decisions about how they could better save for tomorrow," says Aimée Dodson, Thrive director, who led the #SaveABillion efforts. "They are now better prepared for their future thanks to their taking part in the campaign."

Team members increased their estimated retirement balance to $2.8 billion — nearly a $400 million increase — during the three-month campaign. Movement supplemented the #SaveABillion campaign with a new policy auto-enrolling new hires in the plan and offering financial counseling to anyone who wanted to borrow fund from their 401(k).

Team members learned important lessons and found solid ground, thanks to #SaveABillion.

"We finally have our $1,000 savings for emergencies, contributing to a 401(k), have a plan budgeting most of our ongoing medical expenses and are now tackling the debt little by little," says Nancy Myrick, a loan officer assistant in Tampa, Fla.

Movement team members lead the way when it comes to saving for retirement. Nationwide, only about a third of all American workers are saving in a 401(k) or similar tax-deferred retirement plan, according to 2017 report from Bloomberg citing U.S. census data.

In addition to helping team members tackle their finances, #SaveABillion emphasized taking advantage of Movement's match to the 401(k) program. Unlike the national average of 3 percent, Movement provides a dollar-for-dollar match up to 6 percent of an employee's salary.

The lesson sunk in.

"A lot of companies talk about what you should do, but Movement backs it up. They want you to increase your retirement balance so much that they are willing to match your investment at 6 percent," says Melayne Curtis, a processor at Movement's National Sales Support Center in Fort Mill, S.C. "I can't say enough how much I love Movement Mortgage and it has brought so much to my life — and not just money!"

Thanks to #SaveABillion, 62 percent of eligible team members now contribute at least 6 percent to their 401(k).

The writer of Proverbs says, 'The wise store up choice food and olive oil, but fools gulp theirs down.' I believe God has called each of us to be good stewards of the resources we're given," Movement Mortgage Chief Executive Casey Crawford says. "There's still room to improve, but I have to say how thrilled I am with our community for facing this challenge head on."