Predictions for 2017: For the times they are a changin'

Market Update

Yes, it's a classic by Bob Dylan but rather apropos when looking towards 2017. Although, it's impossible to predict the future — change is upon us. While economic forecasting is a lot of guesswork where we get to play the part of a weatherman, our basis is determined upon facts as we know them today and realize that unexpected outcomes will always be there to throw a curve. There are so many unknown factors that can completely change the health of the economy, such as natural disasters, geopolitical factors or just the markets moving in a nonsensical manner.

However, it's important to do our best to plan and prepare based on what we know. So I've pulled together five things that are likely to happen in 2017. These are all based on consensus opinions from some of the top economists in our industry, and will help you understand the environment for mortgage lending in the new year:

1. No more new normal

This entire decade we have dealt with what many economists dubbed "the new normal," which has been very slow growth (if any), historically low interest rates and an economy with little to no inflation, even deflationary at times.

The result has been a business and economic malaise worldwide. The only bright spot has been the rise in domestic equities as easy money policy from central banks has kept the economy grinding forward.

In 2017, everything is going to change. We're approaching full employment. Economic growth is likely to increase and inflation is going to completely change monetary policy dynamics. There's also a good chance international controversy will result in market volatility.

Why? In a word: Trump.

Economic research has proven the person in the White House has much less sway on the overall economy as we often give him or her credit for. However, Donald Trump's election this fall has changed the mood in Washington, and there will be many changes unfolding in 2017 based on his policies, but also a change of sentiment among business leaders.

Trump has proven to be a volatile personality so we're in for a ride as stocks will rise and fall in reaction to a tweet. But Trump is also promising to be a business-friendly leader. Businesses and investors are now making decisions based on the assumption of lower taxes, more federal spending and fewer regulations on many industries. This is all a good mix for higher inflation and a change in policy from central bankers. Instead of trying to boost employment through easy money, they'll be forced to combat an inflationary economy that might finally exceed 2 percent GDP growth.

Trading Economics is already predicting GDP to increase by 2.5 percent in the first quarter of 2017, after bumping along at just below 2 percent in 2016.

2. The interest rate paradigm will change

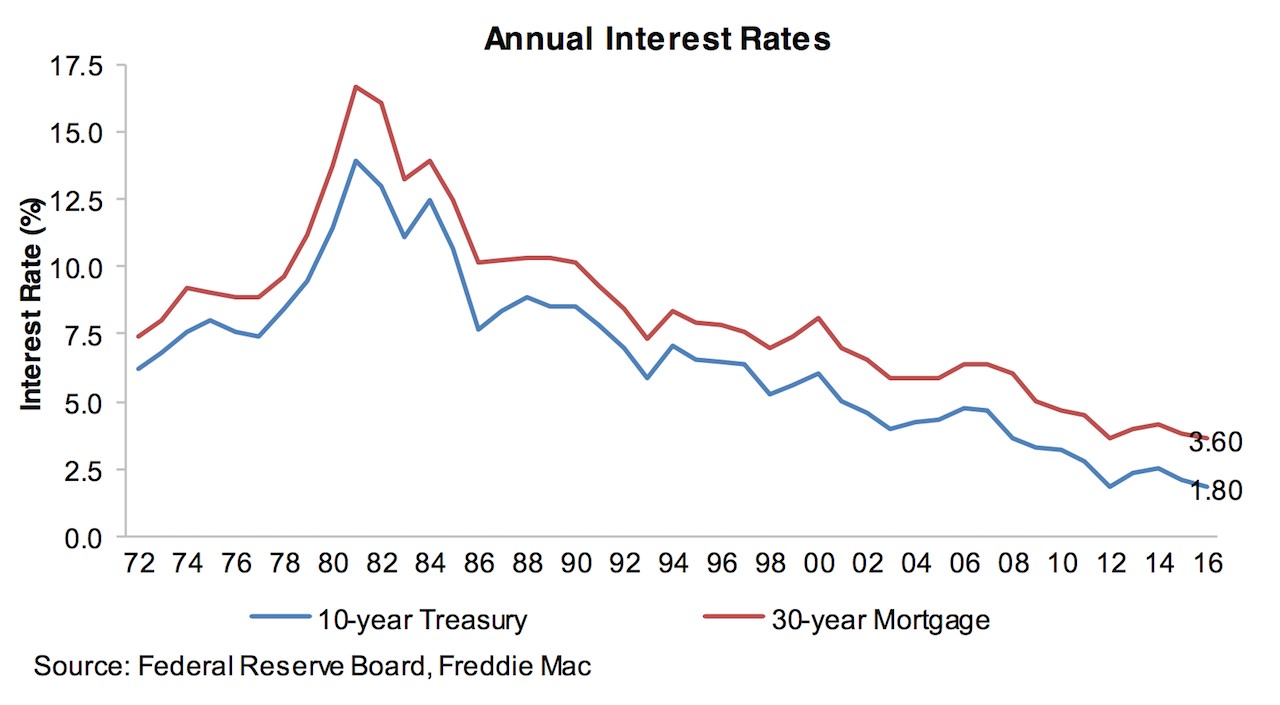

As we all know, post-financial crisis interest rates have remained at or near historical lows. Since inception, Movement Mortgage has enjoyed low interest rates with a keen focus on process and customer service, and we grew our business as a purchase centric lender. That will continue to serve us and our customers well in the coming years as rates continue to rise.

The days of consistently very low rates are over. We will need to be mindful of this as we work with our realtor partners and borrowers.

For all the reasons I've listed above, artificially low interest rates are a thing of the past. In 2017, we will see rates settle into a new environment, with 30-year mortgage rates in the 4.5 to 5 percent range. Some would argue this shift is overdue, as we've been in unprecedented territory for a long time.

This may turn out to be a positive trend for purchase-centric mortgage banks like Movement. The end of monetary stimulus signals a healthier economy. Meanwhile, rates that are still low historically will keep homebuying attractive for many families, while pushing refinance shops into a more difficult environment. Mortgage lenders are forced to compete on service and products as rates rise.

Keep in mind, the Federal Reserve's Open Market Committee in December raised the federal funds target rate 25 basis points to a range of 0.50 percent to 0.75 percent. The Fed's move was expected and priced into the market. But the committee noted the labor market continues to strengthen and the economy continues to grow moderately while inflation growth remains below the 2 percent target.

However, the Fed indicated it is aware of the sudden change in atmosphere since the November elections, and most economists believe the bank is preparing for more inflation in 2017 as the incoming Trump Administration gears up to cut taxes and increase government infrastructure spending. This will put more money into the economy and increase both growth and inflation.

As many as three Fed rate hikes are now expected in 2017 with the first one possibly coming as early as March.

Millennials will drive demand

We've been over this before: Millennials are becoming a driving force in the housing market, and there's cause to believe that 2017 will maintain that trend. Despite the hype suggesting they've eschewed homebuying for apartment living, millennials are poised to take the housing market by storm as their incomes stabilize and wages increase.

If recent data from Realtor.com holds any credence, it's possible 2017 will be the year of the first-time homebuyer. The website's report suggests that first-time homebuyers could make up 52 percent of all buyers next year, going up from 33 percent in 2016. At least 61 percent of those borrowers are under the age of 35.

Should those numbers be brought to bear, home builders will experience a massive marketplace opportunity.

This represents an 'Oh, shift' moment in housing," says Jonathan Smoke, Realtor.com's chief economist.

"With so many first-time buyers in the market, competition will be even fiercer next year for affordable starter homes in the suburbs."

There could be a few obstacles. While construction of single-family homes got a boost this year, labor shortages overall are slowing down the pace of building. The number of construction workers in housing today is 40 percent lower than what it was 10 years ago, according to industry research firm Redfin.

Foreign-born workers are more likely than natives to take construction jobs, according to the Bureau of Labor Statistics. If President-elect Donald Trump and his administration clamp down on immigration policies, we could see more of a dropoff in home building — at least by 6 percent, according to Redfin's estimates.

Home values won't slow down — much

Affordability was a hurdle for some homebuyers in 2016, and there's little to suggest that will change next year.

As millennials enter the housing market at a fever pitch, demand will outpace supply, driving up home prices and squeezing out low-income borrowers.

This year, the S&P Dow Jones reported that home prices climbed at more than twice the rate of inflation. This comes on top of a dwindling housing inventory, which has continued to fall nationally quarter over quarter. With fewer houses available for sale, the prices of current housing stock will just keep climbing.

Zillow predicts that home values will grow 3.6 percent next year, while Frank Nothaft, senior vice president and chief economist for CoreLogic, estimates they will go up about 5 percent, with some neighborhoods even seeing double-digit growth.

Higher prices create a tough barrier to entry for first-time homebuyers, especially millennials who continue to worry about affording down payments. Thankfully Fannie Mae, Freddie Mac and other housing partners all have introduced or will soon rollout more low-down payment programs.

Regulation rollback will be bumpy

Next year, we'll get a much better idea on how Trump and his administration plan to set their policy agenda. Here are some things we already know:

- The Affordable Care Act is at the top of his kill list. As he campaigned, Trump was adamant that he would repeal the controversial healthcare law and replace it with something else. He hasn't reneged on this vow, although he has said he may keep some provisions of the ACA. Perhaps next year, we'll learn what this "something else" will be.

- Trump wants to usher in tax reform by lowering tax rates and limiting the number of tax brackets from seven to three.

- He wants to peel back much of the regulation put in place by President Barack Obama, which may extend to rules that some feel have stifled the financial services industry.

We still don't know how housing will fare under the Trump administration. We do know that Trump has tapped retired neurosurgeon Ben Carson as the secretary of the Department of Housing and Urban Development, which creates even more uncertainty since Carson has no prior housing or bureaucratic experience.

We'll also have to wait to see how Trump decides to handle Dodd-Frank, the 2010 act that created the Consumer Financial Protection Bureau. Even before Trump clinched the presidency, congressional Republicans lobbied for a repeal to Dodd-Frank. Those same policymakers want to restructure the CFPB and place limits on its regulatory powers.

Prepare for plenty of negotiations, starts and stops, and a few tweet storms as the new president and his allies try to navigate the difficult path to regulation reforms.

Obviously, there are many more things to consider when it comes to the economy, housing, interest rates and the impact on mortgage companies. These are just a few to take note of, but suffice it to say that Movement Mortgage is well positioned to be a leader in the industry and thrive as we enter a new paradigm.

In 2016, we had our fair share of surprises that shook up the predictions, from Brexit to the fall elections. Often, the events we didn't expect are what shapes the economy in a given year. Indeed, "the times they are a changin'." Enjoy the ride — 2017 will be a bit volatile but filled with lots of opportunities.