What's TRID and why the heck should I care?

The industry change that affects every homebuyer

You see house. You love house. You buy house.

If only home buying were that simple. Instead, there are records to pull, documents to read, lists to check off and dotted lines to sign before you get to call that charming bungalow yours for good. It may seem like a giant pain, this loan process thing. Eye-crossing acronyms like TRID, TILA, RESPA, LE and CD may feel like obstacles between your family and the homeownership dream.

But what if we told you the process is actually for your benefit? And that TRID, one of the biggest process changes in decades can help you hang on to your homeownership dream long after you score that bungalow. What if we told you that the work involved in getting a loan is a good thing?

Because not too long ago, ultra easy loans led to homeownership horrors.

When housing hit the fan

We won't get entrenched in all the economic details here, but basically, around 2008, the housing market hit the fan. Some of you may have been caught up in it, others of you may have watched as parents, friends or neighbors endured catastrophic consequences. Until then, loans had been easy to come by. Too easy.

And some — scratch that — a lot of borrowers could not afford the mortgage they signed up for.

But the economy seemed strong, people were confident in spending and many lenders were encouraging risky loan after risky loan. Within a few years, homeowners could no longer keep up with above-their-means payments. House values plummeted and another economic recession was written into history.

A not-so-immediate intervention

As the shock wore off and a humbled nation came to grips with the reality of housing affordability, the government formed the Consumer Financial Protection Bureau, or, CFPB. In addition to helping educate and empower people to be wise about their money, a large part of the CFPB's focus is to protect consumers from getting caught up in financial deals they can't afford – namely, loans. In fact, their homepage, consumerfinance.gov, states that they exist to make sure banks and lenders treat consumers fairly. To do this, the CFPB came up with a strategic plan for holding lenders more accountable that would unfold over the course of four years, 2013-2017. TRID is a major piece in this plan.

If I had a nickel for every acronym in this article…

Stay with me here. TRID is the acronym for TILA-RESPA Integrated Disclosures. TILA is the acronym for Truth In Lending Act and RESPA is Real Estate Settlement Procedures Act. Yes, we're dealing with acronyms within acronyms, smh. All you really need to know about TILA and RESPA is that they both existed before TRID and were lending laws offering some form of consumer protection at the time. Which, after the housing meltdown in the late 2000s, the CFPB decided needed improving.

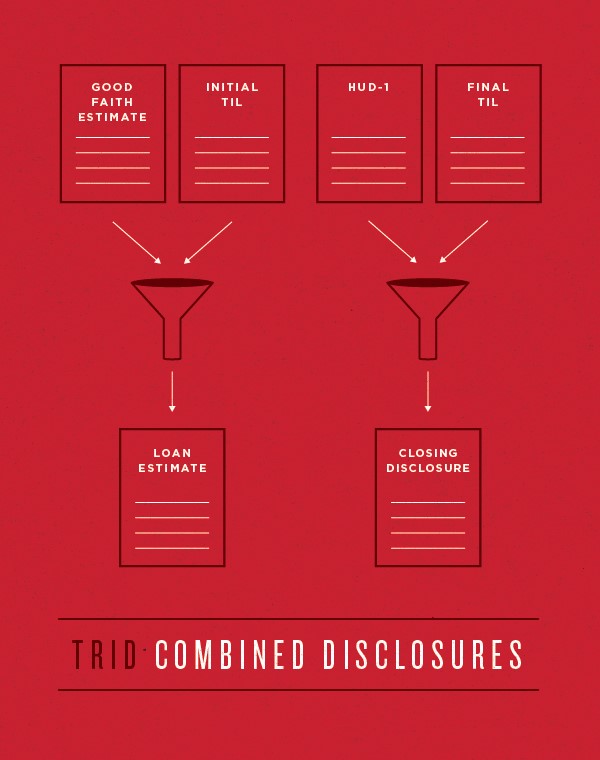

Under TILA-RESPA, four documents were being used as part of the loan process. They were called disclosure forms, with the purpose of disclosing expected costs and breakdowns of the mortgage payment so that borrowers knew what they were getting into.

Good intentions, poor execution. When the CFPB revisited these documents, they were like, "uh…no." Too inconsistent. Too repetitive. Too confusing.

The CFPB came up with a simplified approach. Two documents instead of four: one to kick off the loan process called the Loan Estimate (LE), and one required right before closing called the Closing Disclosure (CD). See? Even the acronyms are simpler. The LE and CD are easier to follow and easier to understand, and two documents are always better than four anyway. By the time a borrower reads through them, that person should know exactly what kind of financial responsibility they're in for – down to the last dollar.

Hurry up and wait

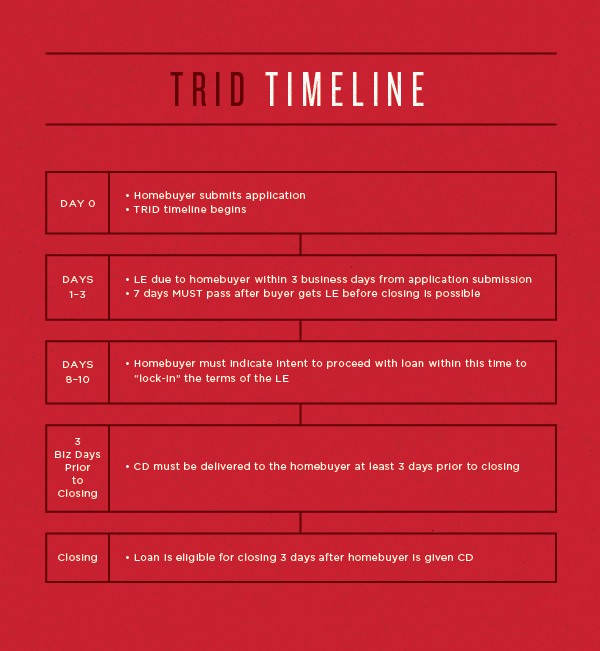

The other major change with TRID is mandatory waiting periods. Yes, enforced waiting on the loan you're DYING to close. But don't worry, it's only a few days. Lenders who have figured out an efficient way to process loans, like Movement Mortgage, aren't really slowed down by it at all. In fact, we kind of thrive on nailing deadlines, but that's a conversation for another day.

TRID's mandatory waiting periods take place just after the LE and CD are issued. It's built-in time so that you, the homebuyer, get sufficient opportunity to read through and comprehend the loan you're signing up for. With plenty of allowance for snack breaks and meditation sessions. Once a borrower is given an LE, TRID requires a seven day wait before closing. No ifs, ands, or buts about it. That doesn't mean the whole process is put on hold, just that no moves to close can be made until seven business days have commenced. With the CD, it's a three day wait. Again, these mandatory waiting periods are supposed to help the borrower really think through the responsibility they're taking on. No rushing this major financial purchase, got it?

A very, very good thing

So when you boil it down, TRID = two simpler disclosures + extra time to study them. The result is better informed homebuyers and fewer questionable loan agreements. And we think that is a very, very good thing.