Yes, rates are going up; no need to panic

Market Update

Rising rates seem to be on everyone's mind. And rightly so. Mortgage interest rates on a 30-year fixed rate loan crossed the 4 percent threshold this week in Bankrate's weekly survey, moving up more than 30 basis points.

But this isn't cause for panic or concern. If anything, this is a positive trend for Movement as rising rates are an indication of economic health, improved growth expectations and a shift to purchasing homes instead of refinancing. An economy that favors buying over refinancing is a good thing for our business and part of our long-term business model.

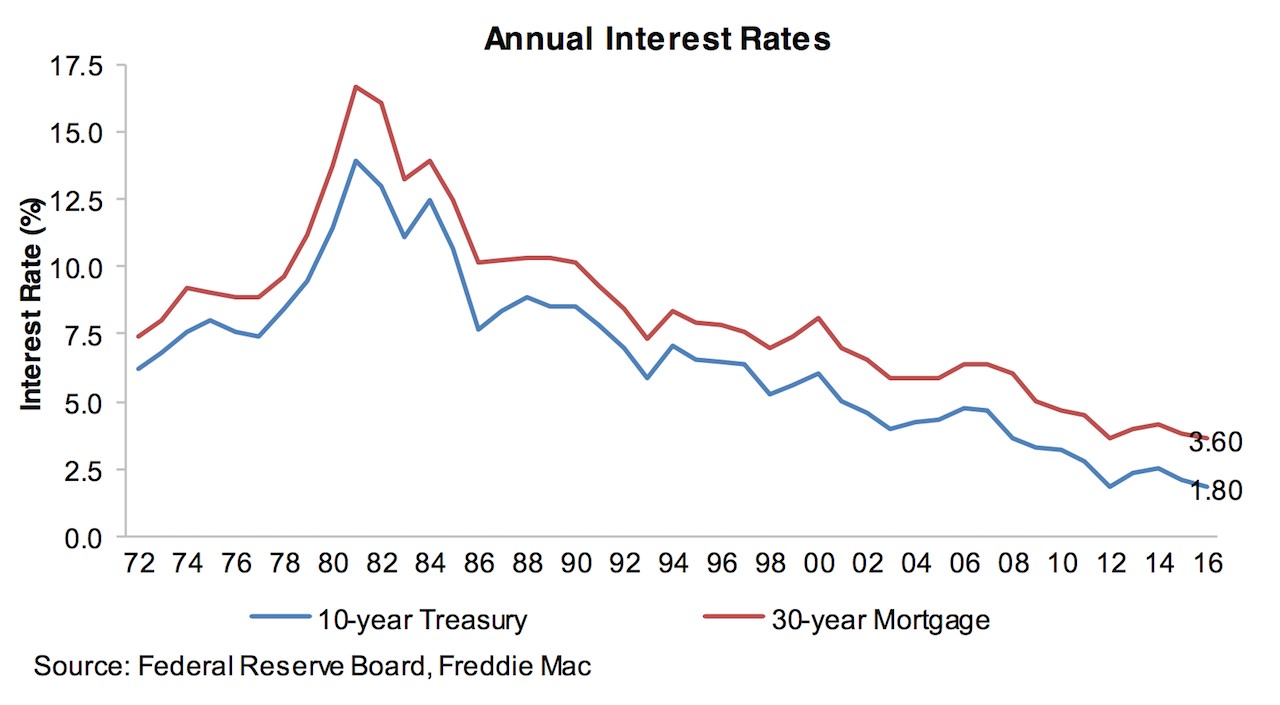

Rates have been on a steady climb for months now, albeit by small, incremental amounts. And while rates have reached levels close to 52-week highs, I'm confident the increase won't create a big market backlash since they're still nearhistoric lows.

I like what Elizabeth Rose, Movement's branch manager in Dallas, told Bankrate this week: "Let's face it, rates are still unbelievably awesome. So lock your rate and be happy with it.”

Why the jump now?

Donald Trump.

In the days after Trump clinched the presidency, the yield on the 10-Year Treasury jumped to just over 2.31 percent, equities rose and the value of the U.S. dollar strengthened.

Why the shakeup? Traders are bracing themselves for the day the president-elect makes good on some of his campaign promises — mainly, major infrastructure spending and tax cuts. Those measures could lead to economic growth, but also are inflationary, hence the reaction in the bond market.

What does this mean for housing and mortgages?

In the short-term, refinancing will appeal to fewer borrowers. Meanwhile, some buyers may be motivated to lock in now before rates tick higher. First-time homebuyers may approach the market with added caution because of headlines making noise about rising rates. Again, don't panic. Almost all major forecasts still predict purchase mortgage originations to grow in 2017.

Yes, rates are going up but remember, they're still historically low.

Yes, rates are going up but remember, they're still historically low.

Here's a simple exercise you can pass on. Let's break it down with the math. Say you're working with a borrower taking on a $100,000 30-year conventional mortgage. With a 3.5 percent interest rate, their principal and interest payment is about $449 a month; with a 3.6 percent interest rate, it's $456. Now, compare those values with a 4 percent interest rate, and the borrower's monthly payment is still only $477, just a $28 monthly increase after the rate goes up 50 basis points.

The change is evident but not overwhelming.

What's next?

Keep your eyes open for Fed activity next month. The Federal Open Market Committee will convene Dec. 13-14, where most observers suspect the long-awaited hike to happen as the economy continues to improve. Bloomberg has pegged the likelihood of a Fed rate increase at over 90 percent.

Fed Chair Janet Yellen affirmed Thursday that the Fed may raise rates "relatively soon" but stressed that any increases will be gradual. She also committed to filling her full term as Fed chair, so Trump's election shouldn't create major upheaval at the central bank for now.