Trump tariff increase drives rates lower

The unknown is driving some volatility in the market this week as President Trump continues to play hardball with China. This week Trump said that China "broke the deal" during trade talks. That is the reason he gave for increasing the tariff on imported Chinese goods worth $200 million from 10% to 25%.

Trump continued, saying that the United States "won't back down until China stops cheating our workers and stealing our jobs."

The negotiations are continuing despite the increase in tariffs. It was hoped that a deal would've been reached before the midnight deadline and there is still a chance that a deal will be reached before the United States collects on any tariffs. However, China has already announced their government will institute retaliatory tariffs immediately. Their government did not give details.

Global markets initially saw a selloff but quickly bounced back and started trading higher on Friday. Early Friday morning, Dow futures dropped 100 points after Trump said there was "no need to rush" on the deal with China. This week alone, the Dow has fallen more than 650 points with the S&P 500 dropping around 2.5%. Bank of America Merrill Lynch said that global equities saw an outflow of about $20.5 billion this week.

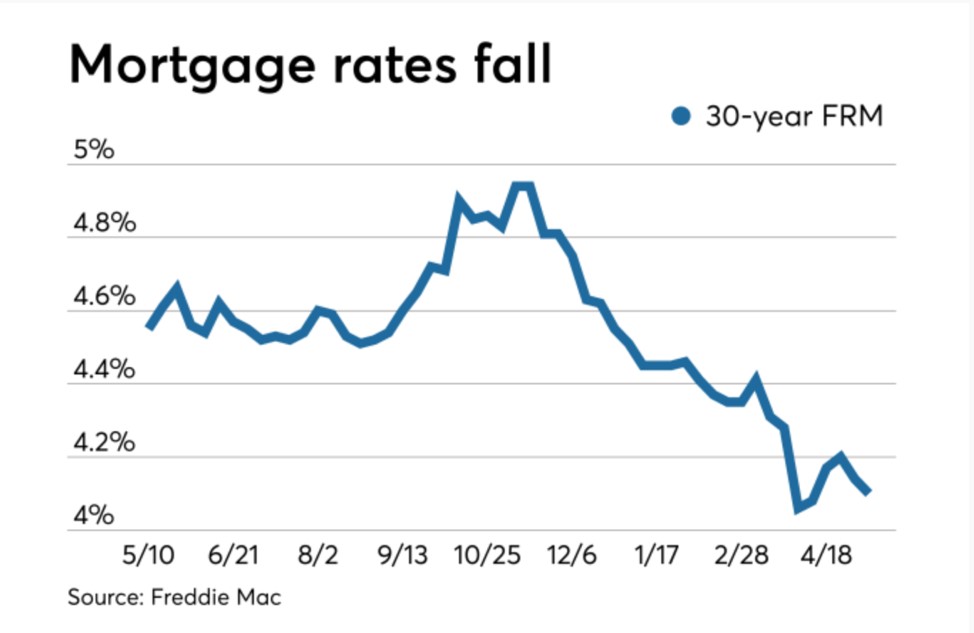

The silver lining of the trade issues is in favor of the housing industry. Uncertainty in equities pushed many investors to the safety of government bonds, causing the 10-year Treasury note yield to fall to 2.46%. The chart below from NationalMortgageNews.com shows the trajectory of the 30-year fixed rate mortgage with data from Freddie Mac. Right now the 30-year fixed rate mortgage average is down slightly to 4.1%.

Two sides of inflation

The producer price index released this week by the Bureau of Labor Statistics increased by a modest 0.2% in April, against expectations for a much larger increase. The core PPI, which excludes food and energy, showed a bigger increase of 0.4%.

Some analysts see that as a sign rebutting Federal Reserve Chairman Jerome Powell's belief that this soft patch of inflation is temporary.

"The smoothing effect from the year-over-year numbers does provide Powell some cover," says Bryce Doty, senior portfolio manager at Sit Fixed Income, "but a couple more months of low inflation readings and we may have a 'the emperor has no clothes' moment on our hands."

However, that core PPI increase of 0.4% was the largest increase since January of 2018 with a year-over-year increase of 2.2%.

The consumer price index also came in below expectations, settling at an increase of 0.3% in April against a 0.4% increase. The cost of living also rose year-over-year by 2%, up from 1.9%. That is the strongest rate of inflation since November but still far below 2018's peak of 2.9%.

The core CPI also increased to 2.1% from 2%. The opinions on whether or not this soft inflation is in fact transitory vary between economists and central bank officials. However they all agree more data is needed before any adjustments are made.

Chief U.S. Economist at High Frequency Economics, Jim O'Sullivan, took the opinion that both options may be true. "The data support the Fed chairman's argument that some of the recent slowing on core PCE inflation was due to 'transitory factors.' That said, underlying trends are not showing significant strengthening or weakening."

Jobs could be the economic tipping point

![]()

This July, the United States will mark 10 years of economic growth. That is the longest streak in our country's history. And according to a report from the Labor Department this week, it could be jobs that cause an issue with growth in the future.

The report showed that people are now more reluctant to quit their jobs and seek other opportunities. The "quit rate," which is the percentage of people leaving their jobs for another one, held steady at 2.3% for the 10th sraight month.

That lack of movement may stymie hiring, which would be an issue says Chris Rupkey, chief economist at MUFG in New York. "The risks right now for the economic outlook going forward is there is actually a danger that companies will run out of the help they need to produce goods or sell their services. The U.S. economy has never faced a time when labor shortages might endanger or cut short a long economic expansion, but now it does."

The report this week showed some stagnation in hiring, with the hiring rate unchanged at 3.8% for March. Some analysts explain that as companies not finding the qualified workers they need to fill those positions.

The home price problem

While we are seeing home price growth slow down considerably over the last few months, home prices are still overvalued according to the latest report from CoreLogic. Looking at the nation's top 50 markets, the report shows about 40% of them were overvalued in March while 16% were undervalued and 44% were at value. Homes are judged as overvalued in CoreLogic's study if they are priced 10% higher than the long-term, sustainable level.

The issues continue for homebuyers looking to come in on the low end for purchasing. CoreLogic's report shows that prices grew by 3.7% in March, just below the Case Shiller Index number of 4.0% growth in March. Both reports show that home price growth is slowing down, but the issue for folks looking to come in on the lower end of the price point is a lack of supply.

Meanwhile, higher-priced homes are in high supply, so we are seeing prices on those homes come down faster as homes sit on the market longer. So when we are looking at home price growth slowing, it may be a more narrow portion of the market causing that slowdown. Ralph McLaughlin, deputy chief economist at CoreLogic, says, “The U.S. housing market continues to cool, primarily due to some of our priciest markets moving into frigid waters. But the broader market looks more temperate as supply and demand come into balance. With mortgage rates flat and inventory picking up, we expect more buyers to take advantage of easing housing market headwinds.”

It also seems consumers are less bullish on now being the time to buy a home, according to the Home Purchase Sentiment Index by Fannie Mae. The index dipped 1.5 points in April. Part of that could be explained by the Federal Reserve's stance on not raising rates for quite some time, giving people a longer window of low interest rates and making the purchase need less urgent.

Doug Duncan, chief economist for Fannie Mae, says people are optimistic about the economic situation, but are losing their gusto for the housing market. "While home selling confidence remains strong and more consumers on net expect mortgage rates to decline over the next year, respondents walked back some of their buying optimism from March," says Duncan. "Improving perceptions of income gains and a softening home price growth outlook should help support housing demand. However, increasing expectations among consumers that mortgage rates will continue to be favorable for some time will likely gain additional support following last week's Fed meeting – and may also be reducing their urgency to buy."