What is property tax used for?

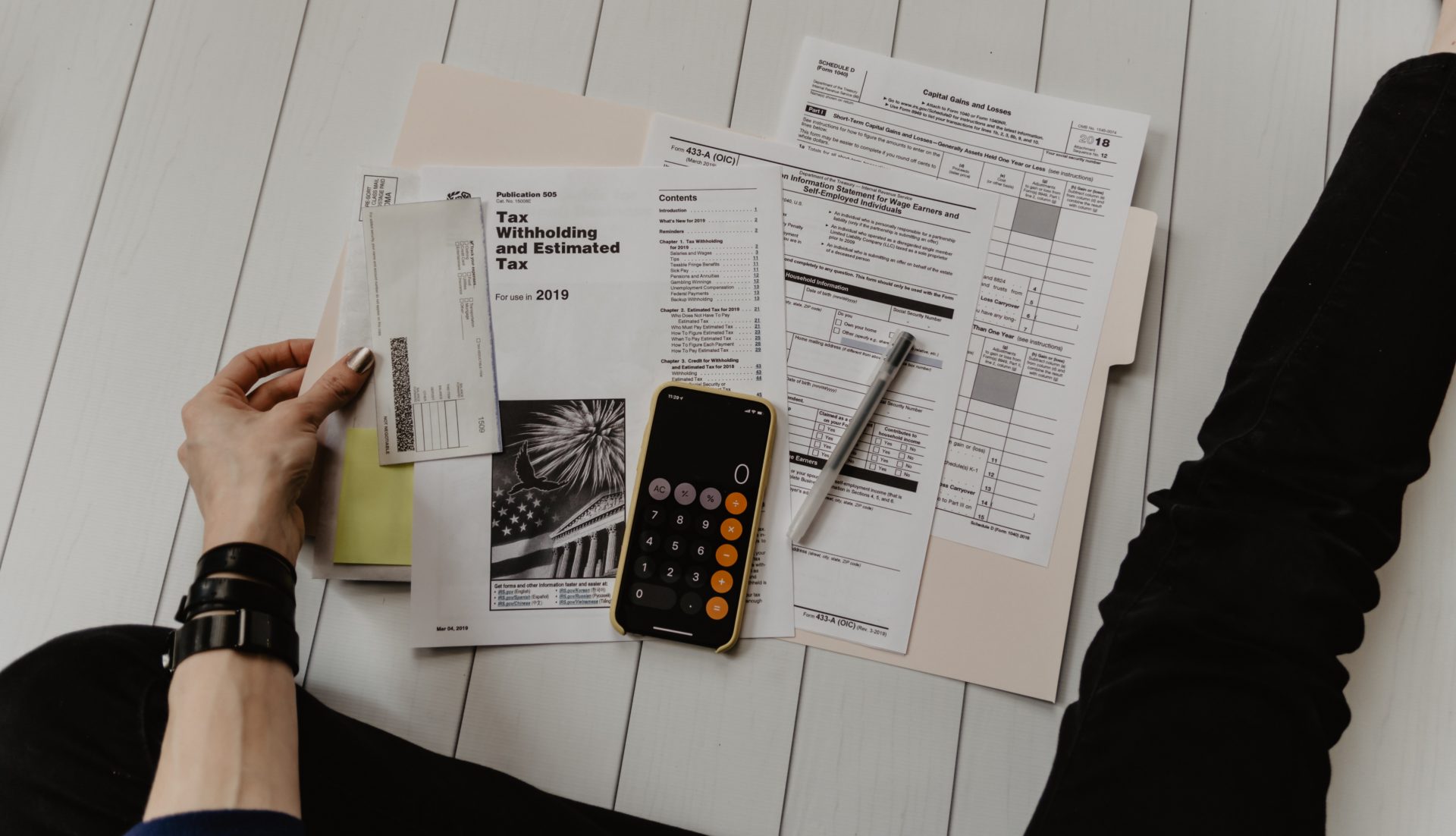

We all have to pay taxes, unfortunately. If you're planning to become a homeowner, you'll need to know about property taxes. Lucky for you, we have another installment of the ABCs of Mortgage to offer more details on what are property taxes and how they impact your home.

What are property taxes?

Property taxes vary by location, so make sure you know how much it costs to live in one neighborhood versus another. Your property tax will typically be built in to your mortgage payment. If you end up paying too much, you'll get a refund from your mortgage company. If you pay too little, you're on the hook at the end of the year. You should receive a notice from your mortgage company or tax assessor's office stating what you owe, says Movement's loan officer Johnathon Kavanaugh.

If you do have an escrow account, look for details on what you owe on your mortgage statement. Or, you can call your servicer to verify that you have the funds in escrow to pay. More on that below.

What is property tax used for anyway?

The city or county government, depending on your property's location, will determine how the collected property taxes are spent. The funds will generally go toward "education, road and highway construction, and other services to benefit the community," as Investopedia states. These taxes go right back into your community to make sure it's being taken care of and maintained.

Rules to know

You can't avoid property taxes or get a discount for them. Property taxes are calculated by the government, so attempting tax evasion is definitely something you shouldn't consider. Property taxes are calculated by location, and by what your property is valued. The type of home you purchase, and where it is, will dictate the amount of property taxes you'll be required to pay.

How do I pay my property taxes?

When you borrow money to buy a house, your property taxes are collected as part of your monthly mortgage payment. They are then deposited into an escrow account. That money is used to pay the property taxes, along with everything else. After you pay off your mortgage, you will be responsible to pay property taxes on your home to your county tax collector directly.

Cool. What now?

If you're ready for homeownership, it's time to talk to your local loan officer to clarify different costs and fees that you'll have to tackle. This also includes property taxes, of which you now have better insight. Any further questions about what property taxes are used for, or any other part of the mortgage process, they'll be able to guide you.

Talk to your local loan officer.