Mortgage rates keep falling under economic pressure

Uncertainty continues to creep into the economic picture as investors try to balance fear with optimism. While there are signs that the economy is still strong and growing, there are also plenty of warning signs and economic pressure within the stock market about a potential recession.

The latest development to rock equities was President Trump's tweet threatening hit Mexico with 5% tariffs on all imports starting June 10. That tariff would then increase to 25% in October unless Mexico stops "illegal migrants" from coming into the United States.

This week we saw another yield curve inversion with the 3-month note yield rising above the 10-year Treasury note rate. This time, the separation was the largest since the financial crisis.

Typically, investors and analysts look at yield curve inversions as a predictor of a recession. The one that they believe is the key indicator is the difference between the 10- and 2-year notes. That inversion has continued to stay positive albeit flatter than investors would like. Right now there is a 16 basis point difference between the two yields.

The trade war with China has continued to bring volatility to equities with the S&P 500 seeing the hardest hits. This month alone, the S&P has lost 4%.

Once again we are seeing the silver lining of a volatile stock market in the form of interest rates moving lower. The 10-year Treasury note yield continues to drop, closing at 2.168% in early Friday trading. That puts it down another .15% for the week. It started the month with a yield of 2.50%.

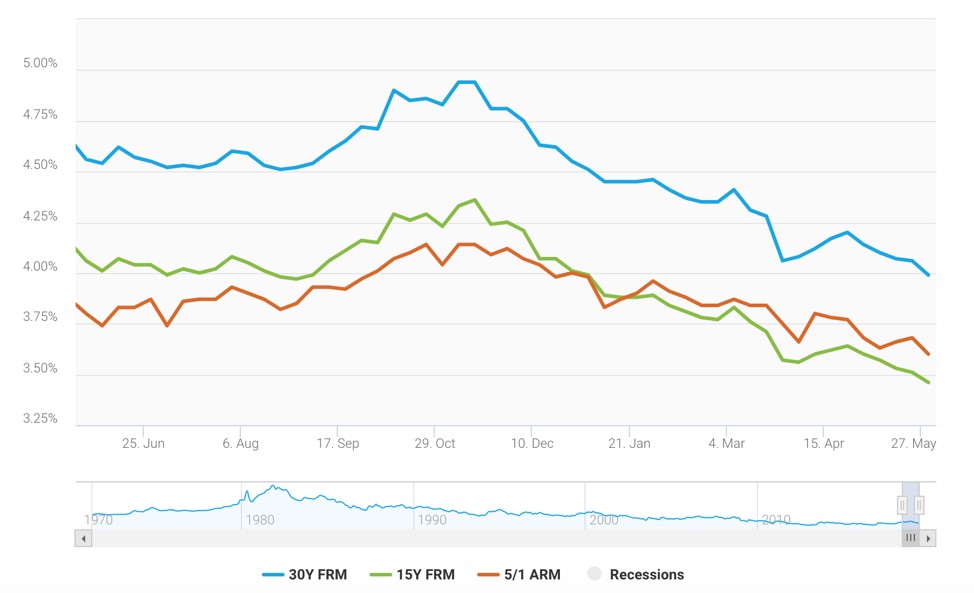

Mortgage rates are being pushed down because of it. This week's Freddie Mac average on a 30-year fixed rate mortgage was 3.99%. That's the first time rates have dropped below 4% since January of 2018. The chart below from Freddie Mac shows the path of interest rates on 30-year, 15-year and 5/1-year ARM.

Credit Suisse equity strategist Patrick Palfrey sees this as a sign that the economic outlook isn't positive. "Interest rates are a barometer of what future expectations are," said Palfrey. "It's a good gauge of what investors are focused on. If interest rates are falling, it's likely the outlook is less bright."

This ongoing trade war has also put more pressure on the Federal Reserve's patient stance on rates. Many bond investors are taking the position that further signs of economic weakness or downturn will force the Fed to lower rates.

Adding to the equation was first quarter real GDP growth being revised down by one-tenth to 3.1%. This development was in line with expectations. But when you exclude trade, inventories and government spending, the economy grew at a rate of 1.3%. The economy is expected to mark 10 years of expansion in July which would be the longest streak on record.

The Fed is basically working a balancing act right now between a preemptive move or a too little too late attack. "There's a cost to the Fed moving rates around a lot," said Minneapolis Fed President Neel Kashkari. "We can add our own uncertainty and volatility to the markets and the economy."

Home prices continue to lose steam

The double-digit annual gains on home prices have stopped, according to the latest S&P Core Logic Case-Shiller home price index. The prices on homes are still gaining but those gains have been consistently waning over the last six months. March home prices rose by just 3.7%, down from 3.9% in February.

Big cities like Seattle, which saw 13% rate gains a year ago, have now tanked to just 1.6% gains. Overall, the 20-city composite went from 6.7% to 2.7% annual gain over the last year. We are still seeing the same trends, however, as lower-end prices continue to see the biggest gains with high-end homes seeding the most price softening.

Chief Economist for the National Association of Realtors, Lawrence Yun, said, "Home price appreciation has been the strongest on the lower-end as inventory conditions have been consistently tight on homes priced under $250,000. Price conditions are soft on the upper-end, especially in high tax states like Connecticut, New York and Illinois." He continued on saying, "The supply of inventory for homes priced under $250,000 stood at 3.3 months in April, and homes priced $1 million and above recorded an inventory of 8.9 months in April."

Perhaps because of the lack of inventory on the lower end price points, pending home sales dropped from March to April by 1.5% according to the NAR. That is the 16th straight month of declines in pending home sales. Despite this stat, Yun believes that "it's inevitable for sales to turn higher in a few months" because of steadily rising mortgage applications and consumer confidence.

A trend returns

Mortgage Real Estate Investment Trusts seem to be making a comeback. According to The Wall Street Journal, Mortgage REITs have "increased their mortgage-bond portfolios by almost 28% to $308 billion over the 12 months through March." Mortgage REITs are simply groups that purchase mortgages or mortgage-backed securities to earn the income from interest on the investments.

As the Federal Reserve has started trimming its own bond holdings, REITs that are focused on home loans have become an important source of capital in the housing market. Although seen as a riskier due to perceived lack of oversight, mREITs saw a resurgence in 2018 raising $6.2 billion in equity. Analysts believe they'll see that same positive revenue growth in 2019, especially with the push toward privatization of government sponsored enterprises Fannie Mae and Freddie Mac.

What's interesting about the resurgence is some analysts are seeing banks take a step back from the mortgage market while still being the investors for the REITs. Chief Executive Officer for Annaly, Kevin Keyes, explained it simply, saying, "We're doing the things they don't want to do."